AUTHOR : SOOK

DATE :16/12/2023

Introduction

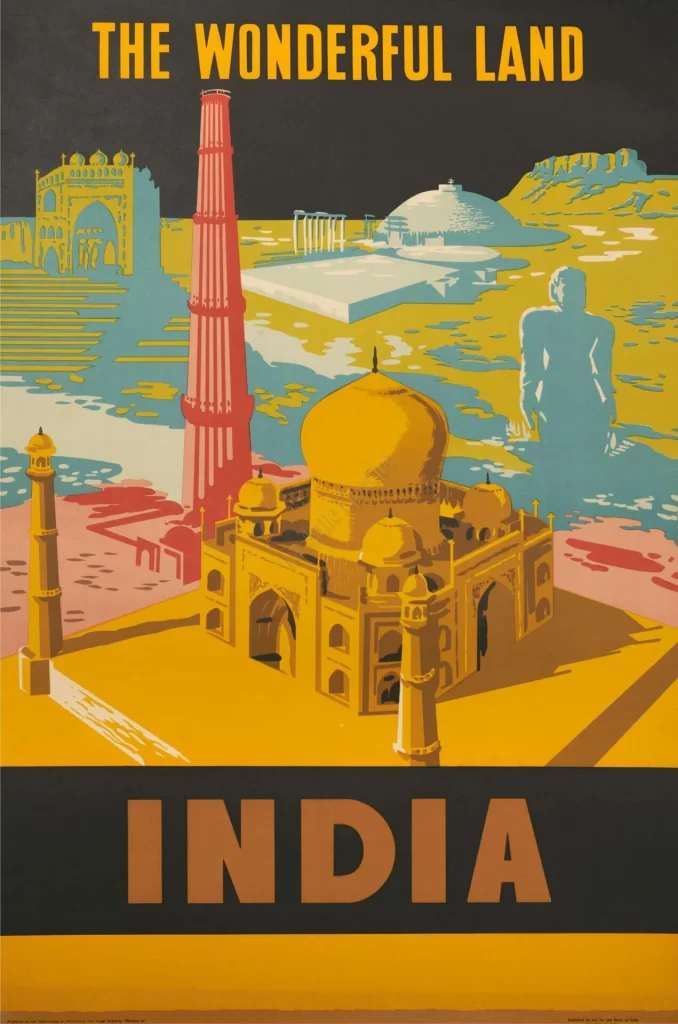

The vintage poster market in India[1] has seen a surge in interest, appealing to collectors, art enthusiasts, and interior designers who value the cultural and artistic significance of these pieces. Vintage posters in India[2] are not just art but also investments, often fetching high prices due to their rarity and appeal. However, the high value of transactions and niche customer base make this industry high-risk in the eyes of financial institutions. This is where high-risk payment service providers (PSPs)[3] come into play, offering essential solutions to ensure smooth, secure, and compliant transactions for vintage poster sellers in India.

Understanding the Vintage Poster Market as High-Risk

1. High Transaction Values

One of the primary reasons the vintage poster market[4] is classified as high-risk is the high transaction values. Collectors are often willing to pay large sums for rare posters, which raises the potential for disputes and chargebacks.

2. Niche Audience and Limited Sales Volume

The vintage poster market caters[5] to a niche audience, which means the frequency of transactions is often lower compared to mainstream retail markets. This makes traditional payment processors hesitant, as they prefer high-volume businesses. High-risk PSPs, however, are familiar with such specialized markets and cater to their specific needs.

3. Chargeback Risk

Disputes over the authenticity, condition, or price of a vintage poster can lead to chargebacks. Due to the high value of these items, chargebacks can be financially draining for sellers. High-risk PSPs help manage these issues, reducing the overall risk for the business.

How High-Risk Payment Service Providers Help Vintage Poster Sellers in India

High-risk PSPs provide vintage poster sellers with tailored services designed to tackle the challenges unique to high-value art sales.

1. Custom Payment Solutions for a Niche Market

High-risk PSPs understand the unique requirements of businesses in specialized markets like vintage posters. They offer customized payment solutions, including multi-currency processing, online payment gateways, and more. These providers are flexible, allowing sellers to adjust payment structures based on customer preferences and market demands.

2. Fraud Prevention and Secure Transactions

High-risk PSPs implement advanced fraud detection tools to secure transactions and reduce the likelihood of fraudulent purchases. With security measures such as Address Verification Service (AVS), tokenization, and encryption, these providers safeguard both the seller and the buyer, fostering trust and confidence in the payment process.

3. Chargeback Management Services

The vintage poster market is vulnerable to chargebacks due to the high value of items and customer expectations for authenticity. High-risk PSPs offer chargeback management solutions, including alerts, monitoring tools, and dedicated support teams to help resolve disputes quickly. By proactively addressing potential chargebacks, PSPs assist businesses in maintaining stability and profitability.

4. Multi-Currency Processing for a Global Audience

Vintage posters attract collectors globally, and high-risk PSP Vintage posters in India allow sellers to process payments in multiple currencies. This feature enables Indian vintage poster sellers to cater to international buyers, opening doors to a broader market and simplifying the buying experience for overseas customers.

5. E-Commerce Integration

High-risk PSPs often integrate seamlessly with popular e-commerce platforms, allowing vintage poster sellers to manage sales, payments, and customer service all in one place. This integration simplifies the selling process, especially for businesses operating online stores.

Key Benefits of Using High-Risk PSPs for Vintage Poster Businesses

1. Higher Approval Rates for Transactions

High-risk PSPs specialize in industries like vintage posters, where transaction approval rates might be lower due to high value and niche market concerns. They work to increase the likelihood of successful transactions, improving the overall shopping experience for customers.

2. Access to Advanced Security Features

High-risk PSPs prioritize security, offering features like two-factor authentication, 3D Secure, and encryption. These measures help prevent fraudulent transactions, making high-value purchases safer and increasing customer trust.

3. Flexibility in Expanding to Global Markets

Multi-currency payment options and e-commerce integration enable Indian vintage poster sellers to reach international buyers with ease. High-risk PSPs provide the necessary tools for expanding globally without additional complexity.

4. Insights and Analytics

Data analytics tools offered by high-risk PSPs give vintage poster sellers insights into their sales patterns, customer behavior, and market trends. These analytics are valuable for understanding customer preferences, making informed decisions, and planning business strategies.

5. Enhanced Customer Satisfaction

When customers feel secure about their transactions, especially for high-value items, they’re more likely to complete the purchase. High-risk PSPs build confidence in the payment process, ensuring a positive buying experience that enhances customer satisfaction.

Challenges in Using High-Risk PSPs in India

1. Higher Fees and Charges

High-risk PSPs usually charge higher fees than traditional payment processors due to the increased risk associated with the vintage poster industry. Businesses need to account for these fees in their pricing and budgeting strategies.

2. Regulatory Compliance

Operating in India requires adherence to strict regulations for high-risk businesses. High-risk PSPs guide merchants on legal requirements, but it’s crucial for sellers to remain compliant to avoid penalties.

3. Limited Options and Provider Selection

There are fewer high-risk PSP options available compared to regular payment processors. Vintage poster sellers should research thoroughly to find a provider that offers competitive rates, necessary features, and strong customer support.

Conclusion

The vintage poster market in India has unique opportunities and challenges due to the high value and niche customer base. For sellers in this industry, partnering with a high-risk PSP offers numerous advantages, from enhanced security to chargeback management and multi-currency processing. While there may be higher fees and compliance requirements, the benefits of working with a high-risk PSP—such as improved transaction approval rates, global reach, and advanced analytics—make it an invaluable partner for vintage poster businesses looking to thrive in this high-risk yet rewarding market.

Frequently Asked Questions (FAQ)

1. Why is the vintage poster market considered high-risk for payment processing?

The vintage poster market is considered high-risk due to high transaction values, niche audience, and frequent chargebacks. Customers purchasing vintage posters may dispute the authenticity or value of the item, leading to financial risks for payment processors. This makes traditional PSPs hesitant to serve this market.

2. What are the benefits of using a high-risk PSP for my vintage poster business in India?

High-risk PSPs provide tailored solutions that address the specific needs of vintage poster sellers. These include chargeback management, fraud prevention, multi-currency options, and seamless e-commerce integration. They also have higher approval rates for high-value transactions and offer enhanced security features.

3. How do high-risk PSPs handle chargebacks?

High-risk PSPs offer proactive chargeback management services. They monitor transactions, provide alerts for potential disputes, and offer support to resolve issues before they escalate. Their chargeback management tools reduce the financial impact of disputes on the business.

4. Can I sell vintage posters to international customers with a high-risk PSP?

Yes, high-risk PSPs support multi-currency processing, allowing Indian vintage poster sellers to reach a global audience. This feature helps international customers pay in their preferred currency, expanding the market for vintage poster businesses.

5. Are there additional fees when using a high-risk PSP?

High-risk PSPs often charge higher transaction fees and may have additional monthly fees due to the higher risk involved. It’s important to review and understand the fee structure before partnering with a high-risk PSP to ensure it aligns with your business goals.