AUTHOR : ADINA XAVIER

DATE : 30/09/2023

In this era of digitalization, the landscape of commerce has experienced a profound and unprecedented metamorphosis. Ecommerce, in particular, has witnessed exponential growth, becoming a significant part of the global economy. With this surge in online shopping, the need for efficient and secure payment solutions has never been more crucial. In India, the concept of a payment gateway for ecommerce websites has gained substantial importance. In this article, we will delve into the intricacies of payment gateways in the context of ecommerce websites in India, exploring their significance, functionality, and benefits.

Understanding Payment Gateways

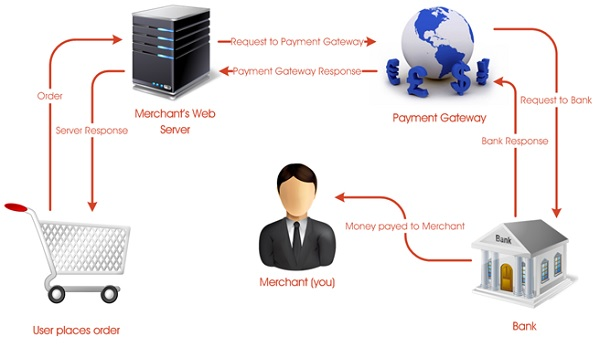

Before we dive deeper, let’s establish a fundamental understanding of payment gateways. In essence, a payment gateway is a technology-driven platform that facilitates online transactions by securely connecting online merchants, customers, and banks. It acts as a bridge that enables the effortless transfer of funds from the customer’s bank account to the merchant’s account.

The Role of Payment Gateways

Payment portals play a pivotal role in the ecommerce[1] ecosystem. They ensure the swift and secure processing of online payments, which is vital for businesses and consumers alike. Here’s a failure of their essential functions:

1. Transaction Authorization

Payment gateways validate whether a customer’s payment method is legitimate and whether they have sufficient funds for the transaction. This step ensures that fraudulent transactions are minimized.

2. Encryption and Security

Security is essential in online transactions. Payment portals employ robust encryption techniques to secure sensitive customer information, such as credit card details.

3. Payment Processing

Once a transaction is authorized and secure, payment portals initiate the transfer of funds from the customer’s account to the merchant’s account.

4. Notification

Payment portals provide instant alerts to both the merchant and the customer, confirming the success of the transaction.

The Growth of Ecommerce in India

India’s e-commerce sector has witnessed exponential growth in recent years, driven by factors such as increased internet entry, a burgeoning middle class, and the convenience of online shopping. This growth has made it imperative for businesses to adopt efficient payment gateway solutions.

1. Diverse Payment Options

In a diverse country like India, payment preferences vary widely. Payment gateways[2] in India offer support for various payment methods, including credit cards, debit cards, digital wallets, UPIs, and net banking. This diversity caters to the needs of a broad customer base.

2. Cash-on-Delivery

Despite the rise of digital payments, the ‘Cash-on-Delivery’ option remains popular among Indian consumers. Payment portals enable businesses to effortlessly integrate this payment method into their e-commerce websites.

The Benefits of Payment Gateways for Ecommerce Websites

1. Enhanced Customer Trust

Payment portals instill confidence in customers by ensuring the security of their financial data. This trust factor encourages more transactions and repeat business.

2. Streamlined Checkout Experience

A seamless and trouble-free checkout experience plays a vital role in minimizing instances of abandoned shopping carts. Payment gateways provide an intuitive and efficient transaction experience, boosting conversions.

3. Global Reach

With payment portals, Indian ecommerce[3] websites can cater to customers worldwide, expanding their reach and potentially increasing revenue.

4. Real-time Reporting and Analytics

Payment portals offer valuable insights through real-time reporting and data interpretation. This data allows businesses to make informed decisions and optimize their online operations.

The Evolution of Payment Gateway Technology

1. Mobile Payment Integration

Due to the widespread adoption of wireless devices, the use of mobile payments has surged in popularity. Payment gateways now offer seamless integration with mobile wallets and apps, making it convenient for customers to complete transactions using their smartphones.

2. Multi-Currency Support

As Indian e-commerce businesses target international markets, payment gateways have added multi-currency support. This feature allows customers from different countries to shop and pay in their local currencies, improving the user experience.

3. Subscription and Recurring Payments

Subscription-based ecommerce models have gained movement. Payment portals facilitate regular payments, making it easier for businesses to manage subscription services and for customers to enjoy uninterrupted access to products or services.

Payment Gateway Providers in India

1. Paytm Payment Gateway

Paytm is one of India’s leading mobile payment platforms, and its payment gateway solution is widely used by e-commerce businesses. It offers a range of payment options, including Paytm Wallet, UPI, debit cards, credit cards, and net banking[4].

2. Razorpay

Razorpay is known for its developer-friendly payment gateway integration. It supports multiple payment methods and offers robust analytics tools to help businesses track and optimize their transactions.

3. CCAvenue

CCAvenue is among the oldest and most trusted payment gateway providers in India. It boasts a wide range of payment options, including international payment methods, making it appropriate for businesses with a global customer base.

4. Instamojo

Instamojo is popular among small and intermediate ecommerce businesses in India. It offers simple integration and a user-friendly interface, making it accessible to startups and entrepreneurs.

Conclusion

In conclusion, payment gateways are the backbone of e-commerce websites in India, playing a pivotal role in simplifying online transactions. Their significance in ensuring security, convenience, and trust cannot be overstated. As the e-commerce landscape continues to evolve, businesses must adapt by embracing reliable payment gateway solutions to stay competitive and serve their customers effectively.

FAQs

1. Are payment gateways secure for online transactions?

Yes, payment portals use advanced encryption and security measures to protect customer data, making them highly secure for online transactions[5].

2. Can e-commerce websites in India accept international payments through payment gateways?

Absolutely. Payment gateways enable Indian e-commerce websites to accept payments from customers worldwide, expanding their global reach.

3. How can payment gateways improve the checkout process?

Payment gateways offer a streamlined and easy-to-use payment process experience, reducing friction and cart abandonment rates.

4. Is ‘Cash on Delivery’ supported by payment gateways in India?

Yes, most payment gateways in India support the ‘Cash-on-Delivery’ payment method, providing for the preferences of Indian consumers.

5. What role do payment gateways play in building customer trust?

Payment gateways play a crucial role in building customer trust by assuring the security and confidentiality of their financial information.