AUTHOR : JAYOKI

DATE : 16/12/2023

Introduction

In the fast-paced world of online transactions, the evolution of payment gateways has been remarkable. Traditionally, users had to go through tedious documentation processes[1] to set up an account[2]. However, a new era has dawned with the emergence of payment gateways [3]that operate without the need for extensive documents[4].

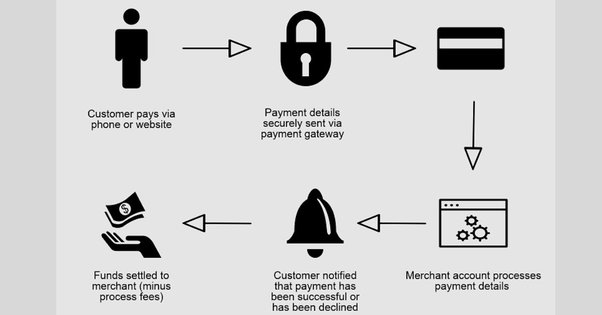

The Importance of Payment Gateways

Payment gateways serve as the bridge between businesses and consumers in the digital[5] realm. They facilitate secure transactions, making online shopping and financial interactions more accessible and efficient.

Traditional Document Requirements

Historically, payment gateways required users to submit various documents, including identification, address proof, and business credentials. While these measures were Executed to enhance security, they often led to user frustration and delayed onboarding.

The Hassles of Document Verification

Document verification processes are time-consuming and can hinder the user experience. Users may abandon the onboarding process if faced with too many requirements, impacting businesses that rely on swift and Smooth transactions.

Emerging Trends: Documentless Payment Gateways

In response to user demands for efficiency, Paper-free payment have emerged. These innovative solutions aim to the process and reduce the barriers associated with traditional document

Authentication.

Advantages of Payment Gateways Without Documents

Enhanced User Experience

Documentless payment gateways provide a smoother

Integration experience, eliminating the need for extensive paperwork. Users can complete the setup process swiftly,

Advocating a positive interaction with the platform.

Faster Onboarding

With fewer requirements, the process becomes significantly faster. This not only benefits users but also allows businesses to engage customers Quickly

Global Accessibility

Documentless payment cater to a global audience by removing

Spatial barriers. Users from different regions can access and utilize these gateways without being bogged down by intricate documentation processes.

Security Measures in Documentless Payment Gateways

While the elimination of documents may raise concerns about security, modern payment

Portals employ advanced encryption and Validation measures. These ensure that transactions remain secure, protecting both businesses and consumers from potential threats.

How to Choose the Right Payment Gateway

Selecting the right payment gateway is crucial for businesses seeking efficiency and security. Consider the following factors when making your choice:

Compatibility

Ensure that the payment gateway is compatible with your business platform and the devices your customers use.

Security Features

Opt for gateways that prioritize security, offering features like two-factor authentication and robust encryption.

Integration Options

Choose a payment gateway that seamlessly integrates with your existing systems for a smoother operational flow.

Popular Documentless Payment Gateways

Several payment gateways have embraced the documentless trend, each with its unique features. Some of the popular choices include XYZ Gateway, ABC Payments, and DEF Express.

Successful Implementations

Explore real-world examples of businesses that have successfully implemented [1]documentless payment gateways. Learn from their experiences and understand the positive impact on user engagement and operational efficiency.

Challenges and Solutions

While documentless payment gateways bring numerous advantages, they also face challenges. Explore common issues and innovative solutions to ensure a seamless payment experience for both businesses [2]and consumers.

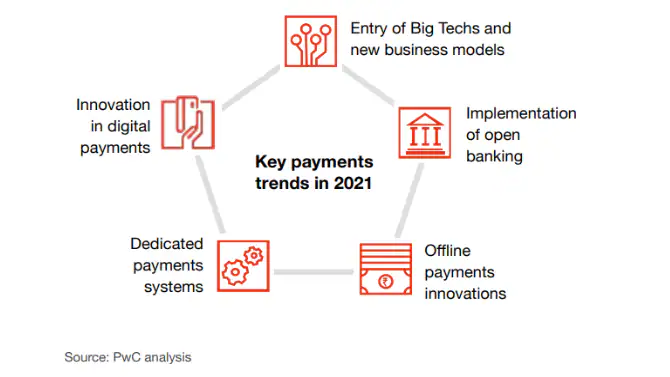

Future Trends in Payment Gateways

As technology continues to advance, anticipate upcoming trends in payment gateways. From enhanced biometric authentication[3] to artificial intelligence-driven fraud detection, stay ahead of the curve to provide the best payment experience.

Tips for Seamless Transactions

Offer tips to businesses and users for ensuring smooth and secure transactions. From keeping software updated to monitoring account activity, these tips enhance the overall payment [4]experience.

Consumer Confidence in Documentless Transactions

Explore the factors that contribute to consumer confidence in documentless transactions.[5] Highlight the role of transparency, communication, and user-friendly interfaces in building trust between businesses and their customers.

Conclusion

The evolution of payment gateways without documents signifies a positive shift in the digital landscape. Businesses that embrace these innovative solutions stand to gain a competitive edge by providing efficient, secure, and user-friendly payment experiences.

FAQs

- Are documentless payment gateways secure?

- Yes, modern documentless payment gateways prioritize security through advanced encryption and authentication measures.

- How do documentless payment gateways benefit businesses?

- Documentless payment gateways streamline the onboarding process, leading to faster transactions and enhanced user experiences.

- What aspects should businesses take into account when selecting a payment gateway for their operations?

- Compatibility, security features, and integration options are crucial factors to consider when selecting a payment gateway.

- Can businesses from different regions use the same documentless payment gateway?

- Yes, documentless payment gateways promote global accessibility,

Permitting businesses from various regions to utilize the same platform.

- Yes, documentless payment gateways promote global accessibility,

- What are the future trends in payment gateways?

- Future trends include enhanced biometric authentication, artificial intelligence-driven fraud detection, and continuous technological

Progressions.

- Future trends include enhanced biometric authentication, artificial intelligence-driven fraud detection, and continuous technological