AUTHOR : JAYOKI

DATE : 15/12/2023

Introduction

India has emerged as a global leader[1] in adopting diverse and innovative payment solutions. Payment options in India[2] range from traditional methods like cash and bank transfers to advanced digital platforms such as UPI, mobile wallets, and contactless card payments. These options cater to the needs of a vast and diverse population, ensuring convenience, security, and accessibility. With government initiatives promoting a cashless economy and a rapidly growing digital infrastructure[3], the landscape of payment options in India continues to evolve, empowering individuals and businesses alike.

Cash Transactions in India

India has a long history of cash transactions, deeply embedded in its cultural and economic fabric. Traditional payment[4] methods, including cash transactions, have been the norm for generations. However, this reliance on physical currency has had its implications, impacting the overall economy and shaping consumer preferences[5].

Digital Payment Revolution

The winds of change started blowing with the advent of digital payment solutions. The rise of digital wallets, the introduction of the Unified Payments Interface (UPI), and the surge in mobile banking have collectively propelled India into a digital age of financial transactions. These innovations not only offer convenience but also contribute significantly to the country’s economic growth.

E-commerce and Online Transactions

With the exponential growth of e-commerce, online transactions have become an integral part of daily life. From booking tickets to purchasing groceries, consumers now have a plethora of options. However, this shift comes with its own set of challenges, leading to the implementation of stringent security measures to protect users’ financial information.

Government Initiatives

The Indian government has played a pivotal role in steering the nation towards a cashless economy. Demonetization in 2016 marked a significant turning point, forcing a shift towards digital transactions. Various incentives and initiatives have been introduced to encourage individuals and businesses to embrace digital payment methods.

Cryptocurrency and its Role

While the acceptance of cryptocurrency in India has been met with mixed reactions, its role in shaping the future of payments cannot be ignored. The potential for decentralized and secure transactions has intrigued many, although regulatory challenges remain a hurdle.

Challenges in Payment Systems

As the digital landscape expands, challenges emerge. Cybersecurity concerns, issues of inclusivity, and technological barriers present hurdles that need careful consideration. Balancing technological advancements with accessibility remains a priority.

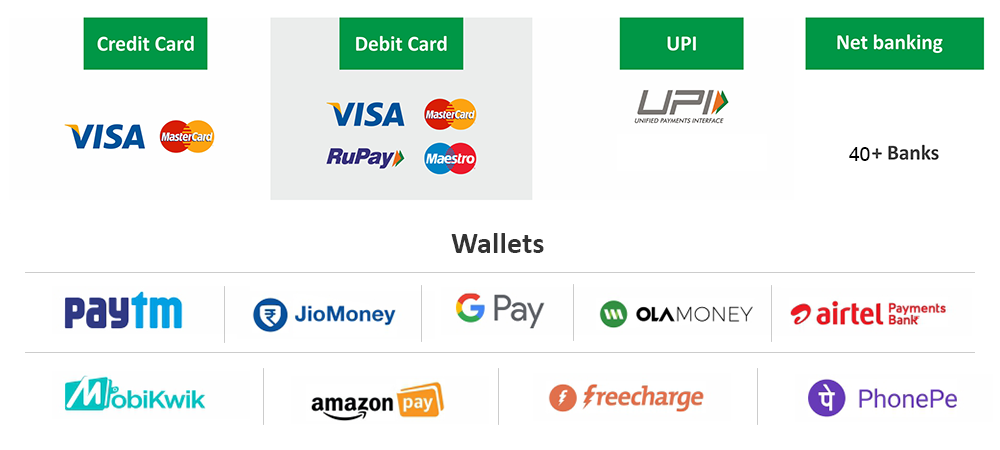

Popular Payment Gateways

The market is flooded with payment gateways catering to businesses of all sizes. From global giants to local players, each offers a unique set of features. The integration of these gateways into businesses has not only streamlined transactions but has also enhanced user experiences.

Impact on Small Businesses

For small businesses,[1] navigating the digital payment landscape can be challenging. Understanding the nuances of various payment options, overcoming initial hurdles, and adapting to new technologies require support and guidance. Government initiatives aimed at supporting small businesses in this transition are crucial.

The Future of Payment Options in India

The landscape of payment options in India is dynamic, with continuous technological advancements and evolving consumer behavior. The future promises even more innovation, with contactless payments, biometrics, and other cutting-edge technologies shaping the way transactions occur.

Educational Initiatives

As the payment ecosystem evolves, the need for public education becomes paramount. Promoting financial literacy and offering training programs can empower individuals to make informed decisions in the ever-changing financial landscape.

Consumer Trust and Confidence

Building trust in online transactions is crucial for the sustained growth of digital payment systems. Ensuring secure and transparent processes is key to gaining and retaining consumer confidence.

Global Comparisons

Comparing India’s payment landscape to other countries provides valuable insights. Learning from global best practices allows for the implementation of effective strategies to further enhance the efficiency and security of payment systems in India.

Conclusion

The variety of payment options in India reflects the country’s progress toward a digitally inclusive economy. From urban centers to rural areas, these payment solutions offer flexibility and efficiency for every user. By embracing these options, businesses can enhance customer satisfaction and expand their reach, while individuals can enjoy the benefits of seamless and secure transactions. As technology continues to advance, India’s payment ecosystem is set to become even more innovative and inclusive.

FAQs

1. What are the most common payment options available in India?

India offers a wide range of payment methods, including UPI, mobile wallets (like Paytm, PhonePe, and Google Pay), credit and debit cards, net banking, and cash on delivery.

2. Why is UPI considered a game-changer for payments in India?

UPI allows instant, real-time fund transfers between bank accounts via mobile apps. Its convenience, speed, and widespread adoption have revolutionized digital payments in India.

3. Are digital payment methods safe in India?

Yes, digital payment platforms in India adhere to strict security protocols like encryption, multi-factor authentication, and compliance with government regulations to ensure secure transactions.

4. How can businesses benefit from offering multiple payment options in India?

By providing a variety of payment options, businesses can cater to diverse customer preferences, improve conversion rates, and create a better shopping experience.

5. Is cash still widely used as a payment method in India?

Yes, while digital payments are growing rapidly, cash remains a commonly used payment method, especially in rural areas or for small-value transactions.