AUTHOR : SARIKA PATHAK

DATE : 20 -09 – 2023

In the digital age, where online transactions have become the norm, payment gateway architecture[1] plays a pivotal role in ensuring seamless and secure financial transactions. Have you ever wondered how your payment information[2] travels from your device to the merchant’s bank[3]? This article will delve into the intricate world of payment gateway architecture[4], breaking it down step by step. So, let’s embark on this journey to understand also the backbone of online payments[5].

Introduction to Payment Gateways

Payment gateways are digital tools that facilitate online transactions by securely transferring payment information from a customer’s device to the merchant’s bank. They serve as intermediaries that validate, authorize, and also process payments.

The Role of Payment Gateway Architecture

Payment gateway architecture is the foundation upon which these transactions are built. It encompasses a complex network of components and also processes designed to ensure the smooth flow of funds between the customer and the merchant.

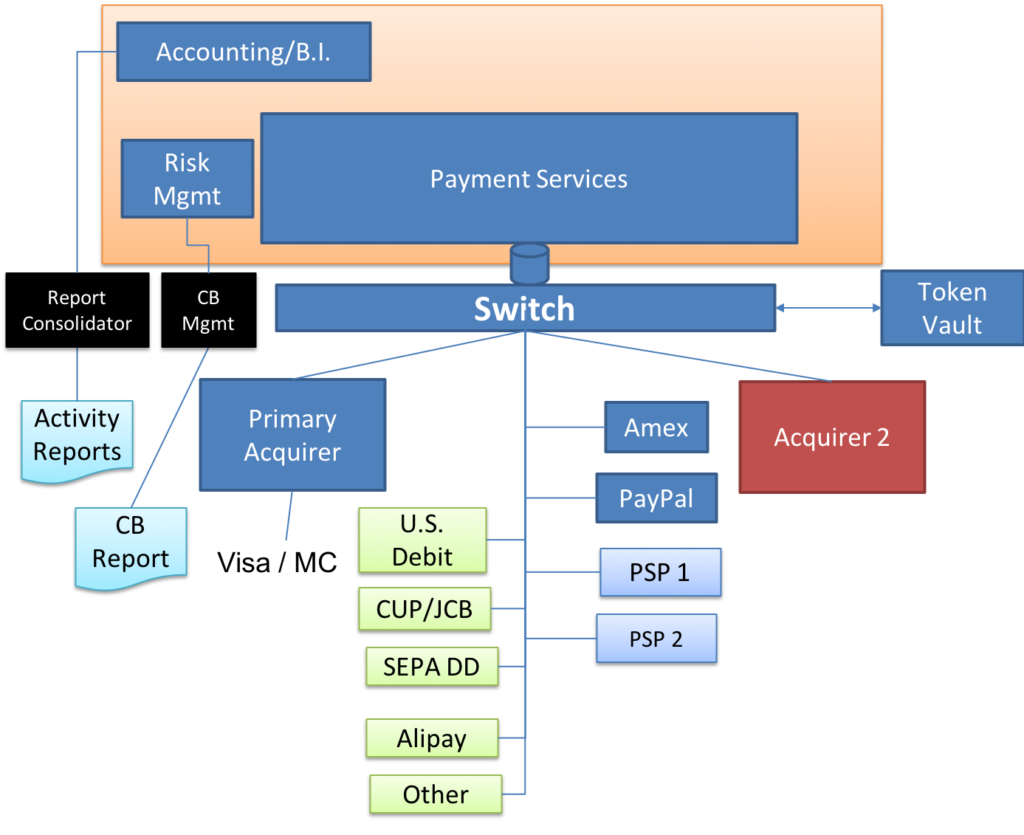

Key Components of Payment Gateway Architecture

Payment Processor

At the heart of payment gateway architecture is the payment processor. This component acts as a bridge between the merchant’s website and also the customer’s bank, facilitating the transfer of funds.

Security Layer

Security is paramount in payment gateway architecture{1}. Advanced encryption and tokenization techniques are employed to safeguard sensitive financial data.

Merchant’s Website

The merchant’s website serves as the starting point for the transaction. It’s where customers initiate payments and also provide their payment information.{2}

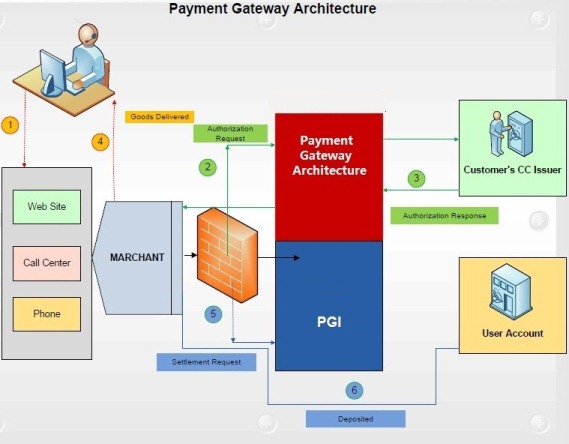

How Payment Gateway Architecture Works

Step 1: Customer Initiates Payment

The customer begins the transaction by selecting products or services and also proceeding to checkout.

Step 2: Encryption and Tokenization

Payment information{3} is encrypted and tokenized to protect it from potential threats.

Step 3: Authorization Request

An authorization request is sent to the customer’s bank, seeking approval for the transaction.

Step 4: Transaction Routing

The request is routed to the appropriate payment processor and then to the bank.

Step 5: Authorization Response

The customer’s bank sends an authorization response, either approving or declining the transaction.

Types of Payment Gateway Architecture

Hosted Payment Gateways

Hosted gateways redirect customers to a secure payment page{4} hosted by a third party.

Integrated Payment Gateways

Integrated gateways allow customers to complete transactions without leaving the merchant’s website.

Benefits of Payment Gateway Architecture

- Streamlined transactions

- Enhanced security

- Global reach

- Real-time processing

Challenges and Security Concerns

While payment gateways offer numerous benefits, they also come with challenges, including security vulnerabilities and the risk of payment failures.

Future Trends in Payment Gateway Architecture

As technology continues to evolve, payment gateway architecture will likely see advancements in areas such as biometric authentication and blockchain integration.

Selecting the Right Payment Gateway for Your Business

Choosing the right payment gateway is crucial for the success of your online business. Factors like transaction fees, security, and also compatibility must be considered.

Integration and Customization

Businesses can customize payment gateways to match their branding and integrate them seamlessly into their websites.

Ensuring Payment Gateway Security

Implementing robust security measures, including PCI DSS compliance, is essential to protect customer data.

Mobile Payment Gateways

The rise of mobile payments has led to the development of mobile-specific payment gateways tailored for smartphones and tablets.

International Payment Gateways

Expanding globally requires payment gateways that support multiple currencies and also languages.

The Impact of Cryptocurrency

Cryptocurrencies are reshaping the payment landscape, and also some payment gateways now accept digital currencies as a form of payment.

Mobile Payment Gateways

In an era dominated by smartphones and tablets, mobile payment gateways have emerged as a game-changer. These gateways are specifically designed to cater to the needs of users who prefer making payments using their mobile devices. They offer a seamless and convenient way to complete transactions while on the go.

Mobile payment gateways come with several advantages:

- User-Friendly Interfaces: They are optimized for touchscreens, making it easy for customers to navigate and also make payments on smaller screens.

- Quick Checkout: Mobile gateways often offer one-click or fingerprint authentication, streamlining the checkout process for users.

- Integration with Mobile Wallets: Many mobile gateways integrate with popular mobile wallet apps like Apple Pay and Google Pay, further enhancing the user experience.

- Real-Time Notifications: Customers receive instant notifications on their mobile devices regarding the status of their transactions, adding an extra layer of transparency.

For businesses, integrating mobile payment gateways into their apps or mobile websites can significantly boost sales and customer satisfaction. It caters to the growing segment of users who prefer shopping and paying for services using their smartphones.

International Payment Gateways

As businesses expand their reach globally, the need for international payment gateways becomes paramount. International gateways enable businesses to accept payments in multiple currencies and languages, facilitating cross-border transactions. Here’s what you need to know:

- Multi-Currency Support: International payment gateways allow businesses to accept payments in various currencies. This feature simplifies the process for international customers, as they can pay in their local currency without worrying about exchange rates.

- Language Localization: These gateways often support multiple languages on their payment pages, making it easier for customers from different parts of the world to understand and complete the transaction.

- Global Reach: International payment gateways enable businesses to tap into new markets and expand their customer base beyond their domestic borders.

- Currency Conversion: Some gateways offer currency conversion services, allowing businesses to receive payments in their preferred currency, even if the customer pays in a different currency.

The Impact of Cryptocurrency

The rise of cryptocurrency has introduced a paradigm shift in the world of payments. While traditional payment gateways primarily deal with fiat currencies, some forward-thinking gateways now accept cryptocurrencies as a form of payment. Here’s how this emerging trend is shaping the payment landscape:

- Decentralization: Cryptocurrencies function within decentralized ecosystems, diminishing their dependence on conventional financial institutions.This can lead to faster transactions and lower fees.

- Global Accessibility: Cryptocurrencies are accessible to anyone with an internet connection, making them ideal for international transactions.

- Security: Blockchain technology, which underlies cryptocurrencies, offers robust security features, reducing the risk of fraud.

- Diversification: Accepting cryptocurrencies can attract tech-savvy customers and diversify payment options for businesses.

However, it’s important to recognize that cryptocurrencies can be volatile, and their regulatory environment varies by region. Businesses considering cryptocurrency payments should carefully assess the potential risks and benefits.

In conclusion, the world of payment gateway architecture is dynamic and constantly evolving to meet the demands of modern commerce. From mobile payment gateways that cater to the mobile-first generation to international gateways that enable global expansion and the emergence of cryptocurrencies as a payment option, businesses have a plethora of choices to consider. Understanding these options and staying informed about industry trends is crucial for businesses looking to stay competitive in the digital age.

Conclusion

Payment gateway architecture is the unsung hero of online transactions, ensuring that your payments are processed securely and efficiently. Understanding its intricacies empowers businesses to make informed decisions when selecting the right payment gateway for their needs.

Frequently Asked Questions

- What is a payment gateway?

- A They is a visual representation of the components and processes involved in a payment gateway system. It helps illustrate how payment information flows from the customer to the merchant’s bank.

- How does payment gateway architecture enhance security?

- Payment gateway architecture enhances security through advanced encryption and tokenization techniques, protecting sensitive financial data from unauthorized access.

- What is PCI DSS compliance, and why is it important for payment gateways?

- PCI DSS (Payment Card Industry Data Security Standard) compliance is a set of security standards designed to ensure the secure handling of credit card information. It is crucial for payment gateways to be PCI DSS compliant to protect customer data.

- What are the future trends in payment gateway architecture?

- Future trends in payment gateway architecture may include advancements in biometric authentication, blockchain integration, and also enhanced mobile payment solutions.

- Can payment gateways accept cryptocurrency payments?

- Yes, some payment gateways now support cryptocurrency payments, allowing customers to use digital currencies for online transactions.