AUTHOR : JAYOKI

DATE : 18/12/2023

Introduction

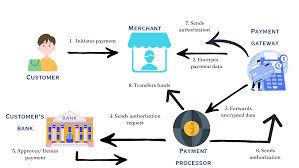

In today’s fast-paced digital world, businesses[1] need robust and secure systems to handle online payments efficiently. A Payment Gateway[2] United States is the backbone of online transaction processing, allowing businesses to securely accept payments from customers across various platforms[3]. This article will explore what a Payment Gateway United States is, why it’s important, and how businesses can choose the right one to meet their needs.

Importance of Payment Gateways in the United States

With the rapid growth of online businesses, the need for efficient and secure payment[4] processing solutions has never been higher. Payment gateways not only enhance the customer experience but also contribute to the overall success of e-commerce ventures[5].

Evolution of Payment Gateways

Early Forms of Payment Processing

In the early days of e-commerce, payment processing was a cumbersome task with limited options. From manual credit card processing to electronic data interchange (EDI), the landscape has witnessed a significant transformation.

Emergence of Modern Payment Gateways

Modern payment gateways have streamlined the entire payment process, offering a range of features such as real-time transaction processing, enhanced security protocols, and compatibility with various payment methods.

Key Features of Payment Gateways

Security Protocols

One of the paramount concerns in online transactions is security. Payment gateways employ advanced encryption techniques and fraud detection tools to safeguard sensitive information, instilling confidence in both merchants and customers.

Integration Options

Flexibility in integration is a key feature of successful payment gateways. Whether it’s a website, mobile app, or point-of-sale system, a robust gateway seamlessly integrates with diverse platforms.

User-Friendly Interface

A user-friendly interface is vital for a positive customer experience. Intuitive design and clear instructions contribute to smooth transactions, reducing the likelihood of abandoned carts.

Popular Payment Gateways in the United States

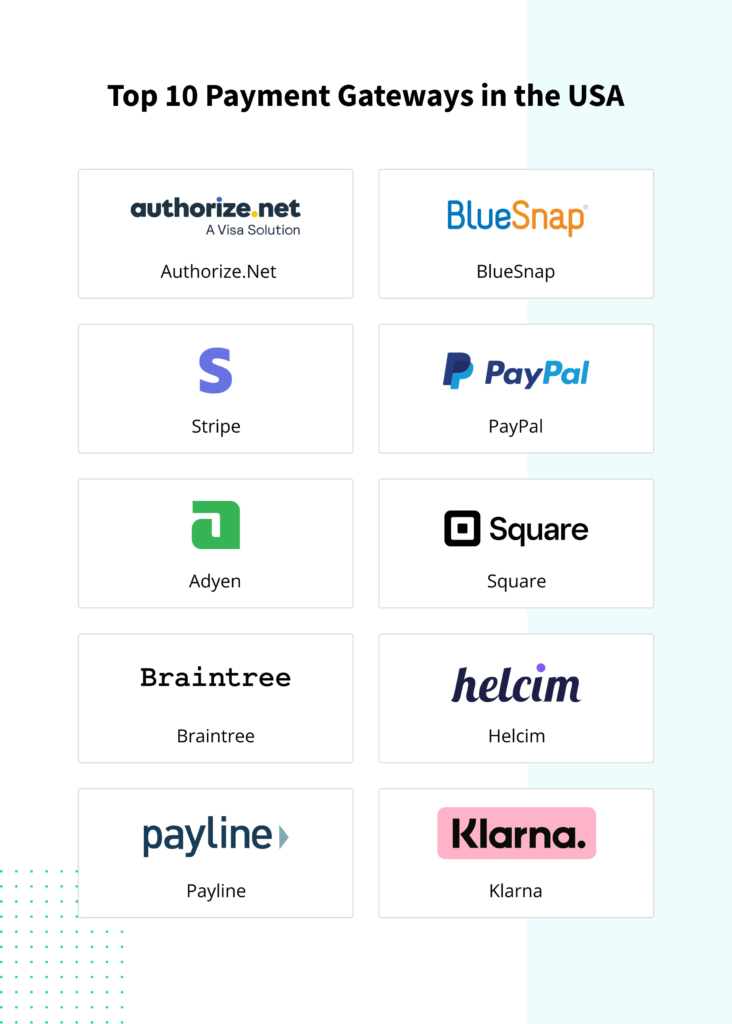

PayPal

As one of the pioneers in online payments, PayPal remains a popular choice for its widespread acceptance and ease of use.

Stripe

Known for its developer-friendly approach, Stripe has gained popularity for its customizable solutions and support for various payment methods.

Square

Square stands out for its simplicity and accessibility, particularly appealing to small businesses and entrepreneurs.

Authorize. Net

With a reputation for reliability, Authorize.Net is a go-to choice for businesses seeking a robust and secure payment gateway.

Choosing the Right Payment Gateway

Factors to Consider

Selecting the right payment gateway involves considering factors such as transaction fees, security features, and compatibility with the business model.

Tailoring to Business Needs

Every business has unique requirements. A successful payment gateway aligns with these needs, providing tailored solutions for optimal performance.

Integration Challenges and Solutions

Technical Compatibility

Integration challenges often arise due to differences in technical requirements. Working closely with developers and leveraging comprehensive API documentation can mitigate these challenges.

Streamlining Integration Processes

Ensuring a smooth integration process is crucial. Payment gateways that offer seamless integration options and proactive support contribute to a hassle-free implementation.

Impact on E-Commerce Businesses

Enhancing Customer Trust

A secure and efficient payment gateway contributes to building trust among customers, encouraging repeat business and positive reviews.

Expanding Market Reach

The convenience of online transactions widens the market reach for businesses, enabling them to tap into a global customer base.

Future Trends in Payment Gateways

Cryptocurrency Integration

The rise of cryptocurrencies has sparked interest in their integration into payment gateways, providing an alternative payment method for tech-savvy consumers.

Biometric Authentication

Advancements in technology may see the incorporation of biometric authentication, further enhancing the security of online transactions.

Security Concerns and Solutions

Fraud Prevention Measures

Constant vigilance and the implementation of advanced fraud detection tools are essential for preventing fraudulent transactions.

Compliance with Industry Standards

Adhering to industry standards and certifications ensures that payment gateways meet the necessary security and regulatory requirements.

Successful Implementations

Real-Life Examples of Effective Payment Gateway Usage

Exploring case studies of businesses that have successfully implemented payment gateways provides valuable insights and best practices for others.

User Experience and Feedback

Importance of Positive User Experience

A positive user experience is pivotal for customer satisfaction. Understanding user feedback and addressing concerns contributes to continuous improvement.

Addressing Common User Concerns

Proactively addressing common user concerns, such as transaction security and ease of use, fosters a positive perception of the payment gateway.

Cost Considerations

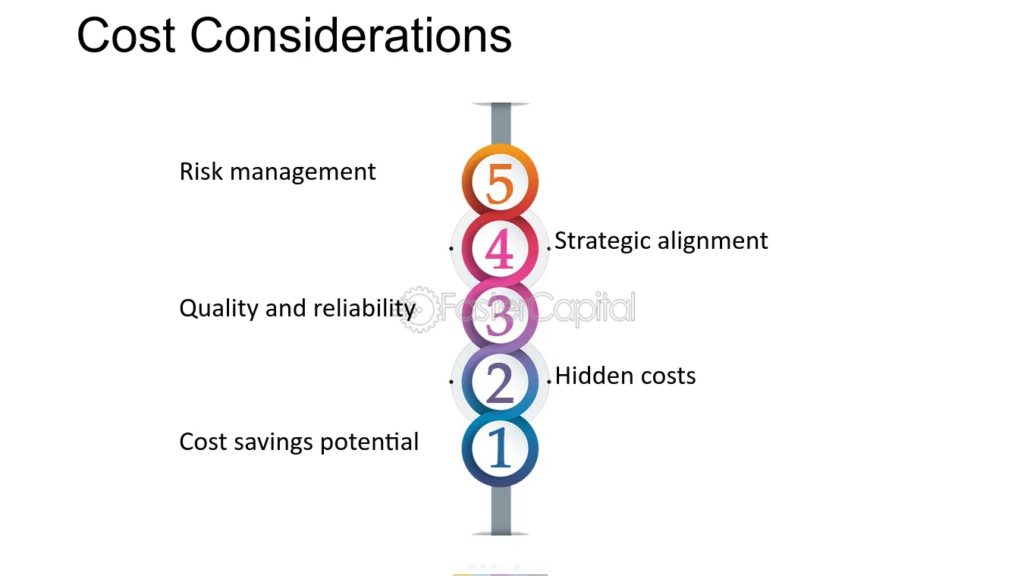

Hidden Fees and Transparency

Transparent pricing and clear communication about transaction fees and charges are vital for establishing trust with merchants.

Finding the Right Balance

While cost is a significant factor, finding the right balance between affordability and functionality is key for sustainable business growth.

Conclusion

In conclusion, payment gateways play a pivotal role in shaping the landscape of digital transactions in the United States. From security measures to user experience, their impact extends across various facets of online business. As technology continues to evolve, payment gateways will likely play an even more integral role in shaping the future of e-commerce and digital transactions.

FAQs

- What is the primary purpose of a payment gateway? A payment gateway facilitates secure online transactions between merchants and financial institutions.

- How do payment gateways contribute to customer trust? Payment gateways enhance customer trust through robust security protocols and a seamless user experience.

- What factors should businesses consider when choosing a payment gateway? Businesses should consider factors such as transaction fees, security features, and compatibility with their business model.

- Are there upcoming trends in payment gateways? Yes, trends include cryptocurrency integration and the potential use of biometric authentication for added security.

- How can businesses address common user concerns regarding payment gateways? Businesses can address concerns by proactively engaging with user feedback and ensuring clear payment instructions.