AUTHOR : MICKEY JORDAN

DATE : 18/12/2023

Introduction

In the rapidly evolving world of digital payments, businesses[1] and consumers alike are increasingly demanding faster, more efficient solutions. One of the most significant innovations in recent years has been the rise of Payment Gateway[2] with Instant Settlement. This cutting-edge technology allows businesses to receive payments and settle them in real-time, drastically improving cash flow, enhancing customer satisfaction, and streamlining financial operations[3].

This article explores the concept of Payment Gateway with Instant Settlement[4], its benefits, how it works, and the potential it holds for transforming payment processing systems in India and globally.

What is a Payment Gateway with Instant Settlement?

A Payment Gateway with Instant Settlement is a payment processing solution that enables merchants to receive payments and settle them instantly, bypassing the traditional settlement[5] times that often take several hours or even days. Typically, payment gateways process transactions by securely transmitting payment details between the customer’s bank, the merchant’s bank, and the payment service provider.

In contrast, instant settlement platforms eliminate the waiting period by transferring funds into the merchant’s account immediately after a transaction is completed. This real-time settlement ensures faster access to funds, which is especially crucial for businesses that rely on quick cash flow.

Key Features of Payment Gateway with Instant Settlement

Real-Time Processing: Payments are processed instantly, ensuring that merchants receive their funds without delay.

24/7 Availability: Unlike traditional settlement systems, instant payment gateways operate around the clock, enabling transactions and settlements at any time.

Security: Instant settlement gateways use advanced encryption protocols to secure payment data, ensuring that customer information remains safe.

Cross-Border Transactions: Many instant payment gateways support international payments, enabling businesses to accept payments from global customers in real-time.

Benefits of Payment Gateway with Instant Settlement

Improved Cash Flow

One of the biggest advantages of a Payment Gateway with Instant Settlement is the immediate access to funds. Traditionally, merchants had to wait for settlement periods that could last anywhere from a few hours to several days. With instant settlement, businesses can use the funds immediately for operational expenses, reinvestment, or growth, without worrying about delayed payments.

Enhanced Customer Experience

Instant settlement not only benefits merchants but also improves the customer experience. Since payments are processed quickly, customers do not face delays in their transactions, leading to increased satisfaction. Moreover, the transparency of the process fosters trust between customers and merchants.

Reduced Transaction Costs

Traditional payment gateways often involve fees for processing payments and additional charges for delayed settlement times. With a Payment Gateway with Instant Settlement, businesses may benefit from lower operational costs, as they no longer need to rely on intermediary financial institutions to process payments over several days. This results in cost savings and more streamlined operations.

Minimizing Risks

Delayed settlements can sometimes lead to errors, disputes, or discrepancies in financial accounts. Instant settlement reduces the chance of such issues by ensuring that payments are processed in real-time and reflected in the merchant’s account immediately.

Support for Small and Medium Enterprises (SMEs)

For small and medium-sized businesses that often operate on thin margins, cash flow is crucial for survival. Payment Gateway with Instant Settlement offers these businesses a lifeline by ensuring they get paid as soon as a transaction is made, thus enabling them to remain competitive and flexible.

How Payment Gateway with Instant Settlement Works

A Payment Gateway with Instant Settlement works by integrating payment processing technology with financial institutions that support real-time fund transfers. The process typically involves the following steps:

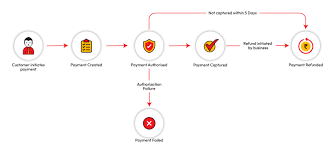

Transaction Initiation

When a customer makes a payment using a credit card, debit card, or mobile wallet, the payment gateway captures the payment details and transmits them securely to the merchant’s bank for authorization.

Authentication and Authorization

The payment gateway communicates with the customer’s bank to verify that there are sufficient funds and that the transaction is legitimate. Once authorized, the transaction is approved.

Instant Fund Transfer

Once the payment is authorized, the payment gateway triggers an instant settlement process, transferring the funds directly into the merchant’s account without any delays. This eliminates the usual waiting time associated with traditional payment gateways, which often require up to 48-72 hours for settlement.

Notification and Confirmation

Both the merchant and the customer receive instant notifications confirming the transaction and settlement. This real-time confirmation increases the efficiency of the payment process and ensures transparency.

Types of Payment Gateways with Instant Settlement

Several types of Payment Gateway with Instant Settlement are available, catering to different business needs. Here are the primary types:

Bank-Owned Payment Gateways

These are payment gateways operated by banks themselves. They offer instant settlement directly into the merchant’s bank account and usually come with lower fees. Banks often provide this service as part of a larger suite of financial services to help merchants manage their payments.

Third-Party Payment Providers

Third-party payment providers like Paytm, Razorpay, and PhonePe are increasingly offering Payment Gateway with Instant Settlement services. These providers partner with banks and financial institutions to process payments and offer instant settlement features, often with a simple integration process for merchants.

Peer-to-Peer (P2P) Payment Gateways

Some newer models of payment gateways leverage blockchain or peer-to-peer technology to enable faster, more secure, and decentralized transactions. These systems promise lower fees and greater security, although they are still evolving.

Payment Gateway with Instant Settlement in India

In India, Payment Gateway with Instant Settlement is becoming more common, thanks to the government’s push toward a digital economy and the rise of fintech companies. The introduction of services like UPI (Unified Payments Interface) has paved the way for faster and more secure transactions, and Payment Processor with instant settlement are now becoming a key component of the Indian payment ecosystem.

Several fintech startups and established payment platforms are working to integrate real-time settlement solutions, benefiting both large enterprises and SMEs. Moreover, the Reserve Bank of India (RBI) is working on improving regulations around real-time settlement platforms, ensuring a secure and seamless digital payments landscape.

Conclusion

The advent of Payment Processor with Instant Settlement is a game-changer in the world of digital payments, offering numerous advantages for businesses and customers alike. From improved cash flow to enhanced customer experiences, this technology is reshaping the way financial transactions are processed. As India’s digital economy continues to grow, the adoption of instant settlement systems will become even more widespread, providing businesses with the tools they need to stay competitive in an increasingly fast-paced world. Whether you are a small business owner or a large enterprise, leveraging a Payment Gateway with Immediate Payment can be a crucial step in streamlining your payment processes and ensuring long-term success.

FAQs.

1. What is a Payment Gateway with Instant Settlement?

A Payment Gateway with Immediate Payment allows merchants to receive payments in real-time, ensuring that funds are transferred immediately into their accounts after a transaction is processed.

2. How does Instant Settlement benefit businesses?

Instant settlement improves cash flow, reduces operational delays, enhances customer satisfaction, and minimizes the risk of transaction errors or disputes. It’s especially beneficial for businesses that need quick access to funds for operational purposes.

3. Is a Payment Gateway with Instant Settlement secure?

Yes, these gateways use robust encryption and security measures to protect payment information. Many platforms also adhere to global security standards such as PCI-DSS compliance to ensure that sensitive data remains secure.

4. Can I use a Payment Gateway with Instant Settlement for international transactions?

Many Payment Processor with Instant Settlement platforms support international transactions, allowing businesses to receive payments from customers worldwide in real-time, though transaction fees may vary based on the payment provider.

5. Are there any drawbacks to using a Payment Gateway with Instant Settlement?

While the benefits of Immediate Payment are numerous, the main drawback could be higher processing fees compared to traditional payment gateways. Additionally, instant settlement may require integration with multiple financial institutions, which could complicate the setup process.