AUTHOR : RIVA BLACKLEY

DATE : 23/11/2023

Introduction

In the fast-paced world of online commerce, the seamless flow of transactions is a key determinant of success. At the heart of this digital ecosystem are payment processors[1] and payment gateway[2]s, each playing a pivotal role in facilitating secure and efficient financial transactions.

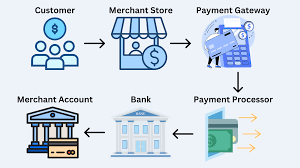

How Payment Processors Work

Payment processors act as intermediaries between the merchant[3], the customer, and the financial institutions involved. They ensure the smooth transfer of funds and play a crucial role in enhancing the security of online transactions. By integrating with e-commerce [4]platforms, payment processors streamline the payment process, making it quick and hassle-free. Security measures such as encryption and fraud detection further fortify the entire transaction ecosystem.

Types of Payment Processors

The landscape of payment processors is diverse, ranging from traditional methods to modern online and mobile solutions. Traditional processors handle credit card[5] transactions in brick-and-mortar stores, while online processors cater to the digital realm. Mobile payment processors have gained popularity, allowing consumers to make transactions using their smartphones seamlessly.

Benefits of Using Payment Processors

Businesses that leverage payment processors enjoy several advantages. Transactions become streamlined, reducing the risk of errors and delays. The heightened security measures employed by processors instill confidence in customers, fostering trust [1]in online transactions. Additionally, payment processors enable businesses to extend their reach globally, breaking down geographical barriers.

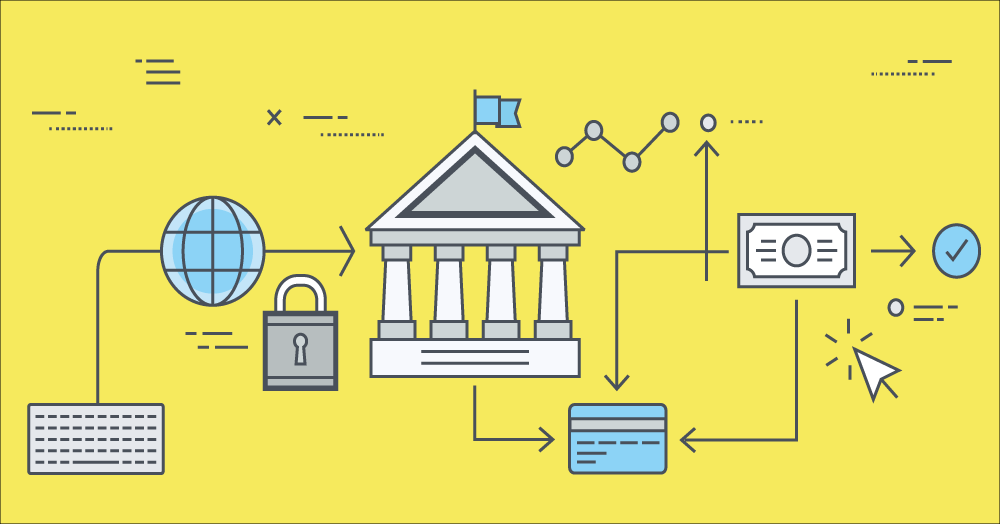

Comparison with Payment Gateways

While payment processors handle the transaction’s financial aspect, payment gateways are responsible for facilitating communication between the merchant’s website [2]and the bank. Understanding the differences between these two components is crucial for businesses seeking to optimize their online payment systems. They work hand in hand to ensure the entire process is efficient and secure.

Choosing the Right Payment Processor

Selecting the right payment processor[3] involves considering various factors. Businesses should evaluate the flexibility of integration with their existing systems, transaction fees, and the processor’s reputation for security. A careful assessment of these elements ensures a seamless and cost-effective payment processing experience.

Challenges in Payment Processing

The landscape of payment processing is not without its challenges. Fraud prevention remains a top concern, with processors continually implementing measures to thwart malicious activities. Regulatory compliance adds another layer of complexity, requiring processors to stay abreast of ever-changing laws. Technical glitches, though rare, can disrupt the smooth flow of transactions, underscoring the need for robust system monitoring.

Trends in Payment Processing

The payment processing industry is dynamic, with trends shaping its future. Contactless payments, driven by technological advancements, are gaining traction. Integration with cryptocurrencies is another frontier, offering a decentralized and secure alternative. Biometric authentication adds an extra layer of security, enhancing the user experience.

Future Outlook of Payment Processors

As technology [4]evolves, so does the landscape of payment processors. Emerging technologies like blockchain and artificial intelligence are poised to revolutionize the industry further. The market is expected to witness substantial growth as businesses increasingly adopt digital[5] payment solutions.

Case Studies

Examining successful implementations of payment processors provides valuable insights. Stories of businesses that have navigated challenges and achieved growth offer practical lessons for others. These case studies illuminate best practices and highlight potential pitfalls to avoid.

Tips for Businesses

For businesses venturing into the digital transaction landscape, adhering to best practices is essential. Emphasizing transparency, ensuring data security, and offering multiple payment options contribute to a positive customer experience. Building trust through reliable and efficient payment processing is paramount for sustained success.

Common Misconceptions

Dispelling myths surrounding payment processing is crucial for informed decision-making. Understanding the intricacies of the industry and debunking jargon contributes to a clearer comprehension of how payment processors operate. Education is key to dispelling common misconceptions.

Conclusion

In conclusion, payment processors and payment gateways form the backbone of online transactions. Their collaborative efforts ensure the smooth flow of funds while safeguarding the security of sensitive information. As businesses navigate the digital transaction landscape, choosing the right payment processor and staying abreast of industry trends are imperative for sustained success.

FAQs

- Q: Are payment processors and payment gateways the same?

While related, payment processors and gateways serve distinct roles in the online transaction process. Payment processors handle transaction authorization, while gateways facilitate communication between the customer and processor. - Q: What factors should businesses consider when choosing a payment processor?

Businesses should consider their type, transaction volume, and security requirements. Transaction fees, security protocols, and integration capabilities are also crucial factors. - Q: How do payment processors ensure the security of online transactions?

Payment processors employ encryption, two-factor authentication, and fraud prevention measures to ensure the security of online transactions and protect sensitive information. - Q: Can consumers benefit from using payment processors?

Absolutely. Payment processors offer convenience, buyer protection, and a streamlined transaction experience, benefiting consumers in the online shopping landscape. - Q: What are the upcoming trends in payment processing?

Future trends include the integration of blockchain technology and the increasing popularity of contactless payments, shaping the future of the payment processing industry.