AUTHOR : SARIKA PATHAK

DATE : 23 – 09 – 2023

In the fast-paced digital landscape of today’s business world, the need for efficient and secure online payment processing[1] has never been more critical. Payment gateway[2] implementation plays a pivotal role in enabling businesses to accept payments seamlessly,[3] providing convenience to customers while ensuring the security of their financial transactions. In this comprehensive guide, we will delve into the intricacies of payment gateway[4] implementation,[5] exploring its significance, key steps, and benefits.

Understanding Payment Gateways

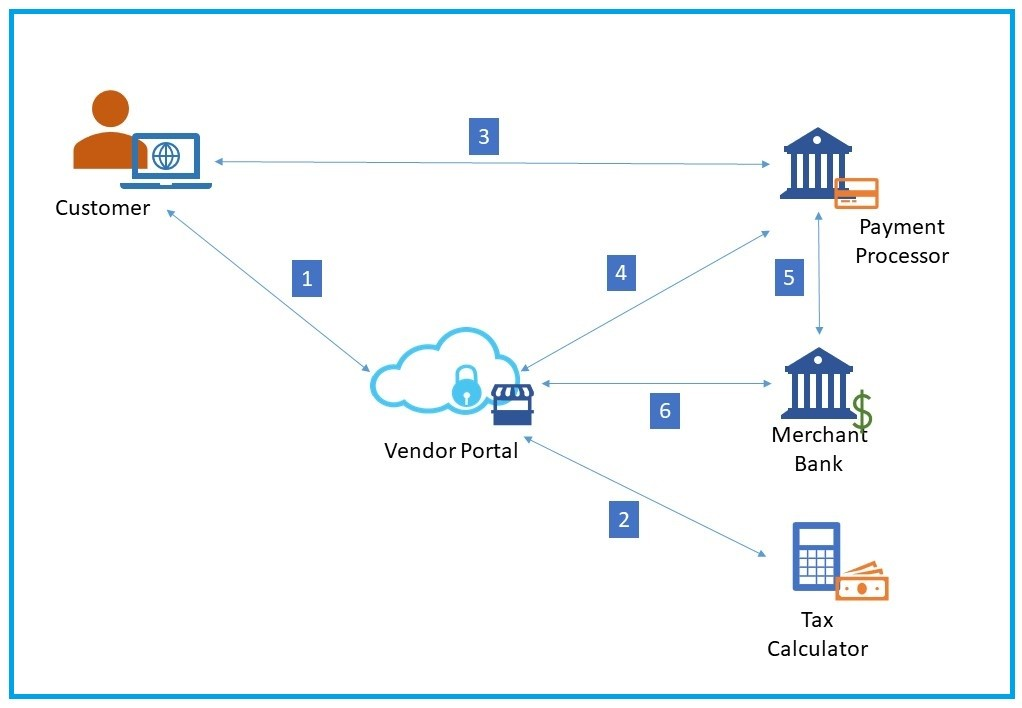

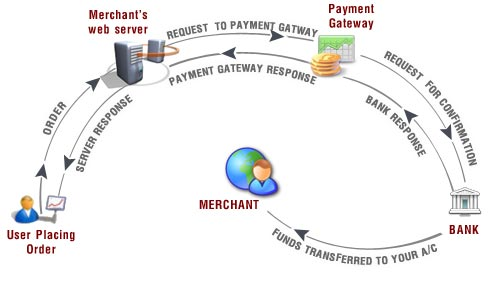

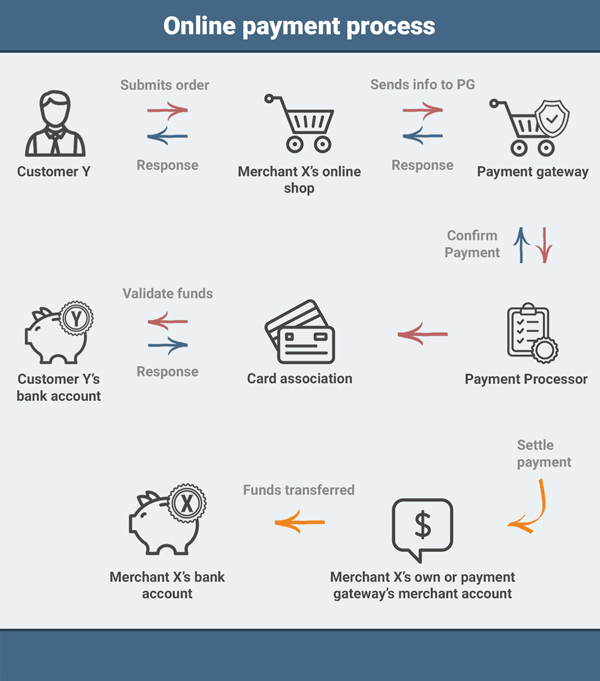

Payment gateways are online tools that facilitate the secure transfer of funds from a customer’s bank account to the merchant’s account, ensuring a smooth and secure online payment experience. They act as a bridge between the customer, the merchant, and the financial institutions involved in the transaction. Here’s a closer look at the key components of payment gateways:

The Role of Payment Gateways

Payment gateways play a multifaceted role in the e-commerce ecosystem:

- Transaction Authorization: Payment gateways verify the authenticity of the payment method and the availability of funds.

- Encryption and Security: They employ robust encryption techniques to safeguard sensitive customer data.

- Transaction Routing: Payment gateways route transactions to the appropriate financial institutions.

- Payment Confirmation: They provide real-time confirmation to customers and also merchants regarding the transaction’s status.

Steps to Implement a Payment Gateway

Implementing a payment gateway involves a series of carefully planned steps to ensure a seamless payment process. Here’s a step-by-step guide:

1: Research and Selection

Before implementation, it’s essential to research and choose a payment gateway provider[1] that aligns with your business needs. Consider factors like transaction fees, security features, and also compatibility with your e-commerce platform.

2: Account Setup

Once you’ve selected a payment gateway provider, create an account and complete the necessary documentation. This typically includes business verification and also financial details.

3: Integration

Integrate the selected payment gateway [2]into your website or mobile app. Most providers offer user-friendly APIs and also plugins for popular e-commerce platforms.

4: Testing

Thoroughly test the payment gateway to ensure it works seamlessly. Simulate different payment scenarios[3] to identify and resolve any issues.

5: Security Measures

Implement additional security measures, such as SSL certificates and PCI DSS compliance, to protect customer data during transactions.

6: User Experience

Focus on optimizing the user experience by customizing the payment page to align with your brand and providing clear instructions for customers.

7: Go Live

After successful testing and also customization, you’re ready to go live. Monitor transactions closely during the initial stages to ensure everything runs smoothly.

Benefits of Payment Gateway Implementation

Implementing a payment gateway[4] offers numerous advantages to businesses of all sizes:

Enhanced Security

Payment gateways employ advanced encryption techniques, reducing the risk of data breaches and fraud.

Global Reach

They enable businesses to accept payments from customers worldwide, expanding their market reach.

Convenience for Customers

Customers appreciate the ease and also convenience of making online payments, which can lead to higher conversion rates.

Streamlined Operations

Payment gateways automate transaction processes, reducing manual intervention and also streamlining operations.

Customization and Branding

One of the advantages of payment gateway implementation is the ability to customize the payment process to align with your brand’s identity.

Branding Opportunities

Payment gateways often allow you to incorporate your brand’s logo and also colors into the payment pages. This not only maintains consistency in your customer’s journey but also reinforces your brand’s presence.

Seamless Integration

An effectively integrated payment gateway should seamlessly merge with your website’s design, providing a cohesive user experience. It should not disrupt the flow of the customer’s interaction with your platform.

Cost Considerations

While payment gateways offer numerous benefits, it’s essential to consider the associated costs.

Transaction Fees

Most payment gateway providers charge a small fee for each transaction. Be sure to understand these fees and how they may impact your bottom line.

Integration and Setup Costs

In addition to transaction fees and subscription charges, there might be initial integration and setup costs involved in implementing a payment gateway. These costs can vary depending on the complexity of your integration needs.

International Transactions

If your business caters to a global audience, you should also consider the additional costs associated with accepting international transactions. Currency conversion fees and cross-border transaction charges may apply.

Security Measures

Ensuring the security of online transactions is paramount, and payment gateway implementation plays a crucial role in this aspect.

Encryption and Data Protection

Payment gateways use advanced encryption methods to safeguard sensitive customer data, such as credit card information. This encryption ensures that the data remains confidential and secure during transmission.

Conclusion

In a digital world driven by convenience and security, payment gateway implementation is the cornerstone of successful online businesses. By following the steps outlined in this guide and choosing the right payment gateway provider, you can streamline your digital transactions, enhance security, and provide a seamless payment experience for your customers.

FAQs

1. What is a payment gateway?

A payment gateway is an online tool that facilitates secure online transactions by acting as a bridge between the customer, the merchant, and financial institutions.

2. How do I choose the right payment gateway provider?

When choosing a payment gateway provider, consider factors like transaction fees, security features, and compatibility with your e-commerce platform.

3. What security measures should I implement for payment gateway integration?

To enhance security, implement SSL certificates and ensure compliance with PCI DSS (Payment Card Industry Data Security Standard).

4. What are the benefits of payment gateway implementation?

Payment gateway implementation offers enhanced security, global reach, convenience for customers, and streamlined operations.

5. How can I optimize the user experience for online payments?

Customize the payment page to align with your brand, provide clear instructions, and ensure a seamless and user-friendly interface.