AUTHOR : JAYOKI

DATE : 18/12/2023

Introduction

In today’s fast-evolving e-commerce landscape[1], providing customers with flexible payment options is essential for driving conversions and enhancing the overall shopping experience. One such payment solution[2] gaining significant traction is the Payment Gateway with EMI Option. By allowing customers to pay for their purchases in installments over time, businesses can cater to a larger audience and increase sales potential, particularly for high-ticket items. This guide explores the concept of payment gateways with EMI[3] options, how they work, and why they are beneficial for both merchants and customers.

What is a Payment Gateway with EMI Option?

A Payment Gateway with EMI Option is a digital payment[4] solution that allows customers to make payments for purchases in installments, typically monthly, instead of paying the full amount upfront. This option is generally offered by payment gateways in collaboration with financial institutions like banks and credit card[5] companies.

When a customer chooses the EMI option, the payment gateway facilitates the transaction and splits the total cost into equal monthly payments over a specified period (e.g., 3, 6, 9, or 12 months). This gives customers greater financial flexibility, especially when purchasing expensive items. The EMI option can be applied to various payment methods, including credit cards, debit cards, net banking, and even UPI.

How Does a Payment Gateway with EMI Option Work?

The process of using a Payment Gateway with EMI Option is straightforward for both merchants and customers. Here’s a step-by-step breakdown:

Customer Purchases an Item: The customer selects a product or service on the merchant’s website or app and proceeds to checkout.

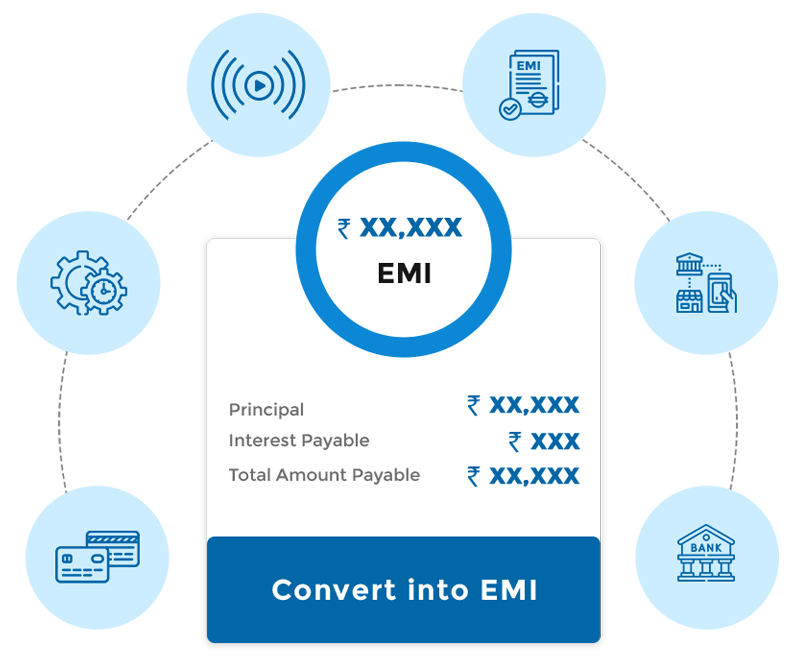

Selecting EMI Option: At checkout, the customer is presented with an option to pay using the EMI method. The available EMI plans, including the tenure and applicable interest rates, are displayed.

Payment Gateway Processes the Transaction: Once the customer selects the desired EMI option, the payment gateway processes the transaction by connecting with the financial institution or bank to verify the customer’s eligibility and initiate the installment plan.

Monthly Installments: The total purchase amount is divided into equal monthly installments, which are automatically deducted from the customer’s bank account or charged to their credit card on the due date.

Merchant Receives Full Payment: The merchant receives the full purchase amount upfront from the payment gateway, while the customer repays the amount in installments over time.

Benefits of Payment Gateway with EMI Option

For businesses, offering a Payment Gateway with EMI Option can have several key advantages:

Increased Sales Conversion

Offering an EMI option allows customers to make larger purchases without the financial strain of paying the full amount upfront. This increases the likelihood of cart completion and reduces cart abandonment rates. For businesses, this can directly lead to higher sales volumes and improved conversion rates.

Expanded Customer Base

The EMI option appeals to a wider demographic, especially those who may not have the financial flexibility to pay large sums at once. It makes purchasing more accessible to a broader customer base, including middle-income groups and young buyers who are more likely to prefer installment-based payments.

Competitive Advantage

In an increasingly crowded online marketplace, offering flexible payment options can give businesses a competitive edge. A Payment Gateway with EMI Option is a feature that differentiates a merchant from others who may not offer such flexibility.

Higher Average Order Value

Since customers can break down their payments into smaller installments, they may be more inclined to purchase higher-ticket items. This can increase the average order value for merchants, potentially boosting revenue without increasing customer acquisition costs.

Customer Loyalty and Retention

Providing a convenient and affordable way to shop via EMI payments can build trust and loyalty among customers. When customers have a positive shopping experience with manageable payment options, they are more likely to return for future purchases.

Key Considerations for Merchants

While offering a Payment Gateway with EMI Option comes with several advantages, merchants must consider the following before implementing this feature:

Choose the Right Payment Gateway Provider

Not all payment gateway providers offer the EMI option. Merchants should choose a reliable payment gateway provider that partners with banks and financial institutions to provide EMI plans. The provider should also have a robust security infrastructure to protect customer data and ensure smooth transactions.

Clear Communication of EMI Terms

Transparency is key to building trust with customers. Merchants should clearly communicate the terms and conditions of the EMI option, including the interest rates, eligible payment methods, and repayment periods. Customers should be fully aware of their obligations before committing to an EMI plan.

Evaluate the Costs Involved

Some payment gateway providers charge higher processing fees for facilitating EMI transactions. Merchants must weigh the benefits of offering EMI options against the additional costs incurred from payment gateway charges and interest rates.

Customer Eligibility

EMI options are usually available only to customers with a good credit history or those who meet specific criteria set by the bank or payment gateway provider. Merchants should consider the eligibility requirements and how they impact their customer base.

How EMI Option Affects Customer Experience

The EMI option significantly enhances the overall customer experience, providing a variety of benefits:

Financial Flexibility

Customers no longer need to bear the entire cost of a high-ticket item upfront. Instead, they can split the payment into smaller, more manageable amounts, reducing the financial burden.

Convenience and Ease of Use

EMI payments are automated, meaning customers do not need to worry about manually making payments every month. The payment gateway will automatically deduct the installment amount from the customer’s preferred payment method.

Increased Purchasing Power

With the ability to pay in installments, customers may be more willing to purchase higher-quality products or services they might have otherwise skipped due to financial constraints.

Conclusion

Incorporating a Payment Gateway with EMI Option into your online business can significantly enhance your sales strategy by making your products or services more accessible to a wider range of customers. With the flexibility of installment payments, customers can enjoy an easier shopping experience, which can lead to higher conversion rates and increased customer loyalty. However, merchants must carefully choose a reliable provider and clearly communicate EMI terms to ensure the success of this payment option. By doing so, businesses can gain a competitive edge, increase average order value, and improve overall customer satisfaction.

FAQs.

1. What is the benefit of a Payment Gateway with EMI Option for customers?

The EMI option provides customers with the flexibility to pay in monthly installments, making it easier to purchase high-ticket items. This reduces the immediate financial burden and allows for more manageable payments.

2. Are there any interest charges for EMI payments?

Yes, most EMI options involve interest charges, which vary based on the payment gateway provider and the bank or financial institution involved. Some providers may offer 0% interest for select products or during promotional periods.

3. Can I offer EMI payments on my website?

Yes, you can integrate a Payment Gateway with EMI Option into your website or app, provided the payment gateway you choose supports this feature. You’ll need to work with the provider to set up the integration.

4. Are EMI payments available for all customers?

EMI options are typically available to customers with a good credit score or those who meet certain eligibility criteria. However, this depends on the payment gateway provider and the financial institutions involved.

5. How do I choose the best payment gateway provider for EMI?

When selecting a payment gateway provider for EMI, consider factors like the provider’s reputation, the range of EMI plans available, processing fees, security measures, and customer support.