AUTHOR : JAYOKI

DATE : 18/12/2023

In today’s rapidly evolving digital landscape, businesses and consumers alike are increasingly seeking streamlined methods to process payments[1] online. The “Payment Gateway Wallet[2]” has emerged as a crucial tool that allows both buyers and sellers to enjoy secure, fast, and hassle-free transactions. Whether you’re a business owner looking to adopt new payment systems[3] or a consumer curious about the technology behind digital wallets[4], this guide will provide everything you need to know about Payment Gateway Wallets.

What is a Payment Gateway Wallet?

A Payment Gateway[5] Wallet is an electronic system that facilitates the transfer of funds between consumers and merchants through a secure digital channel. It combines the functionalities of a traditional payment gateway (which handles transaction processes) and a digital wallet (which stores payment information). Essentially, it is an all-in-one solution that enables users to securely store, manage, and use their payment information across various online platforms.

How Does a Payment Gateway Wallet Work?

At the core of the Payment Gateway Wallet is the concept of digital security. These wallets use encryption technologies to store and transmit sensitive payment details, ensuring that both customers and businesses are protected from potential fraud or data theft. Here’s a simple breakdown of how it works:

- User Registration: To use a consumers first need to create an account with the service provider (e.g., PayPal, Apple Pay, Google Pay). This account holds all the user’s payment data, including credit card information, bank account details, and transaction history.

- Payment Process: When a user makes a purchase online, the Payment Gateway Wallet encrypts the payment information and sends it to the merchant’s payment processor. The processor then validates the transaction and checks for sufficient funds.

- Authorization: After validation, the payment is authorized or denied based on the available balance or credit.

Evolution of Payment Gateways

The journey of payment gateways dates back to the early days of e-commerce when businesses started exploring digital transactions. Over time, the concept evolved, giving rise to the sophisticated gateway wallets we use today.

Key Features of Payment Gateway Wallets

Security remains a paramount concern in the digital age, and payment wallets address this with robust measures such as encryption and multi-factor authentication. Beyond security, the convenience they offer in transactions and seamless integration with various platforms make them indispensable.

Popular Payment Gateway Wallets

Leading the pack are renowned payment wallets, each with its unique features. From user-friendly interfaces to competitive rewards programs, a comparative analysis helps users make informed choices.

How Payment Gateway Wallets Work

Understanding the mechanics behind payment wallets is crucial. A step-by-step explanation of the transaction process, coupled with insights into encryption and tokenization, sheds light on the security measures in place.

Advantages for Businesses

Businesses, both large and small, benefit significantly from incorporating payment These wallets streamline payment processes, enhancing the overall customer experience and fostering customer loyalty.

User Experience and Accessibility

The success of is also attributed to the user experience they provide. With mobile applications and user-friendly interfaces, these wallets are accessible to a wide range of users.

Challenges and Solutions

Despite their advantages, payment wallets face challenges, especially concerning security. However, providers continuously implement solutions to address these issues, ensuring a secure environment for transactions.

Future Trends

As technology advances, payment wallets are expected to evolve further. Integration with emerging technologies, such as blockchain and artificial intelligence, points toward an exciting future for digital payments.

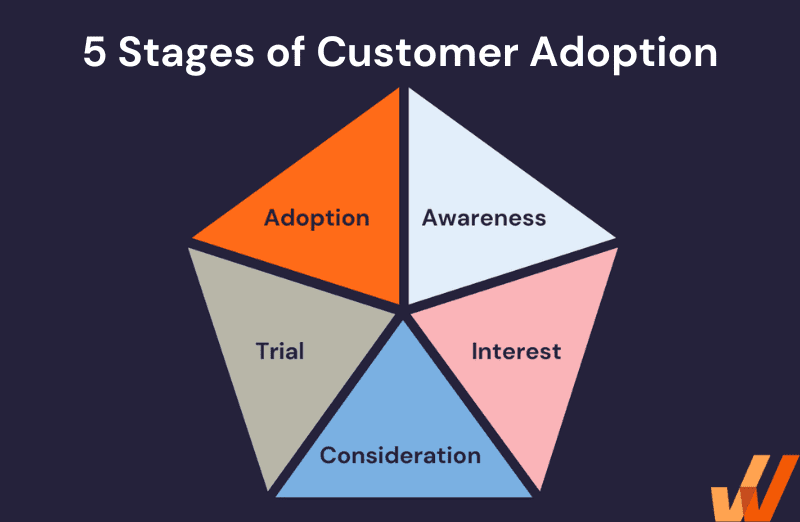

Consumer Adoption and Trends

Consumer preferences shape the trajectory of gateway wallets. Analyzing global usage statistics unveils trends and patterns that providers and businesses can leverage.

Regulatory Framework

Governments worldwide are establishing regulations to govern payment gateways, ensuring compliance and safeguarding user interests. Understanding the regulatory landscape is crucial for industry players.

Comparison with Traditional Payment Methods

Efficiency and speed are key advantages of payment wallets when compared to traditional payment methods. Additionally, the cost-effectiveness of digital transactions positions them as the preferred choice for many.

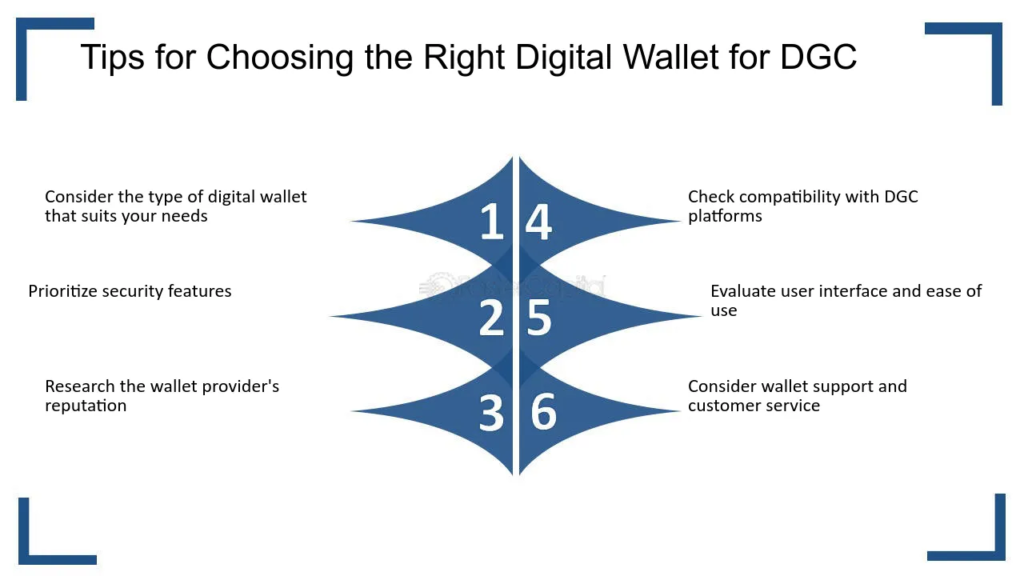

Tips for Choosing the Right Payment Wallet

Selecting the right payment gateway involves considering various factors, from security features to customization options. Businesses can benefit from understanding these factors and tailoring their choices to meet specific needs.

Conclusion

The Payment Gateway Wallet is revolutionizing the way businesses and consumers interact online. By providing a secure, efficient, and convenient method for handling payments, it helps businesses enhance their operations and gives consumers a seamless shopping experience. Whether you’re a business looking to streamline payment processes or a consumer seeking convenience, the Payment Gateway Wallet offers an innovative solution for today’s digital world.

FAQs

- Are payment gateway wallets secure for online transactions?

- Yes, employ advanced security measures such as encryption and multi-factor authentication to ensure secure transactions.

- How do payment wallets differ from traditional methods?

- Payment gateway wallets offer greater efficiency, speed, and cost-effectiveness compared to traditional payment methods.

- What trends can we expect in the future of payment gateway wallets?

- The future holds exciting developments, including integration with emerging technologies like blockchain and artificial intelligence.

- How do businesses benefit from incorporating?

- Businesses enjoy streamlined payment processes, enhanced customer experiences, and improved customer loyalty.

- What factors should businesses consider when choosing a payment gateway wallet?

- Businesses should consider security features, customization options, and integration capabilities when selecting a payment gateway wallet.

Get In Touch