AUTHOR : JAYOKI

DATE : 15/12/2023

Introduction

In the fast-paced world of digital transactions and payment processing[1] companies play a pivotal role in ensuring seamless financial transactions.[2] As our global economy [3]continues its digital transformation,[4] these companies have become indispensable for businesses[5] and consumers alike.

Evolution of Payment Processing Companies

The journey of payment processing companies is a fascinating one, tracing its roots back to traditional banking systems. Over time, these entities have evolved, adapting to technological advancements and transitioning from manual to automated processes.

Key Features of Payment Processing Companies

Security is paramount in the digital age, and payment processors have risen to the challenge. Implementing robust security measures, ensuring swift and efficient transactions, and providing seamless integration capabilities are the hallmarks of these companies.

Major Players in the Industry

In a landscape teeming with competition, several payment processing giants lead the way. Understanding their market share, unique offerings, and strategies is crucial to comprehending the dynamics of the industry.

Types of Payment Processing Services

Credit card processing, mobile payments, and e-commerce solutions are just a few of the services offered by payment processing companies. Each service caters to different needs, reflecting the diversity of modern financial transactions.

Technological Advancements in Payment Processing

Advancements in artificial intelligence and machine learning have revolutionized payment processing. Contactless payments, once a novelty, have become a standard, showcasing the industry’s commitment to innovation.

Challenges and Solutions

While the benefits are immense, challenges such as security concerns and regulatory compliance persist. Payment processing companies continually refine their strategies to address these issues, ensuring the safety and satisfaction of users.

Benefits for Businesses

For businesses, embracing payment processing solutions means more than just financial transactions. Streamlined operations, enhanced customer experiences, and the ability to tap into the global market are among the many advantages.

Choosing the Right Payment Processing Company

The decision to select a payment processing partner is critical. Exploring factors such as reliability, scalability, and compatibility with business needs will guide businesses to the right choice.

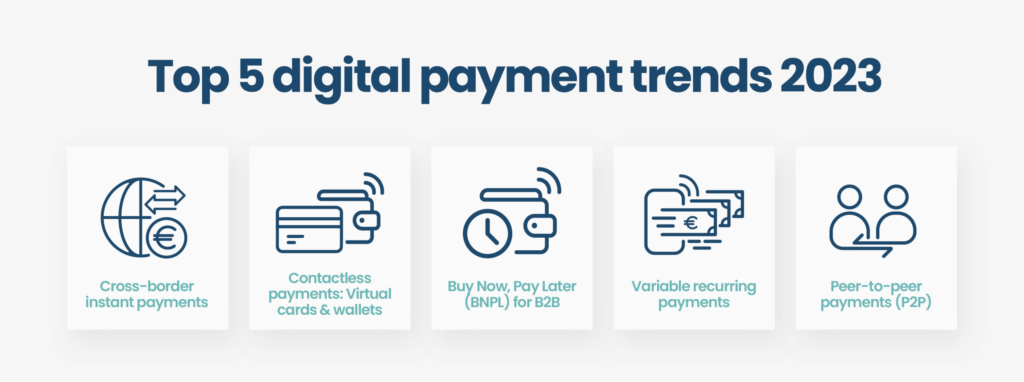

Trends in Payment Processing

The landscape is ever-changing, with trends like cryptocurrency integration and a focus on sustainable practices shaping the industry’s future. Staying informed about these trends is crucial for businesses seeking to stay ahead.

The Future of Payment Processing

As technology continues to advance, so does the future of payment processing. Emerging technologies and predictions for industry growth highlight the exciting developments on the horizon.

Customer Testimonials

Hearing from those who have experienced the services of testimonials payment processing[1] companies firsthand adds a personal touch to the narrative, providing valuable insights into the user experience.

Common Misconceptions About Payment Processing Companies

Dispelling myths and clarifying misconceptions ensures that businesses [2] and consumers make informed decisions when choosing a payment processing partner.

Enhanced Biometric Security

Biometric authentication[3] methods are likely to become more prevalent, adding an extra layer of security to transactions.

Integration with Emerging Technologies

Payment processors will increasingly integrate [4] with emerging technologies like AI and IoT to enhance functionality.

Sustainability in the Digital Realm

The growing concern for environmental sustainability [5] is influencing every industry, and payment processing is no exception. Future payment processors are expected to adopt greener practices, from eco-friendly data centers to carbon-neutral transaction processes. This commitment to sustainability aligns with the global push towards environmentally conscious business practices.

Conclusion

In conclusion, payment processing companies stand as pillars in the digital economy, facilitating secure and efficient financial transactions. The journey from traditional methods to cutting-edge technologies reflects their adaptability and commitment to meeting evolving needs.

FAQs

- Q: How do payment processing companies ensure the security of transactions?

- A: Payment processing companies employ advanced encryption and security protocols to safeguard transactions.

- Q: Are there any eco-friendly practices adopted by payment processing companies?

- A: Yes, some companies focus on sustainability by implementing eco-friendly practices in their operations.

- Q: Can small businesses benefit from payment processing solutions?

- A: Absolutely. Payment processing solutions offer scalability, making them suitable for businesses of all sizes.

- Q: What role does AI play in modern payment processing?

- A: Artificial intelligence enhances fraud detection, customer service, and overall efficiency in payment processing.

- Q: How do payment processors contribute to global market reach for businesses?

- A: By providing diverse payment options and supporting multiple currencies, payment processors enable businesses to reach a global audience.