AUTHOR : JAYOKI

DATE : 18/12/2023

Introduction

In today’s fast-paced digital economy[1], businesses are constantly looking for ways to reduce operational costs, especially when it comes to payment processing. A Payment Gateway with Less Charges[2] can help businesses save money while providing customers with seamless, secure online transaction experiences. This article explores how to choose a payment gateway with minimal fees, the benefits of using such a solution, and answers to common questions about low-fee payment gateways.

What is a Payment Gateway with Less Charges?

A Payment Gateway with Less Charges is a payment processing[3] service that enables businesses to accept payments online with lower transaction fees compared to traditional payment gateways. These solutions handle credit card, debit card, and other types of online payments[4], but with a focus on minimizing the cost of each transaction. By choosing a payment gateway with lower charges, businesses can improve their profit margins and provide customers with a cost-effective, frictionless payment experience[5].

Why Choose a Payment Gateway with Less Charges?

There are several reasons why businesses should consider a Payment Gateway with Less Charges.Here are a few notable benefits to keep in mind:

1. Cost-Effective for Small Businesses

For small businesses or startups with limited budgets, every penny counts. Transaction fees can add up quickly, especially when processing a high volume of payments. By opting for a Payment Gateway with Less Charges, businesses can keep their costs low and allocate resources to other areas of growth.

2. Higher Profit Margins

Reducing payment processing fees directly impacts a business’s bottom line. A Payment Gateway with Less Charges allows businesses to retain more revenue from each sale, improving overall profitability. This is particularly important for businesses that deal with small profit margins or high transaction volumes.

3. Better Customer Experience

Transaction fees are often passed on to customers in the form of hidden charges or increased product prices. By using a Payment Gateway with Less Charges, businesses can avoid these extra costs, leading to a smoother checkout experience and higher customer satisfaction. When customers know they’re not being overcharged for payments, they’re more likely to return.

4. More Flexibility in Payment Options

A Payment Gateway with Less Charges can often support a wide range of payment methods at a lower cost. This flexibility means businesses can offer various payment options, including credit/debit cards, bank transfers, and digital wallets like PayPal or Apple Pay, without incurring high fees for each one.

Key Features of a Payment Gateway with Less Charges

1. Low Transaction Fees

The most obvious feature of a Payment Gateway with Less Charges is its low-cost transaction model. These gateways typically charge lower fees per transaction, which is especially beneficial for businesses with high transaction volumes.

2. Transparent Pricing

Some payment gateways hide their fees or charge additional costs for setup, maintenance, or monthly services. A good Payment Gateway with Less Charges is transparent about its pricing structure, so businesses can accurately predict their costs.

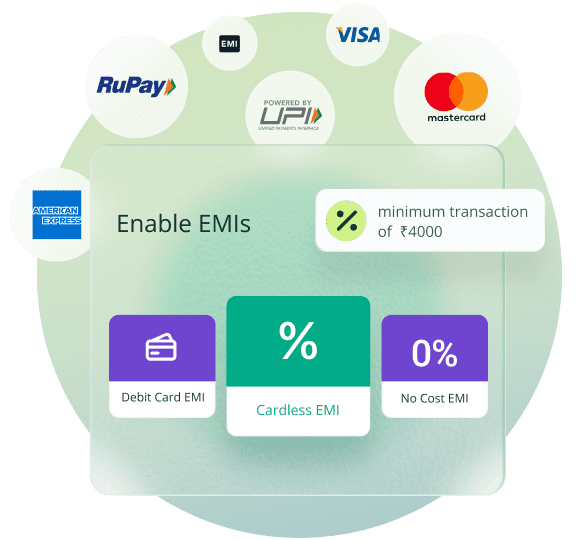

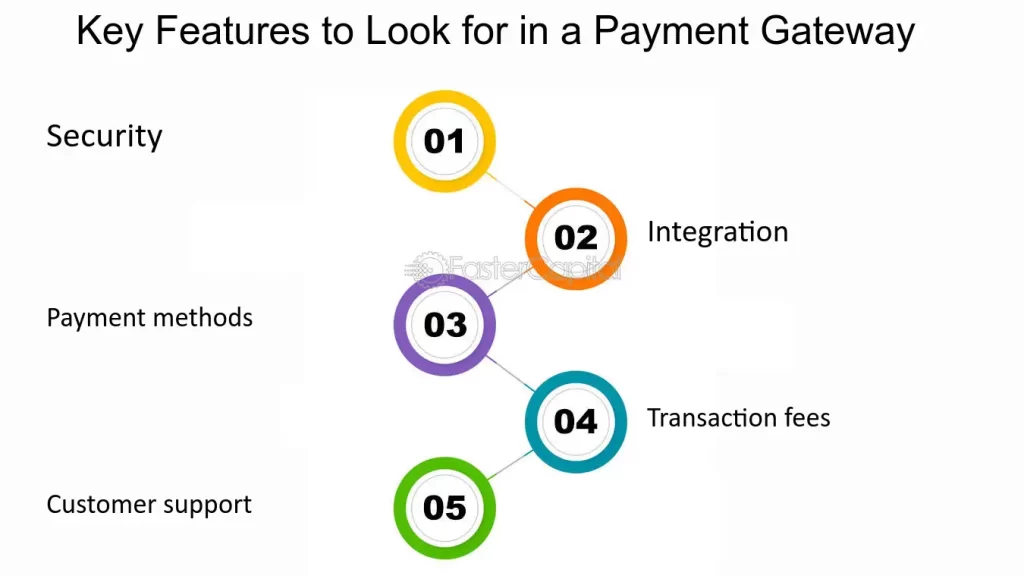

3. Multiple Payment Methods

A Payment Gateway with Less Charges should support a variety of payment methods to accommodate a diverse customer base. From credit and debit cards to digital wallets and bank transfers, the gateway should provide multiple payment options without adding extra costs.

4. Security Features

Even though you’re looking for a Payment Service with Less Charges, security should never be compromised. Look for gateways that offer encryption, fraud prevention, and PCI-DSS compliance to protect sensitive customer data while keeping costs down.

How to Choose the Right Payment Gateway with Less Charges

When evaluating a Payment Gateway with Less Charges, it’s essential to consider a few factors to ensure it meets your business needs:

1. Consider the Transaction Volume

High transaction volumes can benefit significantly from low transaction fees. If your business processes many payments daily, opting for a Payment Gateway with Less Charges will help reduce your overall processing costs.

2. Review the Fee Structure

Transaction Gateway vary in their fee structures; some impose a fixed fee per transaction, while others charge a percentage based on the transaction amount. Make sure to thoroughly review the fee structure of any Payment Gateway with Less Charges you are considering to ensure it aligns with your business model.

3. Evaluate Hidden Costs

Some payment gateways may offer low transaction fees but hide additional costs in the form of setup fees, monthly maintenance charges, or cancellation fees. It’s essential to look for a Transaction Gatewaywith Less Charges that has no hidden fees and offers a clear, simple pricing model.

4. Look for Scalability

As your business grows, so too will the demand for more robust payment processing solutions. Ensure that the Transaction Gateway with Less Charges you choose can scale to handle higher transaction volumes without increasing fees disproportionately.

Popular Payment Gateways with Less Charges

Several payment gateways offer low fees while still providing excellent features and security. Here are a few to consider:

1. Stripe

Stripe is known for its low transaction fees and ease of integration with e-commerce platforms. It charges 2.9% + 30 cents per transaction, which is competitive for most small and medium-sized businesses.

2. PayPal

While PayPal is one of the most popular payment processors worldwide, it also offers a E-paymen with Less Charges compared to traditional credit card processors. PayPal’s fee structure is simple, with charges of 2.9% + fixed fees based on the currency used.

3. Square

Square provides an affordable payment solution for small businesses, charging a flat fee of 2.6% plus 10 cents per transaction. This straightforward pricing structure makes it an ideal choice for businesses looking to minimize transaction costs. In addition, Square offers free point-of-sale software, making it a highly attractive option for physical retail stores that need both an efficient payment system and an easy-to-use sales management tool.

4. Razorpay

Razorpay is a popular payment gateway in India that offers low fees (2% per transaction) and supports a wide range of payment methods, including credit/debit cards, UPI, wallets, and net banking. Transaction Solution also integrates well with e-commerce platforms like Shopify and WooCommerce.

Conclusion

Choosing the right Digital Payment Processor with Less Charges can significantly reduce operational costs for businesses, especially small and medium-sized enterprises. By understanding the key features, evaluating fee structures, and selecting the most suitable provider, businesses can streamline their payment processing and improve profitability. Always ensure that the payment gateway you choose provides a seamless, secure, and cost-effective solution that aligns with your business needs.

FAQs.

1. What is the average transaction fee for a Payment Gateway with Less Charges?

The average transaction fee for a Payment Solution with Less Charges typically ranges from 1.5% to 3% per transaction. However, while some gateways apply a fixed fee per transaction, others may levy a charge based on a percentage of the transaction amount.

2. Can I use a Payment Gateway with Less Charges for international transactions?

Yes, many E-payment System with Less Charges options support international transactions, but fees may vary depending on the currency and country involved. Be sure to check the gateway’s pricing structure for international payments.

3. Are there any hidden fees with low-cost payment gateways?

Thoroughly examining the fee structure of any payment gateway is essential. A reputable E-payment System with Less Charges should be transparent about its pricing and should not have hidden fees like setup or monthly maintenance charges.

4. What types of payments can I accept with a Payment Gateway with Less Charges?

Most Payment Gateway with Less Charges options support a wide variety of payment methods, including credit and debit cards, digital wallets (like PayPal, Apple Pay, and Google Pay), UPI payments, and bank transfers.

5. How do I integrate a Payment Gateway with Less Charges into my website?

Integration depends on the E-payment System provider, but most Digital Payment Processor with Less Charges services offer plugins, APIs, or SDKs that make integration with your e-commerce platform or website easy. You can usually find step-by-step guides and documentation on the provider’s website.