AUTHOR : JAYOKI

DATE : 15/12/2023

Introduction

The Payments Processing Industry[1] is at the heart of modern commerce, facilitating secure, fast, and seamless financial transactions across the globe. From online purchases to in-store payments[2], this industry ensures that businesses can efficiently handle customer transactions while providing robust security measures to protect sensitive information. With the rise of digital wallets, contactless payments[3], and real-time processing, the Payments Processing Industry continues to evolve, driving innovation and transforming how we exchange value. For businesses and consumers alike, this industry plays a critical role in shaping the future of financial interactions[4].

Evolution of Payments Processing

The journey of payments processing dates back centuries, from barter systems to the introduction of coins and paper currency[5]. In recent decades, a paradigm shift towards digital payments has been witnessed, with electronic transactions becoming the norm.

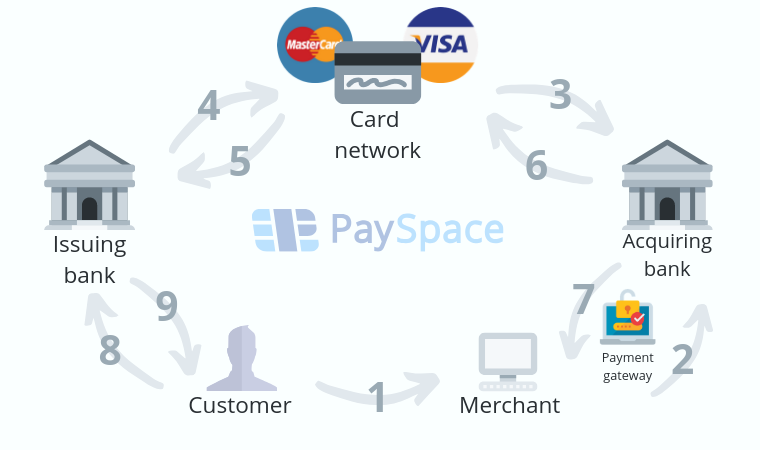

Key Players in the Industry

A handful of major players dominate the payments processing scene, each vying for a significant market share. The competition is fierce, with technological advancements often being the key differentiator.

Technology and Innovation

Technology plays a pivotal role in the efficiency and security of payment processing. Innovations such as contactless payments, biometric authentication, and artificial intelligence are transforming the industry.

Challenges Faced by the Industry

Despite the progress, the payments processing industry grapples with challenges such as data breaches, fraud, and regulatory complexities. Security concerns remain paramount in an age where cyber threats loom large.

Global Market Trends

The dynamics of the payments industry vary across continents, with regions embracing different payment methods. Understanding these global trends is crucial for businesses operating on an international scale.

E-commerce Influence

The surge in e-commerce has reshaped consumer behavior, leading to a surge in online transactions. This shift has prompted a reevaluation of traditional payment methods and a focus on secure digital transactions.

Mobile Payment Revolution

The ubiquitous presence of smartphones has fueled the rise of mobile payments. Mobile wallets and apps offer a convenient and secure alternative to traditional payment methods.

Cryptocurrency and Blockchain

The advent of cryptocurrencies and blockchain technology has introduced decentralized and secure payment options. The industry is cautiously exploring the potential of these innovations.

Customer Experience in Payments

User-friendly interfaces and seamless experiences are paramount in the payments processing industry. Companies are investing heavily in enhancing customer experiences to stay competitive.

Data Security Measures

With data breaches becoming more sophisticated, implementing robust security measures is non-negotiable. Compliance with data protection laws is imperative to maintain trust and credibility.

Future Projections

The payments processing industry is on a trajectory of continuous evolution. Artificial intelligence is expected to play a more prominent role, streamlining processes and enhancing security.

Environmental Sustainability

Corporate responsibility is gaining prominence, with companies adopting eco-friendly initiatives. The industry is acknowledging its environmental impact and striving for sustainable practices.

Riding the Technological Wave

The payments processing industry is not just adapting to technology; it’s riding the crest of a technological wave that is reshaping the very foundations of commerce. From the early days of magnetic stripe cards to the current era of biometric authentication and blockchain, the industry continues to push boundaries.

Biometric Authentication

One of the standout innovations is biometric authentication, where fingerprints, facial recognition, and even voiceprints are being utilized to enhance security. This not only provides a seamless and unique user experience but also adds an extra layer of protection against unauthorized access.

Blockchain and Smart Contracts

The adoption of blockchain technology goes beyond cryptocurrencies. Blockchain offers a decentralized, tamper-proof ledger that ensures transparency and security in transactions. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, are streamlining processes and reducing the need for intermediaries.

Meeting Regulatory Challenges Head-On

As the industry forges ahead, regulatory challenges become more intricate. The need for a standardized and secure framework is essential to build trust among consumers and businesses alike. Compliance with evolving data protection laws and international regulations is primary to maintaining the integrity of the payments processing ecosystem.

Diverse Payment Methods

The modern consumer demands diversity in payment options. From credit cards to digital wallets, Buy Now Pay Later (BNPL) services to currencies payments, the industry is experiencing a surge in the variety of payment methods. This diversity not only caters to different consumer preferences but also fuels competition among payment service providers.

Conclusion

As technology advances and consumer expectations grow, the Payments Processing Industry remains a cornerstone of the global economy. Its commitment to innovation, security, and convenience ensures that businesses can thrive and customers can enjoy seamless transaction experiences. By staying informed about trends and developments in the Payments Processing Industry, businesses can leverage cutting-edge solutions to stay competitive and meet their customers’ needs. This industry’s evolution promises a future of even more efficient and secure payment solutions.

FAQs

1. What is the Payments Processing Industry?

The Payments Processing Industry refers to the sector responsible for enabling the transfer of funds between customers and businesses, including the infrastructure and technology for handling credit cards, digital wallets, and other payment methods.

2. How does the Payments Processing Industry ensure transaction security?

This industry uses technologies like encryption, tokenization, and fraud detection systems to protect sensitive data and ensure secure transactions for businesses and customers.

3. What trends are shaping the Payments Processing Industry?

Emerging trends in the Payments Processing Industry include the adoption of real-time payment systems, advanced AI-powered tools for fraud detection, widespread use of contactless payment methods, integration of blockchain for enhanced transparency, and the increasing popularity of digital wallets and mobile payment solutions.

4. Why is the Payments Processing Industry important for businesses?

The Payments Processing Industry provides businesses with the tools to accept diverse payment methods, expand their market reach, improve cash flow, and offer a seamless customer experience.

5. What factors should businesses consider when selecting the most suitable payment processor for their needs?

Businesses should evaluate processors based on transaction fees, supported payment methods, ease of integration, customer support, security features, and scalability to find the best fit for their needs.