AUTHOR : BABLI

DATE : 13/12/23

Introduction

The growth of digital payments[1] has reshaped India’s financial ecosystem, with payment companies in India being at the forefront of driving this transformation. With the growing adoption of smartphones, internet connectivity, and the government’s push towards a cashless economy, these companies have become integral to both consumer and business financial transactions[2]. From mobile wallets to payment gateways, payment companies in India have pioneered a range of solutions that make it easier for individuals and businesses to transact seamlessly and securely. In this article, we will explore the key players, challenges, and opportunities within the ecosystem of payment companies in India[3].

Evolution of Payment Landscape

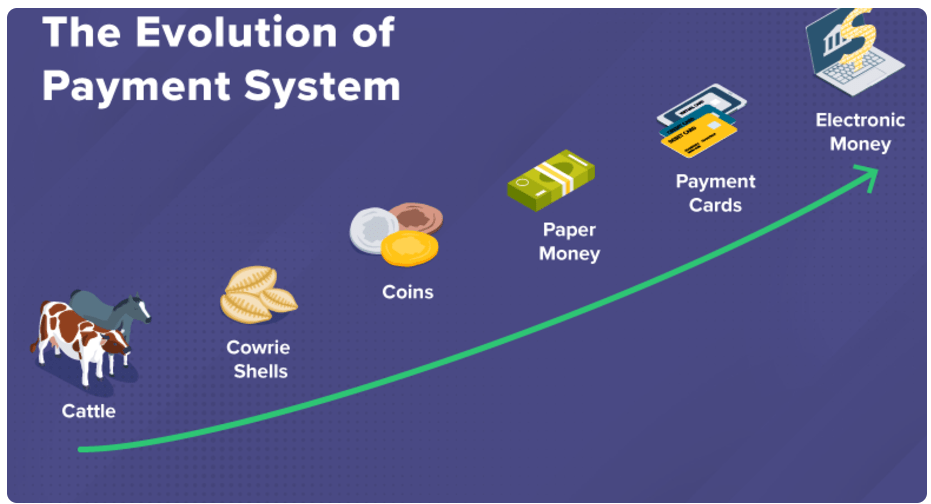

Traditional Methods

Historically, India relied heavily on cash transactions[4] and traditional banking methods. However, with the digital revolution, the landscape witnessed a shift towards more convenient and efficient payment mechanisms[5].

Emergence of Digital Payments

Digital payments gained momentum with the rise of mobile technology and the internet. Mobile wallets and online payment platforms became increasingly popular, offering users a seamless and quick way to transact.

Key Players in the Indian Payment Industry

Overview of Major Companies

Several payment companies have emerged as industry leaders, each contributing uniquely to the evolving landscape. Companies like Paytm, PhonePe, and Google Pay have become household names.

Market Share Analysis

Analyzing the market share of these companies provides insights into their dominance and the competitive dynamics within the industry. Understanding their market presence is crucial to determining the industry’s trajectory.

Impact on Indian Economy

Contribution to GDP

Job Creation

The robust growth of payment companies has a direct impact on the country’s GDP. The increased efficiency in financial transactions contributes significantly to economic development.

The expansion of payment companies has led to job creation across various sectors, from technology development to customer support. This not merely triggers economic expansion but also nurtures the culture of innovation.

Regulatory Framework

RBI Guidelines

The Reserve Bank of India Payments Companies in India (RBI) plays a crucial role in shaping the regulatory environment forPayments Companies in India Adhering to RBI guidelines is imperative for these companies to operate seamlessly.

Compliance Challenges

Navigating the complex regulatory landscape poses challenges for payment companies. Striking a balance between innovation and compliance is an ongoing endeavor in the industry.

Innovations in Payment Technologies

UPI and Mobile Wallets

Unified Payments Interface (UPI) has emerged as a game-changer, providing a single platform for various banking services. Mobile wallets complement UPI, offering users a diverse range of options.

Contactless Payments

With the advent of contactless payments, the need for physical cards is diminishing. The convenience and security offered by contactless transactions contribute to their growing popularity.

Challenges and Opportunities

Security Concerns

As digital transactions increase, so do concerns about cybersecurity.Payments Companies in India Payment companies must invest in robust security measures to protect user data and build trust.

Market Expansion

While urban areas have embraced digital payments, rural penetration remains a challenge. Companies have the opportunity to expand their reach by addressing the unique needs of rural consumers.

Comparison with Global Payment Trends

Unique Aspects of the Indian Market

The Indian payment landscape has unique characteristics shaped by cultural and economic factors. Understanding these nuances is crucial for global players entering the Indian market.

Global Influence on Indian Companies

Indian payment companies are not isolated; they draw inspiration from global trends. Collaborations and partnerships with international players contribute to the industry’s growth.

Success Stories

Case Studies of Leading Payment Companies

Examining success stories such as Paytm’s journey provides insights into the strategies that contributed to their growth. Learning from these cases can guide aspiring companies.

Factors Contributing to Success

Innovation, customer-centric approaches, and strategic partnerships are common factors among successful payment companies. Understanding and implementing these elements can pave the way for success.

Future Outlook

Projected Growth

Analysts project continued growth for the Indian payment industry. Factors such as increasing smartphone penetration and government initiatives contribute to this positive outlook.

Potential Disruptions

Disruptions, whether in the form of technological breakthroughs or regulatory changes, are inherent in the industry. Companies must be agile and prepared to navigate potential disruptions.

Consumer Perspective

Changing Consumer Behavior

Consumer preferences are dynamic, influenced by factors such as convenience, security, and user experience. Adapting to these changing preferences is crucial for sustained success.

Preferences and Expectations

Understanding what consumers value in payment services guides companies in tailoring their offerings. User-friendly interfaces and quick, secure transactions are key expectations.

Social and Cultural Impact

Digital Transformation

The adoption of digital payments signifies a broader digital transformation in society. Understanding the societal impact helps payment companies align their services with societal needs.

Financial Inclusion

Payment companies contribute to financial inclusion by providing services to unbanked and underbanked populations. Bridging the gap in financial access is a societal benefit.

Case Study: Paytm

Background

Paytm, initially focused on mobile recharges, expanded its services to become a leading payment platform. Analyzing Paytm’s evolution provides insights into the adaptability required for success.

Growth Trajectory

From a startup to a unicorn, Paytm’s journey showcases the possibilities in the payment industry. Strategic partnerships and diversification have been integral to its growth.

Conclusion

In conclusion, payment companies in India have reshaped the way transactions are conducted across the nation. As technology continues to evolve, these companies are expected to play an even more significant role in driving economic growth, improving financial inclusion, and fostering innovation. With an ever-expanding digital payment infrastructure and government-backed initiatives, payment companies in India are well-positioned to lead the charge in providing secure, efficient, and accessible financial services to every corner of the country. The future of payments in India is bright, and the companies leading this charge are laying the foundation for a truly cashless society.

FAQs

1. What are payment companies in India?

Payments companies in India are businesses that provide digital payment solutions to facilitate online transactions. They include payment gateways, mobile wallets, and UPI (Unified Payments Interface) providers, enabling individuals and businesses to send and receive money securely.

2. How do payment companies in India help businesses?

Payments companies in India help businesses by providing secure, efficient, and scalable payment solutions. These companies enable businesses to accept payments from customers through multiple channels such as websites, mobile apps, and point-of-sale terminals, thus improving the customer experience and streamlining operations.

3. What are the key players among payment companies in India?

Among the prominent players in the digital payments landscape in India are companies like Paytm, PhonePe, Google Pay, Razorpay, and BharatPe, each contributing significantly to the sector’s growth and innovation. These companies have revolutionized digital payments and continue to innovate with new services and products.

4. How do payment companies in India ensure security?

Payments companies in India prioritize security by employing advanced encryption technologies, multi-factor authentication, and compliance with regulatory standards set by the Reserve Bank of India (RBI). This ensures that transactions are safe and that sensitive financial information is protected.

5. What challenges do payment companies in India face?

Despite their growth, payment companies in India face challenges such as cybersecurity threats, regulatory compliance, the digital divide in rural areas, and competition from both local and international players. However, with continuous innovation and collaboration, these companies are overcoming these hurdles and expanding their reach across the country.