AUTHOR : SAYYED NUZAT

DATE : 25-08-2023

In the digital age, where shopping and online transactions have become the norm, the terms “payment processor” and “payment gateway” hold significant importance. These two components play a pivotal role in enabling seamless and secure online transactions for businesses and consumers alike. Let’s delve into the world of payment processing, demystify it, and understand its vital functions.

- What is the primary role of a payment processor?

- Are payment gateways vulnerable to cyberattacks?

- Can one payment gateway support multiple currencies?

- How does a payment processor ensure transaction accuracy?

- What role does artificial intelligence play in payment processing?

Introduction

In a world where digital[1] transactions dominate, understanding the intricate mechanisms that facilitate these transactions is crucial[2]. At the heart of online payments[3] lie payment processors and also payment gateways[4], working hand in hand to ensure the smooth transfer of funds[5] between buyers and sellers.

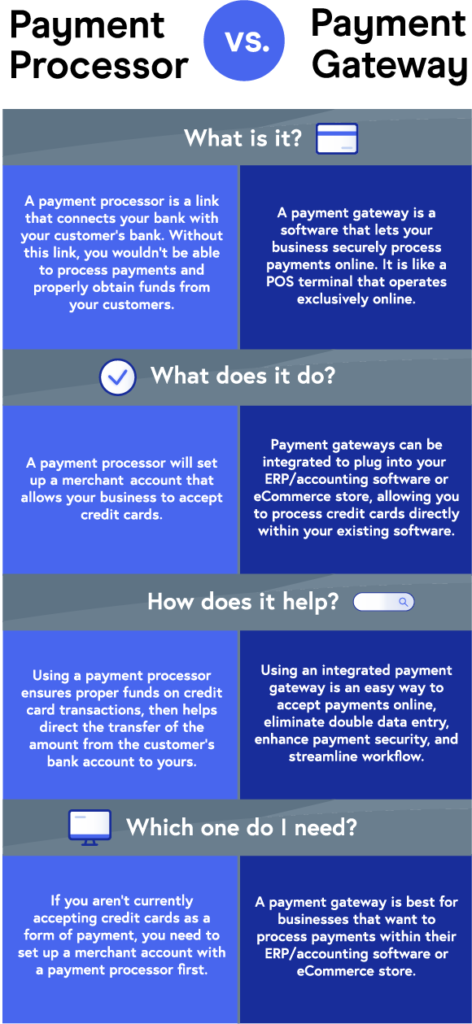

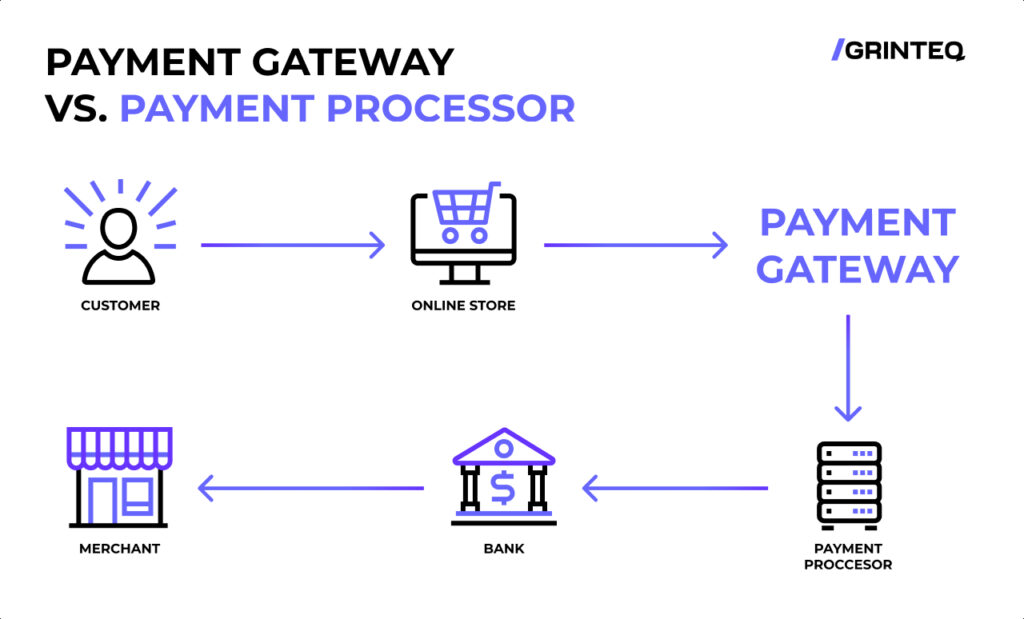

Understanding Payment Processor

A payment processor[1] acts as the intermediary between the merchant’s website and the financial institutions involved. It handles the crucial behind-the-scenes work, including verifying payment details, checking for sufficient funds, and ensuring security measures are in place. Essentially, it’s the engine that powers the transaction[2] process.

How Payment Gateways Operate

Think of a payment gateway as the virtual point-of-sale[3] terminal. When a customer initiates an online purchase, the payment gateway securely collects the payment information, encrypts it, and sends it to the payment processor for validation. Once the payment is approved, the gateway communicates the success to the website[4], allowing the transaction to proceed.

The Symbiotic Relationship

These two components, although distinct, work together harmoniously. The payment gateway[5] handles the customer-facing aspects, while the payment processor manages the complex data processing and communication with banks. This collaboration ensures that transactions are not only secure but also efficient.

Security Measures

Security is paramount in the world of online payments. Payment processors and gateways employ robust encryption and fraud detection tools to safeguard sensitive information. This layered approach thwarts cybercriminals and instills confidence in both buyers and sellers.

User-Friendly Experience

A seamless user experience is vital for customer satisfaction. Payment gateways provide user-friendly interfaces, guiding customers through the payment process. Similarly, payment processors ensure that transactions are processed swiftly, reducing the risk of cart abandonment.

Integration Complexity

Integrating payment solutions can be complex for businesses. Payment processors and Sandys offer various integration methods, catering to businesses of all sizes. From simple plugins to sophisticated APIs, these solutions make it feasible for businesses to adapt and scale.

Mobile-Friendly Adaptation

With the proliferation of mobile devices, payment processors and gateways have evolved to cater to mobile users. Mobile-responsive interfaces and optimized checkout experiences have become imperative for success in the modern shopping landscape.

Cross-Border Transactions

Globalization has led to cross-border transactions becoming the norm. Payment processors and gateways enable businesses to accept payments in multiple currencies, facilitating international trade and also expanding customer reach.

Payment Processing Speed

In the digital realm, speed is of the essence. Payment processors and gateways work tirelessly to ensure that transactions are processed swiftly, reducing waiting times for both customers and merchants.

Choosing the Right Payment Solution

Selecting the appropriate payment processor and gateway is a critical decision for businesses. Factors such as transaction fees, security features, integration ease, and customer support must all be considered in this choice.

Future Trends

The landscape of payment processing is ever-evolving. As technology advances, we can expect innovations such as biometric authentication, AI-driven fraud prevention, and even more seamless checkout experiences to shape the future of online transactions.

Conclusion

In the digital ecosystem, payment processors and payment gateways play indispensable roles, transforming the way we conduct online transactions. Their intricate synergy ensures secure, efficient, and user-friendly payment experiences. As technology continues to advance, these components will remain at the forefront of shaping the future of shopping.

FAQs

- What is the primary role of a payment processor?

A payment processor handles the behind-the-scenes tasks of verifying payment details, ensuring sufficient funds, and facilitating secure transactions between merchants and financial institutions. - Are payment gateways vulnerable to cyberattacks?

Payment gateways employ robust encryption and fraud detection measures to safeguard against cyberattacks, making them highly secure. - Can one payment gateway support multiple currencies?

Yes, many payment gateways support multiple currencies, enabling businesses to accept payments from customers around the world.