AUTHOR : MICKEY JORDAN

DATE : 16/12/2023

Introduction

In the complex realm of monetary exchanges, the phrase “payment gateway” plays a central and indispensable role.Defined as a service that facilitates the seamless transfer of money between a customer and a business[1], payment gateways[2] have become an integral part of e-commerce[3] and digital transactions. However, the incorporation of Goods and Services Tax (GST) into these gateways has raised significant concerns for businesses. In this article, we will explore the concept of a payment gateway without GST[4], examining its pros and cons, impact on business operations, and the evolving landscape of financial technologies[5].

The Role of GST in Payment Gateways

Understanding the significance of GST in payment gateways is crucial for businesses navigating the financial landscape. We’ll delve into an overview of GST, its integration into financial systems, and the challenges faced by businesses in complying with this taxation framework.

Payment Gateway Without GST: Pros and Cons

In this section, we’ll explore the advantages and disadvantages of opting for a payment gateway without GST. From streamlined financial transactions to potential risks, we’ll analyze the factors businesses need to consider when making this critical decision.

How to Identify Payment Gateways Without GST

Choosing the right payment gateway requires thorough research and consideration. We’ll provide insights into identifying payment gateways without GST by examining features, reading user reviews, and consulting with financial experts.

Impact on Business Operations

The decision to opt for a payment gateway without GST has far-reaching implications on business operations. We’ll discuss how it can simplify financial transactions, ensure regulatory compliance, and impact overall costs for businesses.

Choosing the Right Payment Gateway

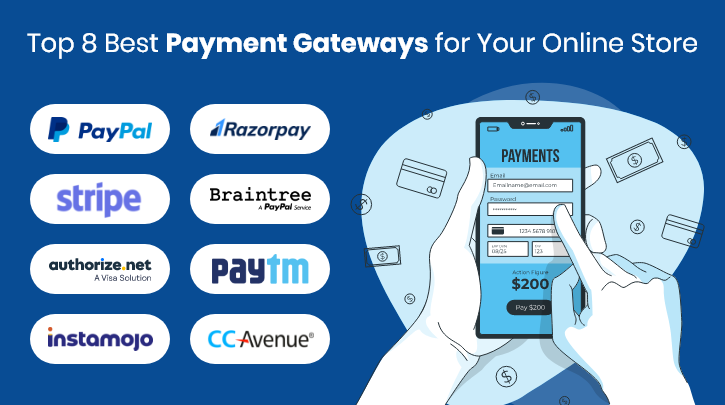

This section will guide businesses through the process of selecting the most suitable payment gateway. We’ll outline the factors to consider, compare popular payment gateways, and present case studies of businesses that have successfully navigated this decision.

Alternatives to Traditional Payment Gateways

For businesses exploring beyond conventional methods, this section explores alternatives such as cryptocurrency, blockchain, digital wallets, and peer-to-peer transactions.

The Future of Payment Gateways Without GST

As technology continues to evolve, so does the landscape of payment gateways. We’ll discuss the potential future developments, considering technological advancements, regulatory changes, and emerging market trends.

Real-life Experiences

Learn from the experiences of businesses that have embraced without GST. Success stories and challenges faced by these enterprises provide valuable insights for others contemplating a similar decision.

Expert Opinions

Gain perspectives from financial analysts and industry experts on the implications and considerations of choosing a without GST.

The Future of Payment Gateways Without GST

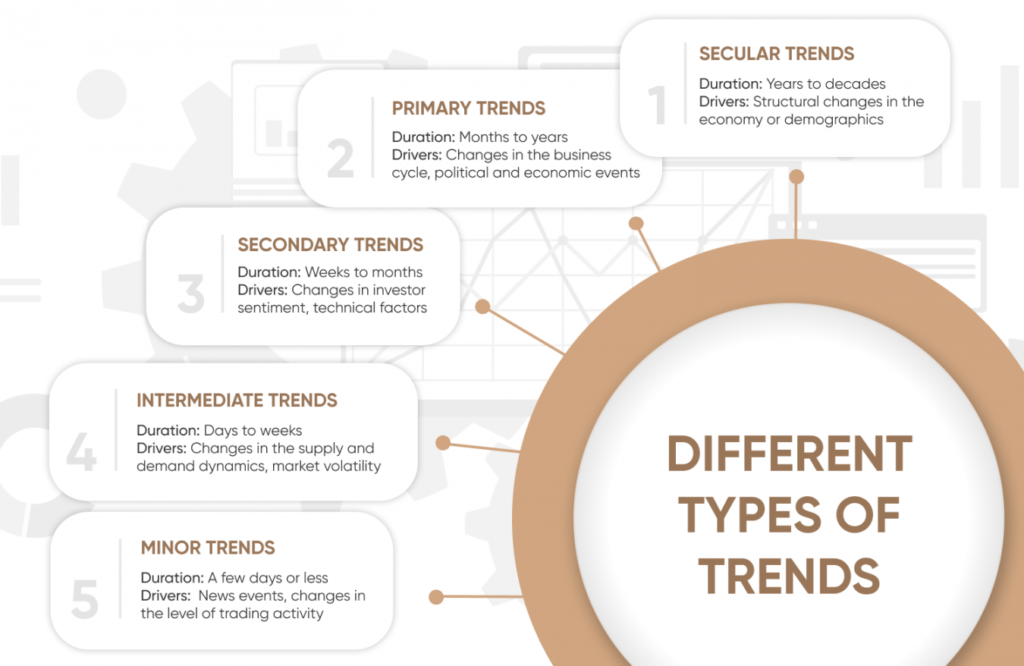

As technology continues to advance, the future of without holds exciting possibilities. Several trends are shaping the landscape[1], influencing how businesses conduct financial transactions.

Technological Advancements

Innovations such as artificial intelligence, machine learning, and biometric [2]authentication are transforming the way payment gateways operate. Businesses can expect more efficient and secure transactions as these technologies continue to evolve.

Regulatory Changes

The regulatory environment surrounding payment gateways[3] is subject to constant changes. Businesses should stay vigilant and adapt to new regulations to ensure compliance and avoid legal complications.

Market Trends

Consumer preferences and market trends play a crucial role in shaping the future of payment gateways. The rise of contactless payments, subscription-based models, and eco-friendly transactions[4] are just a few examples of trends that businesses should monitor and incorporate into their strategies.

In navigating the future, businesses[5] must stay informed, embrace innovation, and adapt to the evolving demands of consumers and regulators alike.

Conclusion

Summarizing key points, this section will provide a concise overview of the article and offer a call to action for businesses navigating decisions.In conclusion, the landscape of payment gateways without presents businesses with both challenges and opportunities. Understanding the intricate relationship between GST and financial transactions is crucial for informed decision-making. Opting for a payment gateway without has its merits, including streamlined transactions and potential cost savings.

FAQs

- What is the significance of GST in payment gateways?

- Answer: GST plays a crucial role in regulating financial transactions, ensuring compliance, and contributing to the overall tax structure.

- Are there any legal implications of using a payment gateway without GST?

- Answer: Businesses must carefully assess legal implications, as non-compliance with tax regulations can lead to penalties and legal consequences.

- How can businesses ensure compliance when opting for a GST-free payment gateway?

- Answer: Thorough research, consultation with financial experts, and regular updates on tax regulations are essential for ensuring compliance.

- What are the potential risks associated with payment gateways without GST?

- Answer: Risks include legal consequences, lack of regulatory compliance, and potential financial challenges.

- Can businesses save costs by choosing a payment gateway without GST?

- Answer: While there may be cost savings, businesses must weigh the advantages against potential risks and ensure overall financial stability.