NAME : CORA JOSU

DATE : 04/11/2023

Demystifying PGTF

In the age of e-commerce, payment gateways have become an integral part of the online business landscape. These gateways facilitate online transactions, enabling customers to make payments for products and services conveniently. However, with the convenience of digital payments comes the often-misunderstood aspect of payment gateway transaction fees. In this article, we will delve into the world of payment gateway transaction fees, explaining what they are, how they work, and their significance for both businesses and consumers.

Understanding PGTF

What Are PGTF?

Payment gateway transaction fees, often simply referred to as transaction fees, are charges levied by payment gateway providers for processing electronic transactions. These fees are incurred by businesses every time a customer makes a purchase using a credit or debit card, digital wallet, or any other online payment method. They are an essential component of the cost structure for online businesses, influencing their profitability and pricing strategies.

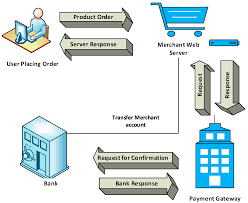

How Do They Work?

To comprehend payment gateway transaction fees better, let’s break down the process of a typical online transaction:

- Customer Initiation: The transaction begins when a customer decides to make a purchase on a website. They select their preferred payment method,[1] such as a credit card.

- Payment Authorization: The customer’s payment information is then transmitted to the payment gateway for authorization. At this stage, the gateway checks the validity of the transaction, ensuring there are sufficient funds in the customer’s account or credit limit.

- Settlement: Once the payment is authorized, the funds are transferred from the customer’s account to the merchant’s account. This step typically happens within a few business days.

- Reconciliation: After settlement, the payment gateway provider’s transaction fee is deducted. This fee is often a small percentage of the transaction amount or a flat fee.

Types of Transaction Fees

Flat Fees:

Flat fees are fixed charges that businesses pay for every transaction processed through the payment gateway. These fees remain consistent, regardless of the transaction amount. They provide a predictable cost structure and are simple to calculate.[2]

Percentage Fees:

Percentage fees are calculated as a percentage of the transaction amount. For example, if a payment gateway charges a 2% fee and a customer makes a $100 purchase, the transaction fee would amount to $2.

Monthly Fees:

In addition to per-transaction fees, some payment gateway providers charge monthly fees. These monthly fees cover the cost of using the gateway’s services and maintaining the necessary infrastructure for secure transactions.

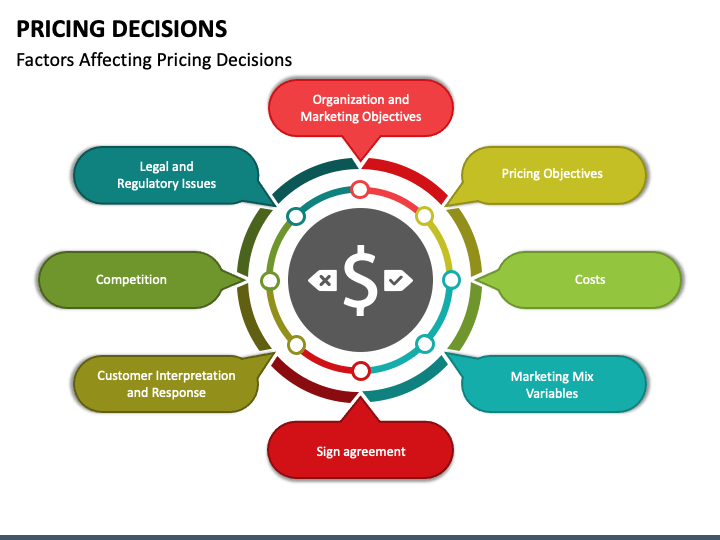

Factors Affecting Transaction Fees

Several factors can influence the transaction fees[3] that a business pays:

Payment Gateway Provider:

Different payment gateway providers offer varying fee structures. Businesses can choose from a range of providers, each with its own set of fees and features. It’s crucial to select a provider whose fee structure aligns with the business’s needs and budget.

Business Type:

The nature of the business can also affect transaction fees. High-risk businesses, such as those in the online gambling or adult entertainment industries, often face higher fees due to the increased likelihood of chargebacks.

Transaction Volume:

The number of transactions a business processes can have a direct impact on the fees incurred. Many payment gateway providers offer volume-based discounts, which can lead to lower transaction costs for businesses with high sales volumes.

Currency Conversion:

If a business operates internationally[4] and accepts payments in multiple currencies, currency conversion fees may apply. These fees can add an extra layer of cost to cross-border transactions.

Chargebacks:

Frequent chargebacks can result in higher transaction fees. Payment gateway providers may charge additional fees or impose stricter terms for businesses with high chargeback rates.

Strategies to Mitigate Transaction Fees:

- Choose the Right Provider: Select a payment gateway provider that offers competitive rates and transparent fee structures. Compare options and negotiate rates when possible.

- Optimize payment processes: Implement efficient payment processing procedures to minimize the occurrence of chargebacks and reduce the associated costs.

- Consider Customer Experience: Offer a variety of payment options to customers, which can help reduce cart abandonment and increase sales.

- Monitor and Review Fees: Regularly review your transaction fees to ensure you are getting the best value from your payment gateway provider.

- Negotiate Volume Discounts: If your business experiences a high transaction volume, inquire about volume-based discounts from your payment gateway provider.

- Stay Informed: Keep up with industry trends and changes in payment processing technology. This knowledge can help you adapt to new cost-saving opportunities.

Conclusion

In the world of e-commerce, understanding PGTF is essential for businesses to make informed decisions. These fees are a fundamental part of online commerce,[5] affecting everything from pricing strategies to overall profitability. By selecting the right payment gateway provider, optimizing payment processes, and being proactive in fee management, businesses can ensure that transaction fees have a minimal impact on their financial health.

FAQs

1. What is a payment gateway transaction fee?

A payment gateway transaction fee is a charge imposed by payment gateway providers for processing electronic transactions. It is applicable each time a customer makes a purchase online.

2. How can businesses reduce their payment gateway transaction fees?

Businesses can reduce transaction fees by choosing a payment gateway provider with competitive rates, optimizing their payment processes, and paying attention to factors that influence fees.

3. Do all businesses pay the same transaction fees?

No, transaction fees can vary depending on the payment gateway provider, the type of business, and the volume of transactions processed.

4. What is the difference between flat fees and percentage fees?

Flat fees are fixed charges per transaction, while percentage fees are calculated as a percentage of the transaction amount.

5. Why is it essential for businesses to choose the right payment gateway provider?

Choosing the right payment gateway provider is critical to balancing competitive fees with the quality of service, ensuring minimal impact on the business’s financial health.