AUTHOR : BABLI

DATE : 16/12/23

Introduction

In today’s competitive marketplace[1], offering diverse payment options for small business is essential to meet customer expectations and drive growth. As consumer preferences evolve, small businesses must adapt by providing flexible and secure payment methods that cater to a variety of needs. Whether it’s cash, credit cards, digital wallets, or online payment gateways, integrating the right payment options[2] for small business ensures seamless transactions, enhances customer satisfaction, and builds loyalty. By choosing the best payment options for small business[3], you can streamline operations and create a competitive edge in the market.

Definition of Payment Options

Payment options for small business refer to the various methods and systems a small business can use to accept payments from customers for goods or services[4]. These options include traditional methods like cash and checks, as well as modern solutions such as credit/debit cards, mobile wallets, online payment gateways, contactless payments, and even cryptocurrency. Providing diverse payment options for small business ensures flexibility, enhances customer experience, and supports efficient transaction processing, making it a vital component of a successful business strategy[5].

Importance for Small Businesses

Understanding the significance of diverse payment options is crucial for small businesses striving to enhance customer satisfaction and streamline financial processes.

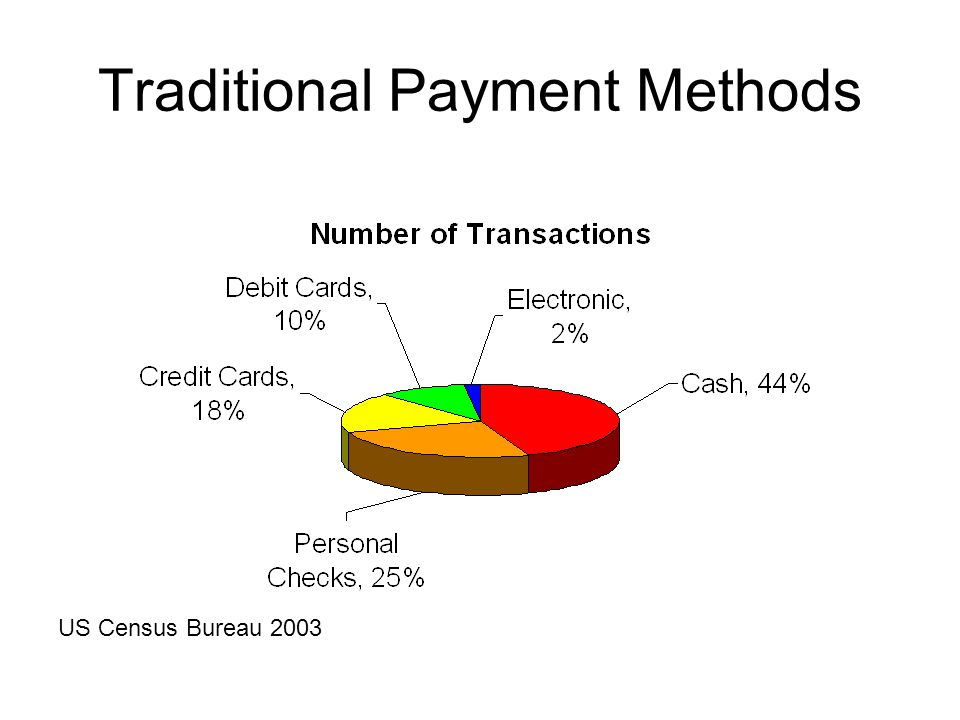

Traditional Payment Methods

Cash Transactions

While often considered old-fashioned, cash transaction remain a tangible and widely accepted form of payment for certain businesses.

Checks

Checks, though declining in popularity, are still utilized by some customers and businesses for their perceived security.

Digital Payment Solutions

Overview

Digital payment solutions have revolutionized the way businesses and consumers handle transactions, offering speed and convenience.

Credit and Debit Cards

Widely embraced, cards provide a quick and secure method, catering to the preferences of a broad customer base.

Mobile Wallets

The surge in smartphone usage has popularized mobile wallets, providing a seamless and contactless payment experience.

Online Payment Gateways

For e-commerce businesses, integrating online payment gateways ensures secure transactions and expands market reach.

Emerging Technologies

Cryptocurrency

The rise of cryptocurrencies introduces decentralized and borderless transactions, offering a new frontier for forward-thinking businesses.

Contactless Payments

Driven by NFC technology, contactless payments have gained prominence, providing a hygienic and efficient option.

Buy Now, Pay Later (BNPL) Services

BNPL services appeal to consumers seeking flexible payment options, allowing them to make purchases and pay in installments.

Choosing the Right Payment Option

Factors to Consider

Businesses must consider factors like transaction costs, customer preferences, and industry-specific requirements when selecting payment options.

Industry-specific Considerations

Certain industries may benefit more from specific payment methods; tailoring options to industry needs enhances efficiency.

The Future of Small Business Payments

Predictions and Trends

Analyzing upcoming trends helps businesses stay ahead; anticipating changes in consumer behavior and technology is key.

Innovations in Payment Technologies

Ongoing innovations, such as blockchain applications and AI-driven payment solutions, showcase the continuous evolution of payment technologies.

Case Studies

Success Stories

Examining successful small businesses and their chosen payment methods provides valuable insights for entrepreneurs.

Lessons Learned

Reviewing the challenges faced by businesses and the lessons learned enhances decision-making for aspiring entrepreneurs.

Expert Opinions

Insights from Industry Experts

Gaining perspectives from payment industry experts offers valuable guidance in navigating the complexities of payment options.

Tips for Small Business Owners

Experts provide actionable tips for small business owners, aiding them in optimizing their payment processes.

Steps to Implement Efficient Payment Systems

Assessing Business Needs

Understanding the unique requirements of the business is the foundational step in implementing efficient payment systems.

Integrating Payment Technologies

Careful integration of chosen payment technologies ensures a smooth transition and minimizes operational disruptions.

Educating Staff and Customers

Education is key; both staff and customers need to be informed about the new payment methods to ensure a seamless experience.

Common Mistakes to Avoid

Ignoring Security Measures

Neglecting security measures can lead to data breaches, damaging the reputation and trust of the business.

Not Considering Customer Preferences

Failing to align with customer preferences can result in a loss of sales and customer dissatisfaction.

Overlooking Hidden Fees

Businesses must be vigilant in identifying and understanding hidden fees associated with certain payment methods to avoid financial surprises.

Conclusion

Choosing the right payment options for small business is a critical step in meeting customer expectations and ensuring smooth transactions. By incorporating a variety of payment methods, such as mobile wallets, credit cards, and online payment gateways, small businesses can provide convenience and flexibility to their customers. Offering diverse payment options for small business not only boosts customer satisfaction but also helps increase sales and build long-term loyalty. As you evaluate the best payment options for small business, prioritize security, scalability, and cost-efficiency to support your business’s growth and success.

FAQs

1. What are the best payment options for small business?

The best payment options for small business include a mix of cash, credit/debit cards, mobile wallets, and online payment gateways. The choice depends on your target audience and business type.

2. How can small businesses accept credit card payments?

Small businesses can accept credit card payments through POS systems, mobile card readers, or online payment gateways like Square or Stripe.

3. Are digital wallets necessary for small businesses?

Yes, digital wallets are becoming increasingly popular and are essential for small businesses that want to cater to tech-savvy customers. They offer convenience, security, and faster transactions.

4. What are the most affordable payment options for small business?

Cash and direct bank transfers are the most affordable payment options for small business, as they typically incur no transaction fees. However, they may lack the convenience of modern methods.

5. How can I make payment options secure for my small business?

To secure payment options for small business, use PCI DSS-compliant systems, invest in encryption technologies, and regularly update your payment software.