AUTHOR : SELENA GIL

DATE : 14/12/2023

Introduction

In today’s digital economy[1], businesses thrive on the ability to process payments seamlessly. One crucial aspect of online transactions[2] is the payment gateway—the bridge between a customer[3]‘s purchase and the merchant’s bank account[4]. When considering a payment gateway[5], one significant factor to ponder is the transaction fee, as it directly impacts a business’s profitability. Let’s delve into the world of payment gateways with the lowest transaction fees and explore how they can benefit your business

Factors Influencing Transaction Fees

Transaction Volume

The volume of transactions processed through a payment gateway often influences the applicable fees. Higher transaction volumes might qualify for reduced fees, making it essential to assess your business’s anticipated transaction load.

Payment Method

Different payment methods, such as credit cards, digital wallets, or bank transfers, can incur varying transaction fees. Certain gateways might offer lower fees for specific payment methods, influencing your choice.

Geographic Reach

Operating in diverse geographical locations might lead to varying transaction fees due to currency conversions and regional regulations. Considering your business’s reach is pivotal in choosing a cost-effective payment gateway.

Payment Gateways with Lowest Transaction Fees

Gateway 1: Analysis and Features

Gateway 1 offers competitive transaction fees coupled with robust security features. With a user-friendly interface, it caters well to small and medium-sized businesses. Integration is seamless, ensuring a hassle-free experience.

Gateway 2: Analysis and Features

Gateway 2 boasts remarkably low transaction fees, especially for international transactions. Its scalability and adaptability make it a popular choice for businesses expanding globally.

Gateway 3: Analysis and Features

Gateway 3 stands out for its transparent fee structure and customizable solutions. Although its fees might not be the lowest, its tailored services cater to unique business requirements effectively.

Comparison of Low-Fee Payment Gateways

When comparing these gateways, beyond transaction fees, it’s crucial to assess user experience, integration capabilities, and security measures. Evaluating these aspects helps in making an informed decision aligned with your business goals.

Choosing the Right Payment Gateway

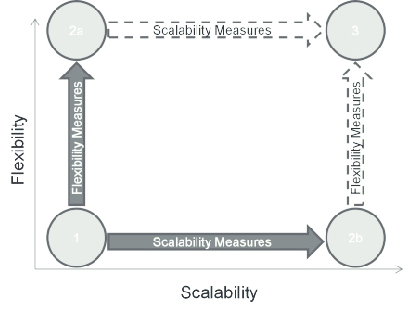

Selecting the ideal payment gateway involves aligning its features with your business needs. Consider scalability, customer support, and flexibility to ensure seamless operations and growth potential.

Innovative Features

Innovation within payment gateways extends beyond just reducing transaction fees. Modern gateways are exploring AI-powered fraud detection, facilitating seamless cryptocurrency transactions, and integrating with emerging payment methods like digital wallets and buy-now-pay-later options. These innovative features not only enhance transaction[1] efficiency but also introduce cost-saving possibilities for businesses.

Comparative Analysis of Fees

Understanding the full spectrum of charges associated with payment gateways is crucial. While transaction fees are prominent, there are often additional costs such as chargeback[2] fees, setup fees, monthly fees, and fees for additional services. Conducting a detailed comparative analysis unveils the overall cost implications, ensuring businesses choose a gateway aligned with their financial strategies.

Case Studies

Real-world examples can vividly illustrate the impact of payment gateway choices on businesses. For instance, an e-commerce[3] startup might find that selecting a gateway with slightly higher transaction fees but lower chargeback rates and robust fraud protection ultimately saves more money in the long run. Case studies serve as practical guides, offering insights into potential savings and operational efficiencies.

Tips for Selecting the Right Payment Gateway

The journey to finding the optimal payment gateway involves considering various factors. Business size, transaction volume, industry-specific needs, and growth projections are pivotal. Small businesses may prioritize ease of setup and low monthly costs, while larger enterprises may focus on negotiating lower transaction fees due to higher volumes.

Community and Reviews

Examining user experiences and community feedback can provide invaluable insights into the practical performance of payment gateways. Online forums, social media groups, and review platforms often host discussions and testimonials from users across various industries. This real-world[4] feedback goes beyond advertised features, shedding light on usability, customer service quality, and overall satisfaction levels.

Scalability and Flexibility

A payment gateway[5]‘s ability to scale alongside a growing business is critical. As enterprises expand, their transaction needs evolve. A flexible gateway that accommodates increasing transaction volumes without disproportionately increasing fees is advantageous. It ensures seamless operations during growth phases without incurring substantial additional costs.

Conclusion

In conclusion, the quest for a payment gateway with the lowest transaction fees is multifaceted. It involves evaluating not only the fees but also the services offered and their compatibility with your business model. By weighing these factors, businesses can optimize their financial processes effectively.

FAQs

What exactly are transaction fees?

Transaction fees are charges imposed by payment gateways for processing online transactions.

How do payment gateways determine transaction fees?

Payment gateways often consider factors like transaction volume, payment methods, and geographic reach to determine fees.

Are there any hidden fees associated with payment gateways?

Some payment gateways might have hidden fees, making it crucial to review their terms and conditions carefully.

Can payment gateway fees affect business profitability?

Absolutely. Higher transaction fees can impact a business’s bottom line, especially for smaller businesses.

How often do payment gateway fees change?

Payment gateway fees can change periodically due to market conditions or updates in their pricing structures.