AUTHOR : HANIYA SMITH

DATE : 20/09/23

In the ever-evolving landscape of online transactions and e-commerce, the terms “payment aggregator” and “payment gateway” often surface, creating some confusion among both merchants and consumers. Are these two interchangeable terms, or do they serve distinct roles in the world of digital payments? In this comprehensive guide, we will unravel the intricacies of payment aggregators and payment gateways, shedding light on their functions, benefits, and differences. So, let’s embark on this journey to demystify the world of online payments[1].

Introduction

In today’s fast-paced digital world, online payments[2] have become the norm for businesses and consumers alike. Amidst the myriad of payment-related terms, “payment aggregator” and “payment gateway” stand out. While both facilitate online transactions, they serve distinct purposes in the payment ecosystem. To make informed choices as a business owner or consumer, it’s crucial to grasp the nuances of these two entities.

What Is a Payment Aggregator?

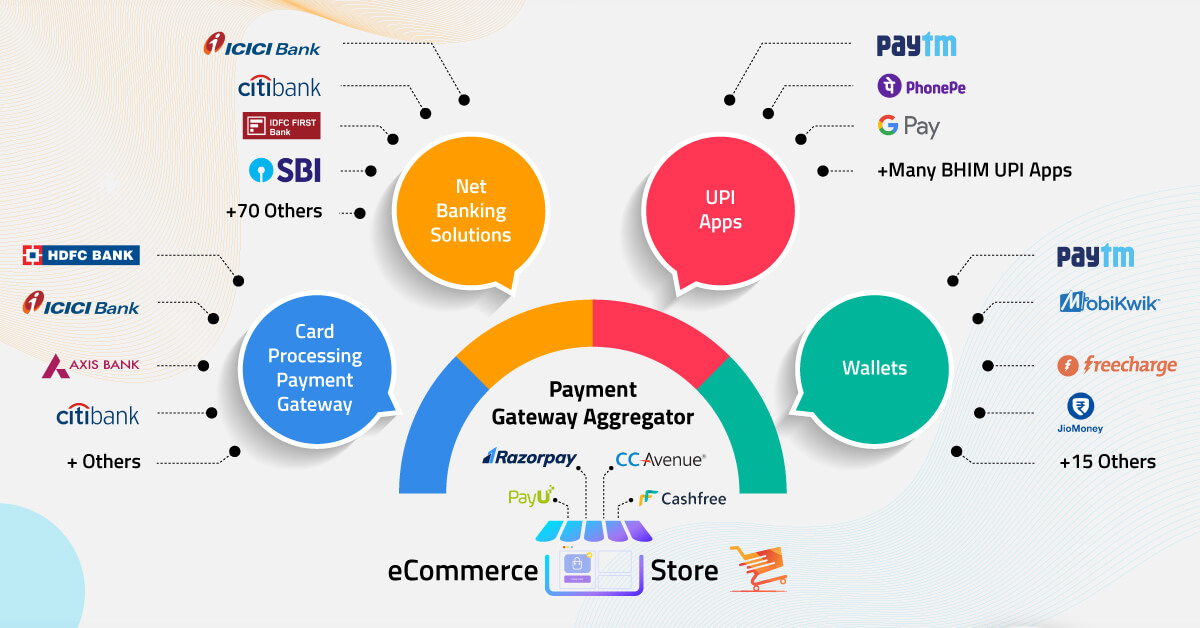

A payment aggregator[3] is essentially a middleman that simplifies the payment process for merchants[4]. It allows businesses to accept online payments[5] without the need for establishing individual merchant accounts with multiple payment processors. Instead, a payment aggregator pools transactions from various merchants into a single merchant account.

How Payment Aggregators Work

Payment aggregators streamline the onboarding process for merchants. They typically provide a unified application process, quick approval times, and also easy integration of payment services into e-commerce platforms. This convenience makes payment aggregators an attractive choice for small to medium-sized businesses looking to accept online payments swiftly.

Pros of Using a Payment Aggregator

- Simplicity: Easy setup and integration also.

- Quick Approval: Faster processing times.

- No Long-Term Contracts: Flexibility for merchants.

- Cost-Efficiency: Lower upfront costs.

Cons of Using a Payment Aggregator

- Higher Fees: Transaction fees can be relatively higher.

- Limited Control: Less control over the payment process.

- Risk of Account Holds: Potential for frozen funds in case of disputes.

Payment Gateway: The Bridge to Secure Transactions

What Is a Payment Gateway?

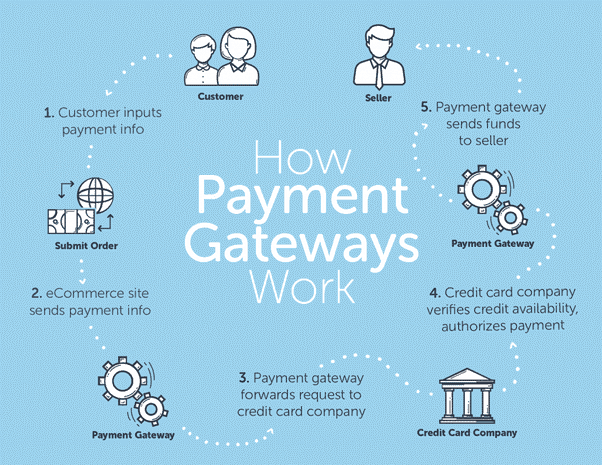

A payment gateway, on the other hand, acts as a secure bridge between the merchant’s website and the payment processor. It ensures that sensitive payment data is transmitted securely from the customer to the payment processor and also back.

The Role of Payment Gateways

Payment gateways play a pivotal role in online transactions, encrypting data to protect against fraud and unauthorized access. They provide a seamless and also secure checkout experience for customers by verifying the authenticity of transactions and handling payment authorization.

Benefits of Utilizing a Payment Gateway

- Enhanced Security: Robust encryption safeguards sensitive data.

- Customization: Merchants can tailor the checkout process.

- Global Reach: Access to a wide range of payment methods.

- Reduced Chargebacks: Enhanced fraud prevention measures.

Drawbacks of Using a Payment Gateway

- Complex Integration: May require technical expertise.

- Monthly Fees: Ongoing costs for usage.

- Merchant Account Required: Each merchant needs their own account.

Distinguishing Between Payment Aggregator and Payment Gateway

The primary distinction between a payment aggregator[1] and a payment gateway lies in their role within the payment process. While payment aggregators consolidate transactions and simplify onboarding, payment gateways focus on securing and also authorizing individual transactions.

When to Choose a Payment Aggregator

Small businesses or startups seeking a hassle-free way to accept online payments can benefit from payment aggregators. They offer a straightforward setup process and also are well-suited for businesses with limited technical resources.

When to Opt for a Payment Gateway

Larger enterprises or businesses with specific customization requirements often prefer payment gateways. [2]Payment gateways provide more control over the checkout process and are ideal for those prioritizing security and scalability.

Integration and Compatibility also

When considering payment options, compatibility with your e-commerce platform is crucial. Payment aggregators and gateways may have different integration requirements, so choosing the one that seamlessly fits your existing setup is essential.

Security Concerns

Security should always be a top priority in online transactions. Payment gateways are designed to offer advanced security features, making them the preferred choice for businesses handling sensitive customer data.

Cost Considerations

Both payment aggregators and also gateways have cost implications. Merchants should evaluate[3] transaction fees, setup costs, and monthly charges to determine which option aligns with their budget.

Customer Experience

A smooth and secure payment process enhances the customer experience. Evaluate how each option impacts your customers’ checkout journey to ensure satisfaction and also repeat business.

Case Studies: Real-Life Scenarios

Let’s delve into real-world examples of businesses that have successfully leveraged payment aggregators and payment gateways to meet their unique needs.

Conclusion

In the dynamic world of online payments, understanding the differences between payment aggregators and payment gateways is essential for making informed choices. Whether you’re a startup looking for simplicity or an established business prioritizing security, there’s a payment solution tailored to your needs. By carefully weighing the pros and also cons of each option, you can pave the way for seamless and secure online transactions.

FAQs

1. What is the main difference between a payment aggregator and a payment gateway?

The key difference lies in their role within the payment process. Payment aggregators consolidate transactions, while payment gateways focus on securing and authorizing individual transactions.[4]

2. Are payment aggregators suitable for small businesses?

Yes, payment aggregators are a suitable choice for small businesses due to their simplicity and quick setup.

3. Which option is more secure, a payment aggregator or a payment gateway?

Payment gateways are generally more secure, as they prioritize data encryption and fraud prevention.

4. Do payment aggregators have lower fees than payment gateways?

Payment aggregators often have lower upfront costs but may charge higher transaction fees compared to payment gateways.