AUTHOR : NUZAT SAYYED

DATE : 20-08-2023

In today’s fast-paced digital economy, businesses must adapt to a variety of payment methods to meet consumer expectations. Choosing the right payment gateway is a critical decision for any e-commerce venture. This article focuses on comparing top payment gateway providers[1], discussing their features, pricing structures, security measures, and overall user experiences. Whether you’re a small business owner or an enterprise-level corporation, understanding these aspects will help you make an informed choice. In this guide, we will delve into comparing top payment[2] gateway providers, highlighting their features, fees, security, and user experience.

What is a Payment Gateway?

A payment gateway[3] acts as a bridge between your online store and the financial institutions that process credit card transactions. It is essential for facilitating online payments securely, ensuring that sensitive information is encrypted and transferred safely. In essence, a payment[4] gateway verifies and authorizes transactions, helping businesses accept payments from customers seamlessly. The payment gateway[5] processes transactions by encrypting sensitive information, ensuring secure communication between the customer and the merchant.

Why is Choosing the Right Payment Gateway Important?

The choice of a payment gateway can significantly impact your business’s operations. Here are a few reasons why selecting the right one is crucial:

- Security: A reliable payment gateway offers robust security features to protect sensitive customer information and prevent fraud.

- User Experience: A smooth and intuitive checkout process can enhance customer satisfaction and increase conversion rates.

- Integration: The gateway should easily integrate with your existing e-commerce platform and other business tools.

- Cost Structure: Understanding the fee structures associated with each payment gateway is essential for budgeting and financial planning.

- Customer Support: Reliable support can help resolve issues quickly, ensuring your business operates smoothly.

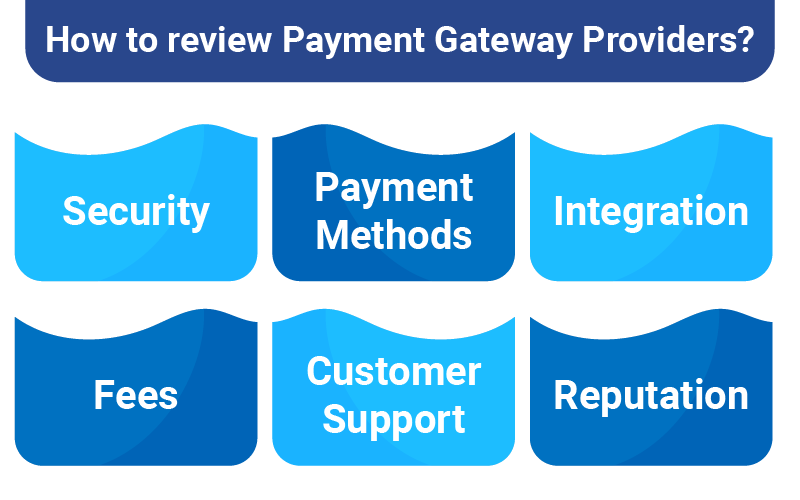

Key Features to Evaluate

When comparing top payment gateway providers, consider the following features:

- Transaction Fees: Different providers have different fee structures, which can affect your profit margins.

- Payment Methods Supported: Look for gateways that accept a wide range of payment options, including credit cards, digital wallets, and bank transfers.

- Security Features: Ensure the gateway complies with PCI standards and offers encryption and fraud detection services.

- Integration Options: The gateway should integrate seamlessly with your website or e-commerce platform.

- Customer Experience: Evaluate how the payment process looks and feels from the customer’s perspective.

Overview of Top Payment Gateway Providers

1. PayPal

PayPal is a pioneer in online payment solutions, known for its ease of use and widespread recognition among consumers.

- Transaction Fees: PayPal typically charges 2.9% plus $0.30 per transaction, with reduced rates for higher volumes.

- Security: The platform offers strong security measures, including encryption and buyer protection policies.

- Integration: PayPal integrates with numerous e-commerce platforms and offers plugins for easy setup.

2. Stripe

Stripe has become a favorite among developers and businesses for its extensive API and flexibility.

- Transaction Fees: Stripe charges 2.9% plus $0.30 per successful transaction, with additional fees for international payments.

- Security: Stripe is known for its high-security standards, including end-to-end encryption and PCI compliance.

- Integration: It provides extensive documentation and support for developers, making integration straightforward.

3. Square

Square offers a comprehensive payment processing solution, ideal for both online and brick-and-mortar businesses.

- Transaction Fees: Square charges 2.6% plus $0.10 for in-person payments and 2.9% plus $0.30 for online transactions.

- Security: The platform is PCI compliant and offers tools for fraud detection.

- Integration: Square has its own point-of-sale (POS) system and integrates well with various e-commerce platforms.

4. Authorize. Net

As one of the oldest payment gateway providers, Authorize.Net is known for its reliability and strong customer support.

- Transaction Fees: The fee structure includes $0.25 per transaction, a monthly gateway fee of $25, and a standard rate of 2.9% plus $0.30.

- Security: Authorize.Net offers advanced fraud detection and is fully PCI compliant.

- Integration: It supports various shopping carts and platforms, ensuring flexibility for users.

5. Adyen

Adyen is a global payment gateway that caters to businesses of all sizes, offering a wide range of payment methods.

- Transaction Fees: Adyen’s pricing is tailored to each business, making it competitive based on transaction volume and type.

- Security: The platform is PCI compliant and provides advanced fraud prevention tools.

- Integration: Adyen offers a comprehensive set of APIs and SDKs for easy integration with online platforms.

Cost Comparison

When comparing top payment gateway providers, understanding the cost structures is vital. Here’s a brief breakdown of transaction fees for the mentioned providers:

- PayPal: 2.9% + $0.30 per transaction

- Stripe: 2.9% + $0.30 per transaction

- Square: 2.6% + $0.10 for in-person; 2.9% + $0.30 for online

- Authorize.Net: $0.25 per transaction + $25 monthly + 2.9% + $0.30

- Adyen: Variable based on transaction type and region

Each provider has its strengths, making it crucial for businesses to assess their specific needs and transaction volumes when evaluating costs.

Security Features to Consider

Security is a paramount concern for any online transaction. When comparing top payment gateway providers, here are key security features to consider:

- PCI Compliance: This is a must-have for any payment gateway to ensure that card data is handled securely.

- Fraud Detection Tools: These tools help monitor transactions for suspicious activity and mitigate risks.

- Data Encryption: Secure transmission of customer data is essential to protect against breaches.

Providers like Stripe and PayPal are noted for their comprehensive security features, making them reliable choices for businesses concerned about data protection.

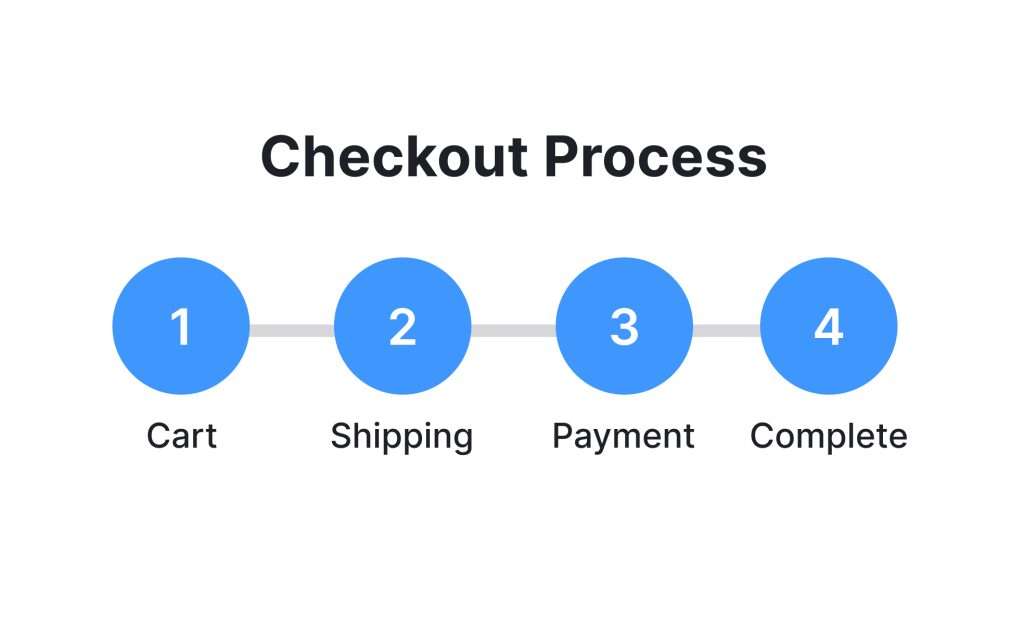

User Experience and Checkout Process

The user experience during checkout can significantly affect your sales conversion rates. Consider the following aspects when comparing top payment gateway providers:

- Checkout Design: Is the checkout process intuitive and quick? A complicated process can lead to cart abandonment.

- Mobile Optimization: With the rise of mobile shopping, ensure the gateway provides a seamless experience on smartphones and tablets.

- Support Options: Check if the provider offers responsive customer support, as quick resolution of issues can enhance the user experience.

Providers like Square and Stripe have received positive feedback for their streamlined checkout processes and mobile compatibility.

Conclusion

In summary, comparing top payment gateway providers involves a thorough analysis of transaction fees, security features, user experience, and integration capabilities. Each provider has its unique strengths, making it essential for businesses to evaluate their specific needs and customer preferences. By understanding these factors, you can select the right payment gateway that will enhance your online transactions and contribute to your business’s success. The right choice not only secures transactions but also improves customer satisfaction, ultimately driving sales and growth.

FAQs

1. What should I look for in a payment gateway?

When comparing top payment gateway providers, consider transaction fees, security features, ease of integration, and customer support.

2. Are there any hidden fees with payment gateways?

Many payment gateways have transparent pricing models, but some may have additional fees for chargebacks, international transactions, or monthly subscriptions.

3. How do payment gateways ensure security?

Payment gateways use encryption, PCI compliance, and fraud detection tools to secure customer data and protect against unauthorized access.

4. Can I change my payment gateway after setting it up?

Yes, businesses can change their payment gateway, but it may require some technical adjustments and reconfiguration of payment settings on their e-commerce platform.

5. Which payment gateway is best for international transactions?

Providers like Stripe and PayPal are well-suited for international transactions, offering support for multiple currencies and payment methods.