AUTHOR : MICKEY JORDAN

DATE : 18/12/2023

Introduction

In the rapidly evolving landscape of online transactions, payment gateways[1] play a pivotal role in facilitating seamless and secure monetary exchanges. However, the emergence of virtual accounts [2]has further revolutionized the way we perceive and conduct online payments[3]. This article delves into the world of payment gateway virtual accounts[4], exploring their definition, benefits[5], providers, and the future trends shaping the industry.

What is a Payment Gateway?

At its core, a payment gateway serves as a bridge between merchants and financial institutions, ensuring the secure transfer of funds during online transactions. It acts as a virtual point-of-sale terminal, authorizing transactions and encrypting sensitive data to safeguard user information.

The Role of Virtual Accounts in Payments

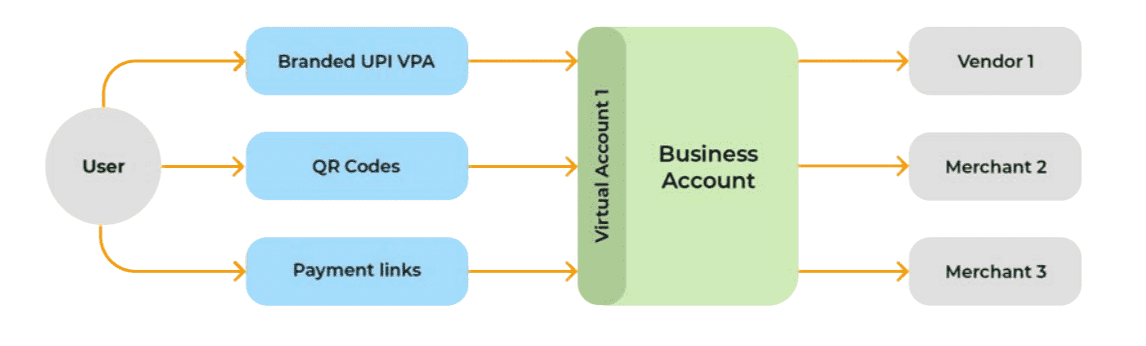

Virtual accounts, in essence, are bank accounts that exist only electronically. They are instrumental in streamlining online payments by providing a dedicated account for each transaction. These virtual accounts seamlessly integrate with payment gateways, offering an added layer of security and efficiency.

Benefits of Virtual Accounts

The adoption of virtual accounts brings forth a myriad of advantages. Firstly, the enhanced security measures, including encryption and tokenization, significantly reduce the risk of fraud. Moreover, virtual accounts contribute to quicker transaction processing, ultimately improving the overall user experience. The convenience they offer to users is unparalleled, making them an indispensable component of modern online transactions.

Popular Payment Gateway Virtual Account Providers

In the realm of virtual accounts, several providers stand out for their innovative solutions. From established players to emerging platforms, each has its unique features catering to diverse business needs. Understanding the offerings of these providers is crucial for businesses seeking to integrate virtual accounts into their payment systems.

How to Choose the Right Payment Gateway Virtual Account

Selecting the most suitable virtual account provider requires careful consideration of various factors. Businesses must evaluate compatibility, transaction fees, security features, and scalability. Choosing a provider that aligns with the specific needs of the business ensures a seamless integration that enhances rather than hinders operations.

Setting Up a Virtual Account for Online Transactions

For businesses venturing into the world of virtual accounts, a step-by-step guide proves invaluable. From registration to integration with existing systems, understanding the process helps in overcoming common challenges associated with setting up virtual accounts for online transactions.

Security Measures in Virtual Transactions

The paramount concern in online transactions is security. Virtual accounts employ advanced encryption techniques and tokenization to safeguard sensitive information. Understanding these security measures is essential for both businesses and users to instill trust in the virtual payment ecosystem.

Virtual Accounts for E-commerce Businesses

E-commerce[1] businesses, in particular, can leverage the benefits of virtual accounts to enhance customer experience. Tailoring virtual accounts to suit the unique requirements of online stores contributes to smoother transactions and increased customer satisfaction.

Mobile Payments and Virtual Accounts

With the rise of mobile payments, the integration of virtual accounts with mobile wallets becomes increasingly relevant. Exploring the intersection of virtual accounts and mobile payment technology[2] unveils the potential for further advancements in the way we conduct transactions through our smartphones.

Future Trends in Payment Gateway Virtual Accounts

As technology continues to evolve, so does the landscape [3]of payment gateway virtual accounts. Anticipated developments include improved security features, enhanced user interfaces, and greater integration with emerging technologies such as blockchain. Understanding these trends is crucial for businesses looking to stay ahead in the dynamic world of online payments.

Common Misconceptions about Virtual Accounts

Dispelling myths surrounding virtual accounts is essential for fostering a clear understanding of their functionality and benefits. Addressing common misconceptions ensures that businesses make informed decisions when considering the integration of virtual accounts into their payment systems[4].

Challenges and Solutions in Virtual Account Management

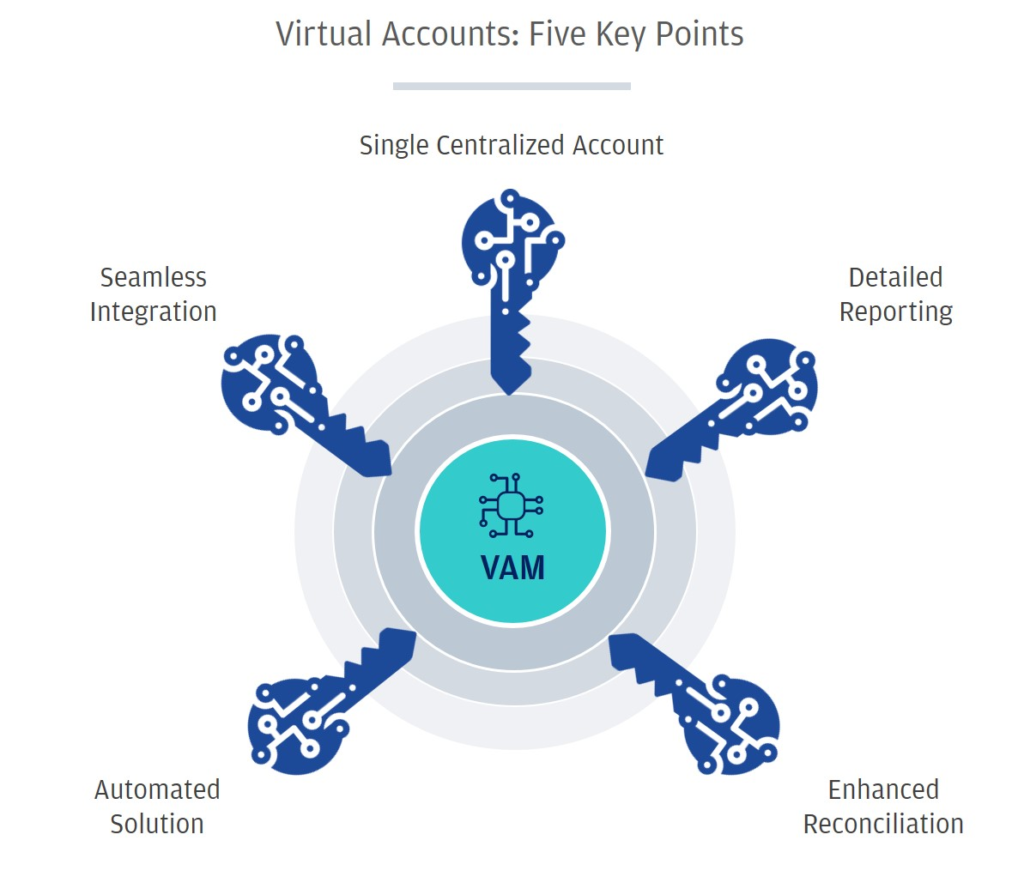

While virtual accounts offer numerous advantages, they are not without challenges. Understanding and addressing issues related to account management, transaction[5] reconciliation, and system integrations is crucial for businesses to maximize the benefits of virtual accounts.

Conclusion

In conclusion, payment gateway virtual accounts represent a paradigm shift in the world of online transactions. Their enhanced security, speed, and convenience make them a valuable asset for businesses and users alike. As we navigate the evolving landscape of online payments, the role of virtual accounts is set to become even more prominent, shaping the future of digital transactions.

FAQs

- Are virtual accounts secure for online transactions?

- Virtual accounts employ advanced encryption and tokenization, ensuring a high level of security for online transactions.

- How do virtual accounts benefit e-commerce businesses?

- Virtual accounts enhance customer experience for e-commerce businesses by providing a secure and efficient payment method.

- What factors should businesses consider when choosing a virtual account provider?

- Businesses should consider compatibility, transaction fees, security features, and scalability when selecting a virtual account provider.

- Can virtual accounts be integrated with mobile wallets?

- Yes, virtual accounts can be seamlessly integrated with mobile wallets, contributing to the convenience of mobile payments.

- What are the future trends in payment gateway virtual accounts?

- Anticipated developments include improved security features, enhanced user interfaces, and greater integration with emerging technologies such as blockchain.