AUTHOR : ADINA XAVIER

DATE : 23/09/2023

In today’s digital age, where online transactions are an integral part of our daily lives, payment gateway APIs (Application Programming Interfaces) have become the unsung heroes of e-commerce. These sophisticated tools enable seamless financial transactions over the internet, providing a secure bridge between customers, merchants, and financial institutions. In this article, we will delve into the world of payment gateway APIs, exploring their significance, functionality, and how they contribute to the seamless functioning of online businesses.

Understanding Payment Gateways

What is a Payment Gateway?

A payment gateway serves as a technological marvel, enabling the safe transfer of funds between a purchaser and a vendor in the realm of online transactions. It acts as the virtual point of sale, ensuring that payment data is encrypted also transmitted securely.

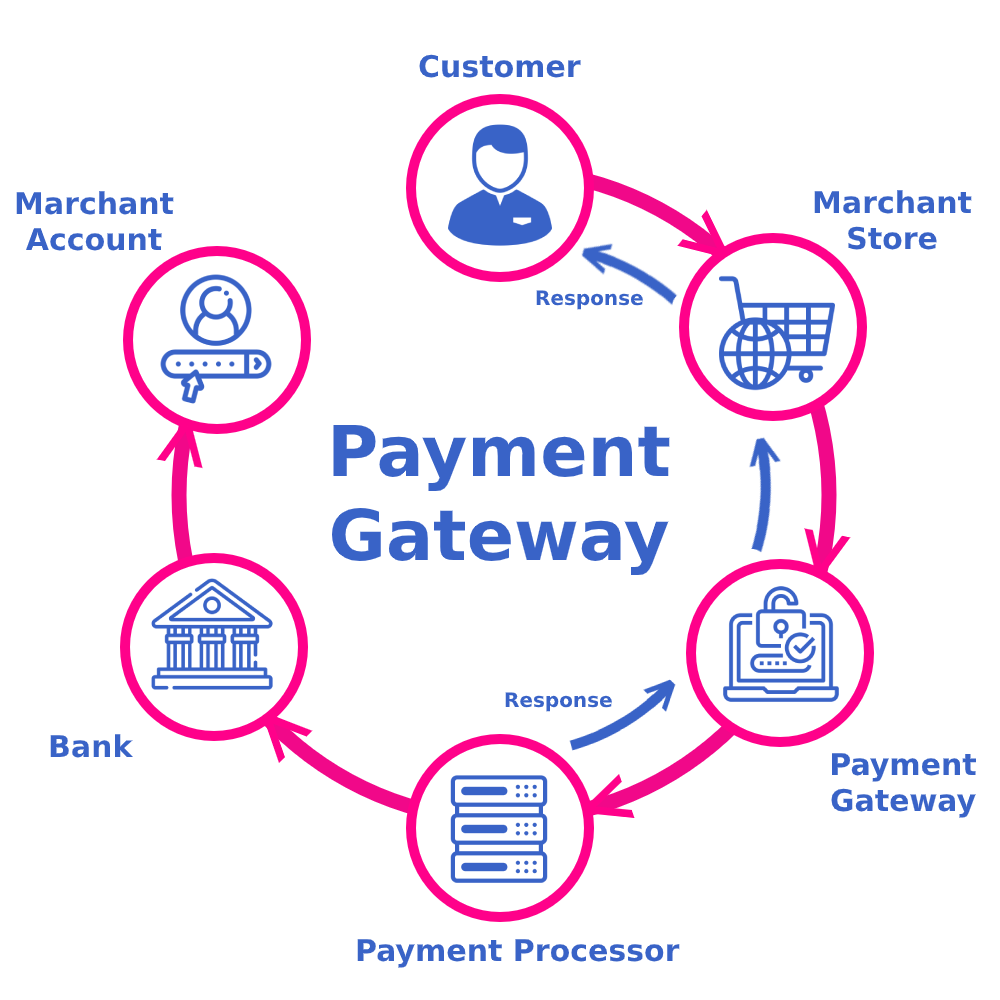

How Does a Payment Gateway Work?

Payment gateways work by encrypting sensitive payment information (such as credit card details) and securely transmitting it from the customer to the merchant’s server. The gateway then communicates with the payment processor and the customer’s bank to authorize and complete the transaction.

The Role of Payment Gateway APIs

What are Payment Gateway APIs?

Payment Gateway APIs are the building blocks that allow businesses to integrate payment processing into their websites also applications seamlessly. They provide a set of rules and protocols that developers can use to communicate with the payment gateway.

Benefits of Payment Gateway APIs

- Flexibility: APIs offer flexibility, allowing businesses to customize the payment experience to suit their brand and customer preferences.

- Security: Payment gateway[1] APIs are designed with security in mind, ensuring that customer payment data is protected from fraud and breaches.

- Seamless Integration: APIs enable smooth integration with e-commerce platforms, mobile apps, and websites, ensuring a hassle-free payment process for customers.

Popular Payment Gateway API Providers

Stripe

Stripe is a well-known payment gateway API provider that offers a developer-friendly platform with robust features for handling online payments. It supports multiple programming languages also provides excellent documentation for easy integration.

PayPal

PayPal, a household name in online payments[2], offers a comprehensive set of APIs for businesses of all sizes. With PayPal APIs, merchants can accept payments, manage subscriptions, and handle refunds effortlessly.

Authorize.Net

Authorize.Net is a reliable choice for businesses looking for a secure and scalable payment gateway solution. It provides a range of APIs also SDKs to cater to various integration needs.

Choosing the Right Payment Gateway API

Factors to Consider

- Transaction Fees: Evaluate the fees associated with each API, including setup costs, per-transaction fees, and any additional charges.

- Security: Ensure that the API provider complies with industry security standards, such as PCI DSS, to safeguard customer data.

- Compatibility: Check whether the API is compatible with your chosen e-commerce platform or website technology.

Integrating Payment Gateway APIs

Step-by-Step Integration

- Select Your API Provider: Choose the payment gateway API provider that aligns with your business requirements.

- Obtain API Keys: Register with the provider and obtain the necessary API keys and credentials.

- Integration: Follow the provider’s documentation to integrate the API into your website or application.

- Testing: Thoroughly test the integration in a sandbox or testing environment to ensure it functions correctly.

- Go Live: Once testing is successful, switch to the live environment also start accepting payments from customers.

The Evolution of Payment Gateway APIs

Adapting to Changing Consumer Behavior

As consumer behavior continues to shift towards online shopping and digital transactions, payment gateway APIs have evolved to meet the changing demands of the market. These APIs have become more user-friendly, enabling businesses to provide a seamless payment experience for their customers.

Mobile-Friendly Solutions

With the proliferation of smartphones and mobile apps, payment gateway APIs have adapted to cater to mobile commerce[3]. Today, many APIs offer mobile SDKs (Software Development Kits) that make it easier for developers to create mobile-friendly payment solutions.

Global Reach

Payment gateway APIs have expanded their global reach. They now support multiple currencies and offer international payment processing, allowing businesses to tap into the global market.

Challenges in Payment Gateway Integration

Regulatory Compliance

One of the challenges in integrating payment gateway APIs is ensuring compliance with various regulations, such as GDPR (General Data Protection Regulation) and PSD2 (Payment Services Directive 2). Businesses must navigate these regulations to protect customer data and maintain trust.

User Experience

A seamless user experience is crucial for online businesses[4]. Ensuring that the payment process is intuitive and frictionless requires careful design and testing during the integration of payment gateway APIs.

Security Concerns

As cyber threats become more sophisticated, security remains a top concern. Payment gateway APIs must continually enhance their security features to protect against data breaches and fraud.

Conclusion

Payment gateway APIs play a pivotal role in the world of e-commerce by enabling secure and also efficient online transactions. Whether you’re a small business owner or a large enterprise, choosing the right payment gateway API can significantly impact your online success. By understanding the functionality and benefits of these APIs, you can make informed decisions to enhance your online payment processing.

FAQs

- What is the primary function of a payment gateway API?

- A payment gateway API facilitates secure online transactions by encrypting and transmitting payment data between customers and merchants.

- Which are some popular payment gateway API providers?

- Popular payment gateway API providers include Stripe, PayPal, and Authorize.Net, among others.

- How do payment gateway APIs enhance security?

- Payment gateway APIs enhance security by encrypting sensitive payment data and complying with industry security standards such as PCI DSS.

- What factors should businesses consider when choosing a payment gateway API?

- Businesses should consider transaction fees, security measures, and compatibility with their e-commerce platform when selecting a payment gateway API.

- How can I get started with integrating a payment gateway API into my website?

- To get started, choose an API provider, obtain API keys, follow integration documentation, thoroughly test in a sandbox environment, and then go live to accept payments.

Get In Touch