AUTHOR : JAYOKI

DATE : 15/12/2023

Introduction

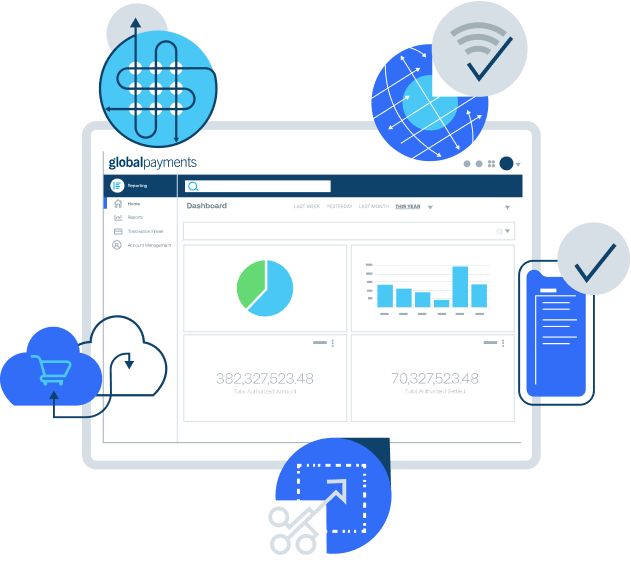

A Payments Merchant Portal[1] is a centralized platform that empowers businesses to manage and track their payment transactions seamlessly. It provides merchants with tools to monitor sales, process refunds, generate detailed reports, and gain real-time insights into payment activities. Whether operating a small business[2] or a large enterprise, a Payments Merchant Portal simplifies payment management by offering secure, user-friendly interfaces and comprehensive features. With the increasing complexity of payment ecosystems, this portal is a vital asset for merchants looking to optimize operations and deliver better customer experiences[3].

Evolution of Payments Technology

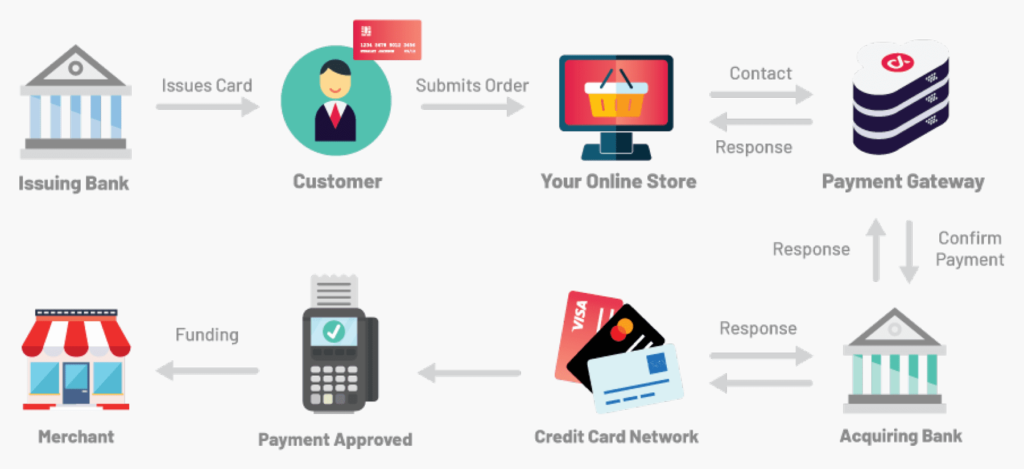

The journey of payment technology is fascinating. From traditional cash transactions to the advent of credit cards[4], the landscape has evolved significantly. Today, with the rise of digital payments[5], portals play a pivotal role in facilitating seamless transactions.

Key Features of a Payments Merchant Portal

A user-friendly interface is paramount in ensuring merchants can navigate the portal effortlessly. Transaction management tools and robust reporting and analytics contribute to the overall efficiency of these portals, providing businesses with valuable insights.

Benefits for Merchants

Merchants stand to gain substantially from implementing a payments merchant portal. The enhanced efficiency in payment processing translates to improved customer experiences, ultimately boosting the bottom line. Let’s delve deeper into the advantages.

Security Measures in Merchant Portals

In an era where cyber threats loom large, the security of payment transactions is non-negotiable. Encryption, robust data security, and advanced fraud detection measures are integral components of a reliable payments merchant portal.

Integration with E-commerce Platforms

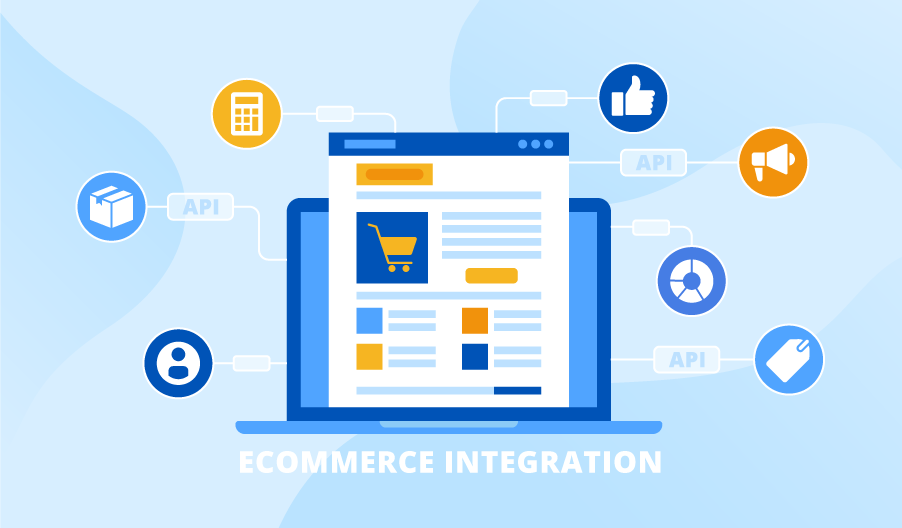

For businesses with an online presence, the integration of merchant portals with e-commerce platforms is a game-changer. This ensures a seamless connection between the online store and the payment processing system, fostering a smooth customer journey.

Choosing the Right Payments Merchant Portal

Selecting the most suitable merchant portal for your business requires careful consideration. Analyzing business needs and conducting a comparative assessment of available options are crucial steps in making an informed decision.

Future Trends in Payment Portals

The landscape of payments is ever-evolving. Exploring emerging technologies and anticipated developments in Merchant Payment Dashboard provides businesses with a glimpse into the future, helping them stay ahead of the curve.

Challenges in Implementing Merchant Portals

While the advantages are numerous, challenges in implementation exist. Overcoming integration hurdles and addressing security concerns are pivotal in ensuring a smooth transition to a merchant portal.

User Testimonials

The real experiences of merchants using payment portals offer a unique perspective. Hearing firsthand accounts of how these portals have transformed businesses provides valuable insights for prospective users.

Tips for Maximizing the Benefits

To derive the maximum benefits from a merchant payment dashboard, businesses should explore and utilize advanced features. Staying updated with portal enhancements ensures that merchants are making the most of available tools.

Industry Regulations and Compliance

Adherence to industry standards and compliance requirements is a non-negotiable aspect of payment processing. Navigating the regulatory landscape ensures that businesses operate within legal and ethical boundaries.

Comparing Merchant Portals Across Industries

Different industries have varied needs. Tailoring payments merchant solutions to specific industry requirements is crucial. Let’s explore how these portals cater to the distinct needs of various sectors.

The Environmental Impact of Digital Transactions

As businesses become more conscious of their environmental footprint, the environmental impact of digital transactions is gaining attention. Merchant portals that focus on sustainability, such as providing electronic receipts and reducing paper usage, are becoming preferred choices for environmentally conscious businesses.

The Future Landscape of Payments Merchant Portals

Looking ahead, the future of merchant portals is exciting and filled with possibilities. The integration of blockchain technology is gaining attention for its potential to revolutionize the security and transparency of transactions. Blockchain ensures a decentralized and tamper-resistant ledger, reducing the risk of fraud and enhancing trust in payment processes.

Conclusion

The Payments Merchant Portal is a game changer for businesses, providing the functionality and insights needed to manage payments efficiently. From streamlining transaction monitoring to generating actionable reports, this portal ensures merchants have the tools to stay in control of their financial operations. Embracing a Payments Merchant Portal helps businesses reduce administrative burdens, enhance security, and deliver exceptional service. It’s an essential solution for thriving in today’s fast-paced, digital-first economy.

FAQs

1. What is a Payments Merchant Portal?

A Payments Merchant Portal is a web-based platform that allows businesses to manage payment transactions, view sales reports, process refunds, and gain insights into financial activities in real-time.

2. How can a Payments Merchant Portal benefit my business?

A Payments Merchant Portal simplifies transaction management, provides access to detailed reporting, enhances financial oversight, and enables faster issue resolution, all of which improve operational efficiency.

3. Is a Payments Merchant Portal secure?

Yes, most portals prioritize security with features like encryption, multi-factor authentication, and PCI DSS compliance to protect sensitive financial data.

4. Can I use a Payments Merchant Portal for multiple payment methods?

Absolutely. A Payments Merchant Portal typically supports a variety of payment methods, including credit cards, digital wallets, bank transfers, and mobile payments, making it versatile for all business types.

5. How do I choose the right Payments Merchant Portal for my business?

Consider factors such as ease of use, integration capabilities, reporting features, scalability, security standards, and customer support when selecting a merchant payment dashboard to ensure it meets your business needs.