AUTHOR : EMILY PATHAK

DATE : 21 – 09 – 2023

In an era dominated by digital advancements, the landscape of financial transactions in India[1] has undergone a remarkable transformation[2]. The rise of e-commerce, mobile apps, and online services[3] has led to an increasing demand for efficient and secure payment gateways[4]. This article delves into the thriving world of payment gateway businesses[5] in India, exploring the key aspects, challenges, and future prospects of this industry.

Introduction

The payment gateway industry in India is experiencing exponential growth, and also for a good reason. With the Government of India’s push towards a cashless economy and the rapid digitalization of businesses, payment gateways have become the backbone of online transactions. This article aims to provide an in-depth understanding of this thriving sector.

The Evolution of Payment Gateways

Payment gateways have come a long way from their inception. Initially, they were primarily used for processing credit card payments.{1} However, with the advent of mobile wallets, UPI (Unified Payments Interface), and other digital payment methods, payment gateways have diversified their offerings.

Why Payment Gateways Matter

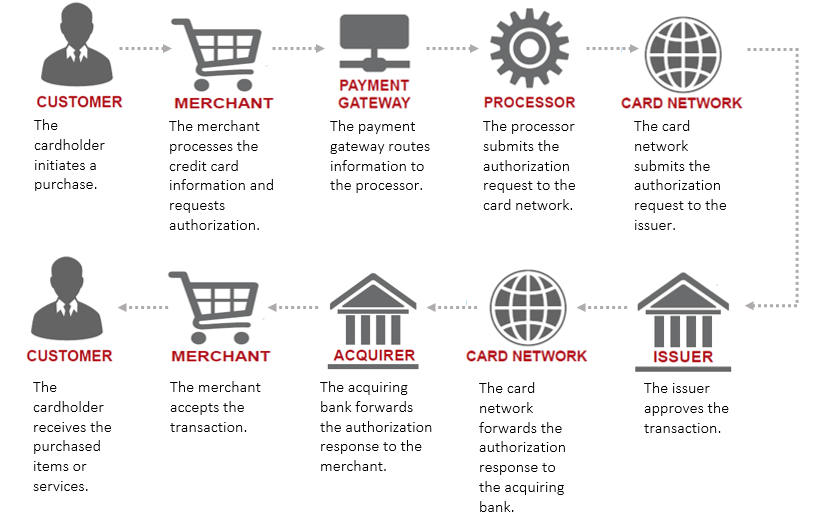

Payment gateways{2} play a pivotal role in ensuring that online transactions are seamless, secure, and efficient. They act as intermediaries between the buyer, seller, and banks, facilitating the transfer of funds while safeguarding sensitive information.

Key Players in the Indian Market

Several key players dominate the Indian payment gateway market,{3} each offering unique features and services. Prominent names include Paytm, Razorpay, Instamojo, and CCAvenue, among others.

Regulations and Compliance

The Reserve Bank of India (RBI) and the National Payments Corporation{4} of India (NPCI) have implemented stringent regulations and compliance measures to ensure the safety and also security of digital transactions. Payment gateway businesses must adhere to these guidelines to operate in India.

Challenges Faced by Payment Gateway Businesses

Despite the promising growth, payment gateway businesses encounter various challenges. These include increasing competition, the need for continuous innovation, and the ever-present threat of cyberattacks.

The Future of Payment Gateways in India

The future of payment gateways in India looks promising. As more businesses and also individuals embrace digital transactions, the demand for secure and user-friendly payment gateways will continue to rise.

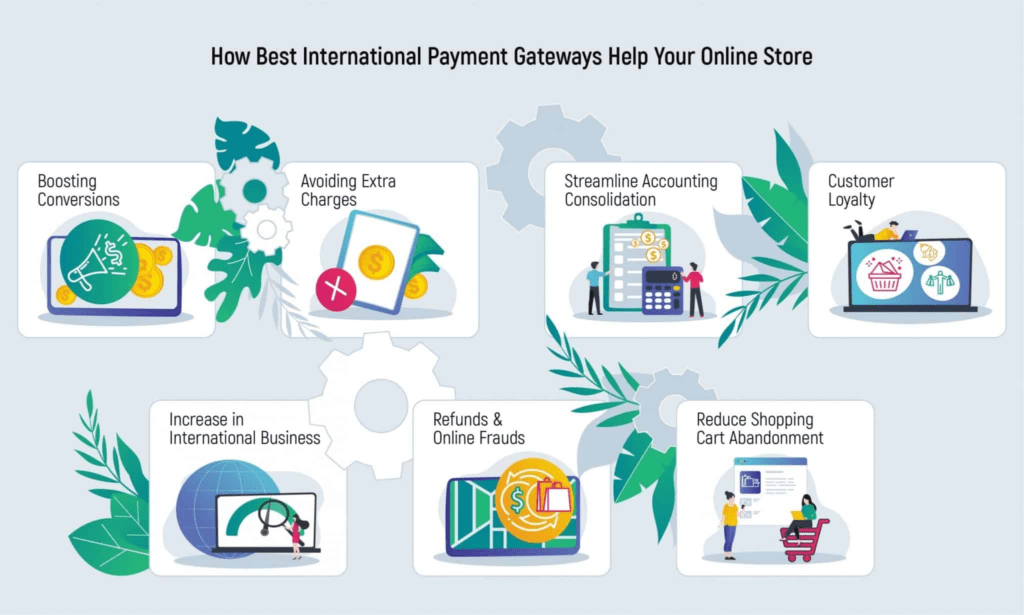

Benefits of Using Indian Payment Gateways

Indian payment gateways offer several advantages, including competitive pricing, local language support, and compatibility with various payment methods. These factors make them the preferred choice for businesses operating in India.

Case Studies: Success Stories

To illustrate the impact of payment gateways, let’s explore a few success stories of businesses that have thrived by integrating these solutions into their operations.

Security Measures in Payment Gateways

Security is paramount in the payment gateway industry. We’ll delve into the robust security measures employed by payment gateways to protect users’ financial information.

How to Choose the Right Payment Gateway

Selecting the right payment gateway is crucial for businesses. We’ll provide valuable insights into the factors to consider when making this decision.

Integration and User Experience

A seamless integration process and an excellent user experience are vital for the success of payment gateways. We’ll discuss best practices in this regard.

Customer Support in Payment Gateways

Responsive customer support can make or break a payment gateway’s reputation. We’ll explore the importance of efficient customer service.

The Importance of Payment Gateways for E-commerce

E-commerce has witnessed unprecedented growth in India, with consumers increasingly turning to online shopping for convenience and variety. Payment gateways are the linchpin of e-commerce, ensuring that customers can securely make purchases online. This includes everything from ordering groceries and electronics to booking flights and also hotels.

The ease of use and reliability of payment gateways have contributed significantly to the success of e-commerce platforms. Customers trust that their payment information is kept safe, which in turn encourages them to make more online purchases.

Mobile Wallets and the Digital Revolution

In recent years, mobile wallets have become a ubiquitous presence in India. Apps like Paytm, Google Pay, and PhonePe have revolutionized the way people pay for goods and also services. These mobile wallet apps often integrate seamlessly with payment gateways, providing users with a variety of payment options.

Mobile wallets offer convenience and speed, allowing users to make payments with just a few taps on their smartphones. This has particularly benefitted small businesses and street vendors who can now accept digital payments without the need for expensive point-of-sale systems.

Rural India and the Digital Payment Revolution

While urban areas have readily embraced digital payments, rural India has also seen significant progress. Initiatives like Jan Dhan Yojana, Aadhaar, and the Bharat Bill Payment System (BBPS) have played a pivotal role in bringing digital financial services to remote villages.

Payment gateway businesses have adapted to cater to the unique needs of rural customers. They offer simplified interfaces, support for regional languages, and also tie-ups with local businesses to facilitate digital payments even in areas with limited connectivity.

Future Innovations and Trends

The payment gateway industry in India is not resting on its laurels. It continues to innovate to meet the evolving demands of consumers and businesses. Some of the exciting trends on the horizon include:

- Contactless Payments: With the ongoing concerns about hygiene, contactless payments using NFC (Near Field Communication) technology are on the rise. Payment gateways are actively developing and promoting this feature.

- Blockchain and Cryptocurrency: While still in the experimental phase, some payment gateways are exploring the integration of blockchain technology and cryptocurrencies to offer more options for users.

- AI-Powered Fraud Detection: Artificial intelligence is being harnessed to enhance security measures, detecting and preventing fraudulent transactions in real-time.

- Voice-Activated Payments: Voice recognition technology is being used to facilitate payments through voice commands, making the process even more convenient.

- Integration with Social Commerce: Payment gateways are looking to integrate with social media platforms, allowing users to make payments directly within social apps.

Conclusion

In this digital age, payment gateways are the unsung heroes of India’s financial ecosystem. They enable businesses to thrive, consumers to shop with ease, and also the nation to progress toward a cashless economy. As technology continues to advance, we can only expect payment gateways to become more sophisticated and indispensab

FAQs

- Are payment gateways in India safe to use?

- Yes, Indian payment gateways adhere to strict security standards to ensure the safety of transactions.

- How do payment gateways benefit small businesses?

- Payment gateways enable small businesses to accept online payments, expand their customer base, and improve cash flow.

- What are the common challenges faced by payment gateway businesses?

- Challenges include competition, security threats, and the need for continuous innovation.

- Can individuals use payment gateways for personal transactions?

- Yes, many payment gateways in India also cater to individual users for various purposes.

- What is the future outlook for the payment gateway industry in India?

- The industry is poised for growth as more businesses and consumers embrace digital payments.