AUTHOR : HANIYA SMITH

DATE : 13/09/2023

In today’s digital age, businesses are increasingly reliant on e-commerce and online transactions to reach[1] a wider customer base. While this shift has its advantages, it also presents challenges, especially for businesses classified as high-risk merchants. In the United Kingdom, obtaining a high-risk merchant [2]account is crucial for businesses operating in industries prone to chargebacks, fraud, or legal complexities. In this comprehensive guide, we will delve into what a high-risk merchant account[3] is, why it’s essential, and also how to secure one in the UK.[4]

Understanding High-Risk Merchant Accounts

Defining High-Risk Merchants

A high-risk merchant is a business that operates in an industry where there is an increased likelihood of chargebacks, fraud, or legal complications. These businesses often face difficulties in obtaining traditional merchant accounts.[5]

The Importance of High-Risk Merchant Accounts

High-risk merchant accounts [5]provide businesses with the ability to accept payments securely and efficiently, ensuring continuous operations and also profitability.

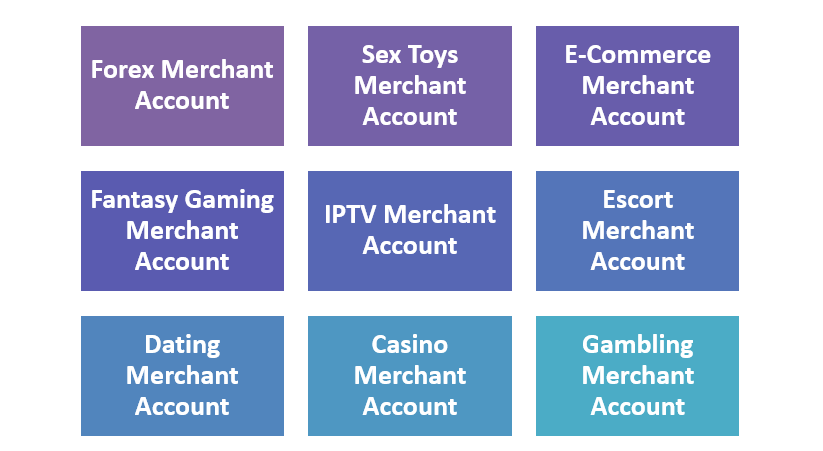

Industries Considered High-Risk

Online Gambling

The online gambling industry is notorious for chargebacks and

The sale of nutritional supplements and also herbal products can be challenging due to varying regulations. Nutraceutical companies often seek high-risk merchant accounts.

Adult Entertainment

Due to the controversial nature of adult entertainment, businesses in this industry are often classified as high-risk merchants.

Nutraceuticals

The sale of nutritional supplements and also herbal products can be challenging due to varying regulations. Nutraceutical companies often seek high-risk merchant accounts.

Travel and Tour Booking

The travel industry often experiences cancellations and chargebacks. High-risk merchant accounts help travel businesses navigate these issues.

Forex Trading

Forex trading involves high-value transactions, making it susceptible to chargebacks. High-risk merchant accounts offer stability to forex trading platforms.

Challenges Faced by High-Risk Merchants

Chargebacks and Fraud

High-risk businesses are more susceptible to customer disputes and also fraudulent activities, leading to potential revenue loss.

Limited Payment Processing Options

High-risk merchants may find it challenging to access a variety of payment processing options, limiting their ability to cater to customers’ preferences.

Benefits of a High-Risk Merchant Account

Enhanced Fraud Protection

High-risk merchant accounts often come with robust fraud prevention measures, safeguarding businesses from fraudulent transactions.

Diverse Payment Options

These accounts offer a wide range of payment processing options, ensuring businesses can accommodate various customer preferences.

Business Expansion Opportunities

With a high-risk merchant account, businesses can expand their operations globally, tapping into new markets and also revenue streams.

Applying for a High-Risk Merchant Account in the UK

Documentation Requirements

Businesses seeking high-risk merchant accounts must provide comprehensive documentation, including financial records and also business plans.

The Application Process

The application process for a high-risk merchant account involves thorough review and also due diligence by the payment processor.

Aspects to Take Into Account When Picking a Payment Processor

Reputation and alsoExperience

Payment processors with a strong track record of serving high-risk merchants are preferred.

Fee Structure

Understanding the fee structure is essential[1] to assess the long-term financial viability of the partnership.

Integration Options

Compatibility with existing systems and also ease of integration should be considered.

Customer Support

Access to reliable customer support is vital for addressing issues promptly and also efficiently.

Managing Risks

Implementing Fraud Prevention Measures

High-risk merchants should employ advanced fraud prevention[2] tools and also regularly update their security measures.

Staying Compliant with Regulations

Adhering to industry regulations and also compliance standards is critical to avoid legal issues.

Monitoring Chargebacks

Regularly monitoring and also addressing chargebacks can help businesses minimize revenue losses.

Building Trust with Customers

Transparent Policies

Clear and also transparent business policies instill trust in customers, reducing disputes and chargebacks.[3]

Secure Payment Processing

Ensuring secure[4] payment processing is crucial for safeguarding customer data[5] and also preventing fraud.

Conclusion

In the UK, obtaining a high-risk merchant account is essential for businesses in industries prone to risks and challenges. These accounts offer stability, security, and the ability to expand operations. By understanding the requirements, selecting the right payment processor, and also implementing effective risk management strategies, high-risk merchants can thrive in a competitive market.

FAQs

- What is a high-risk merchant account? A high-risk merchant account is designed for businesses operating in industries prone to chargebacks, fraud, or legal complexities.

- How do I apply for a high-risk merchant account in the UK? To apply, you need to provide detailed documentation, choose a reputable payment processor, and also go through a thorough application process.

- What industries are considered high-risk in the UK? High-risk industries in the UK include online gambling, adult entertainment, nutraceuticals, travel and tour booking, and also forex trading.

- What benefits do high-risk merchant accounts offer? High-risk merchant accounts provide enhanced fraud protection, diverse payment options, and also opportunities for business expansion.