AUTHOR : RIVA BLACKLEY

DATE : 24/11/2023

Introduction

In the vibrant landscape of India’s financial ecosystem, the role of payment providers[1] has become increasingly crucial. As the nation embraces the digital era, the demand for efficient and secure payment[2] solutions has skyrocketed. This article[3] delves into the dynamics of payment providers in India, exploring their evolution, major players, popular methods, challenges, and future trends.

Evolution of Payment Systems in India

Traditionally, India relied on cash transactions[4], but the digital payment revolution has transformed the way transactions occur. From the introduction of credit cards[5] to the current dominance of digital wallets and UPI, the evolution has been nothing short of revolutionary. Milestones like demonetization acted as catalysts, propelling India into a digital payment era.

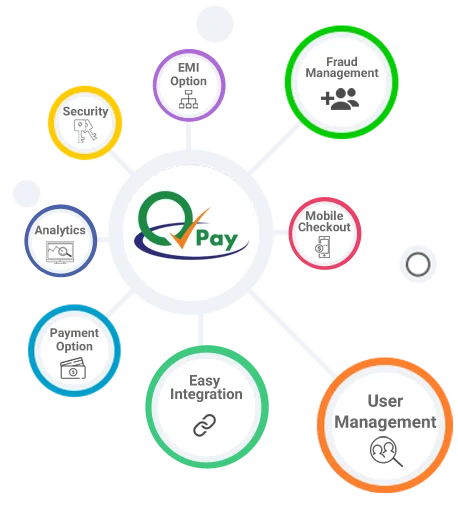

Major Payment Providers in India

Leading the charge are payment service giants such as Paytm, PhonePe, and Google Pay. Each offers a unique set of services, from mobile recharges to online purchases, contributing to the diversification of payment options available to consumers. A comparative analysis reveals the strengths and weaknesses of each player, catering to different user preferences.

Popular Payment Methods

Digital wallets have gained immense popularity due to their convenience and user-friendly interfaces. Additionally, the Unified Payments Interface (UPI) has emerged as a game-changer, facilitating seamless peer-to-peer transactions and merchant payments.

Challenges Faced by Payment Providers

However, this digital transformation hasn’t been without its challenges. Security concerns, including data breaches and fraud, pose significant threats. Moreover, navigating the complex regulatory landscape remains an ongoing challenge for payment providers.

Innovations in Payment Technology

In response to challenges, the payment industry has witnessed innovative strides. Contactless payments have gained traction, offering a swift and secure alternative. Furthermore, the integration of artificial intelligence enhances fraud detection and ensures a more robust security[1] infrastructure.

Impact on Businesses

The influence of payment providers extends beyond individual transactions. Businesses, both small and large, now leverage these services to streamline transactions and provide customers with a variety of payment options. The ease of transactions positively impacts revenue and customer satisfaction.

Government Initiatives and Regulations

The Indian government has actively promoted digital[2] payments, unveiling policies that incentivize businesses and consumers to adopt cashless transactions. Regulatory frameworks have been established to ensure the responsible functioning of payment providers, balancing innovation with consumer protection.

Future Trends in Payment Services

Looking ahead, the payment industry is poised for continuous innovation. From the integration of blockchain to the rise of decentralized finance[3] (DeFi), the landscape is evolving rapidly. Embracing these trends will be crucial for payment providers to stay competitive.

User Experience and Accessibility

The success of payment providers hinges on the user experience they offer. A seamless interface, coupled with accessibility considerations for users with diverse needs, contributes to increased adoption and customer loyalty.

Rise of FinTech Companies

The emergence of FinTech companies has added another layer of dynamism to the payment sector. Collaborating with traditional banks, these companies offer innovative solutions, challenging the status quo and pushing the industry towards continuous improvement.

Security Measures in Payment Systems

Ensuring the security of user data is paramount. Encryption technologies and secure authentication methods play a pivotal[4] role in safeguarding transactions. Payment providers actively invest in these measures to build trust among users.

Consumer Adoption and Behavior

Understanding consumer behavior is crucial for the sustained growth of payment[5] providers. Factors such as convenience, rewards programs, and trust play a role in shaping user preferences and driving the adoption of digital payment methods.

Global Comparisons

Comparing India’s payment system with global counterparts provides valuable insights. Learning from the experiences of other countries, both successes and failures, can inform strategies to enhance India’s payment infrastructure further.

Innovation and Collaboration

The rapid evolution of payment systems in India has been driven by a spirit of innovation and collaboration. FinTech companies, in particular, have played a pivotal role in introducing groundbreaking technologies. From blockchain-based solutions to decentralized finance, these innovations not only enhance the efficiency of transactions but also foster financial inclusion.

The Role of Cybersecurity in Payment Providers

As the digital landscape expands, so do concerns about cybersecurity. Payment providers are acutely aware of the need for robust security measures. The implementation of two-factor authentication, biometric recognition, and continuous monitoring are steps taken to fortify the defenses against potential cyber threats, ensuring the safety of user data.

Conclusion

In conclusion, the journey of payment providers in India is a testament to the nation’s embrace of digital transformation. The evolving landscape presents challenges and opportunities, with security, innovation, and user experience at the forefront. As we navigate this dynamic terrain, the importance of payment providers in shaping India’s financial future cannot be overstated.

FAQs

- Are digital wallets safe for online transactions?

- Digital wallets employ robust security measures like encryption to ensure the safety of online transactions.

- How do government regulations impact payment providers?

- Government regulations set the framework for responsible and secure operations, balancing innovation and consumer protection.

- What role does artificial intelligence play in payment systems?

- Artificial intelligence enhances fraud detection and overall security in payment systems.

- How are FinTech companies changing the payment landscape?

- FinTech companies collaborate with traditional banks, introducing innovative solutions that challenge the industry’s norms.

- What should businesses consider when choosing a payment provider?

- Businesses should consider factors such as transaction fees, user experience, and the range of services offered when selecting a payment provider.