AUTHOR : SELENA GIL

DATE : 13/12/2023

Introduction

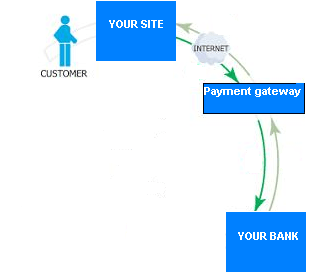

A clear payment platform definition[1] is essential for understanding the foundation of modern financial transactions. A payment platform serves as a technological solution that enables businesses and individuals to process, manage, and streamline payments in a secure and efficient manner. By integrating various payment methods, including credit cards[2], digital wallets, and bank transfers, these platforms simplify the transaction experience for users. The Payment Platform Definition encompasses features such as multi-currency support, fraud prevention, and real-time reporting, making them indispensable in today’s digital-first economy. Whether for e-commerce, in-store purchases, or global payments[3], a robust payment platform ensures smooth operations across all channels.

Understanding the Payment Platform Landscape

Major Players in Payment Platforms

Payment platforms incorporate.” a diverse array of entities, from financial institutions[4] to tech-driven companies. Leading the charge are established names like PayPal, Stripe, and Square, alongside emerging players constantly creating””in the fintech sphere[5].

Evolution of Payment Platforms

Over time, payment platforms have evolved from conventional banking systems to sophisticated digital ecosystems. Their evolution parallels the increasing demand for speed, security, and ease of use. in financial transactions.

Features and Functions of Payment Platforms

Payment Processing

At the core of payment platforms lies their ability to process transactions swiftly and securely. They facilitate various payment methods, including credit/debit cards, bank transfers, e-wallets, and cryptocurrencies, catering to diverse consumer preferences.

Security Measures

Ensuring trust is paramount in payment platforms. Robust encryption, tokenization, multi-factor “confirmation, and continuous security enhancements fortify these platforms against potential threats, safeguarding sensitive financial data.

Integration Capabilities

Payment platforms offer seamless integration with e-commerce websites, mobile applications, and point-of-sale systems. Transactions are optimized by this smooth integration, improving user satisfaction and increasing merchant productivity.

Types of Payment Platforms

Traditional Payment Platforms

Traditional payment platforms, rooted in established financial institutions, form the foundation of financial transactions. These encompass banking systems, credit card networks, and wire transfer services, providing stability and reliability.

Innovative Fintech Solutions

Fintech disruptors introduce innovative payment platforms, leveraging cutting-edge technologies like distributed ledger technology and artificial intelligence. Payment Platform Definition These platforms redefine financial interactions, offering speed, efficiency, and often “serving niche markets.

The Role of Payment Platforms in E-commerce

Enhancing Customer Experience

Payment platforms significantly contribute to the success of e-commerce by offering a user-friendly checkout process. They provide various payment options and a smooth” experience, reducing cart abandonment rates and boosting…”” customer satisfaction.

Risk Management and Fraud Prevention

In the realm of online transactions, fraud remains a concern. Payment platforms employ advanced risk management tools and fraud recognition mechanisms to mitigate risks, protecting both merchants and consumers.

The Future of Payment Platforms

Embracing Innovation

Continual innovation drives the evolution of payment platforms. Advancements in technologies like digital ledgers, hands-free. payments, and biometrics are reshaping the landscape, paving the way for more efficient, secure, and inclusive financial systems.

Focus on Financial Inclusion

Payment platforms are increasingly addressing the needs of the unbanked or underserved populations. By providing accessible, low-cost financial services, they bridge the gap and empower individuals who previously lacked access to traditional banking services.

The Technology Behind Payment Platforms

Encryption and Tokenization

Payment platforms utilize robust encryption methods to secure sensitive data during transactions. Tokenization further enhances security by replacing sensitive information with unique tokens, reducing the risk of data breaches.

APIs and Integration

Application Programming Interfaces (APIs) form the spine of payment platforms, enabling seamless integration with various software and systems. This integration facilitates a smooth flow of data and transactions between platforms, enhancing functionality

Global Impact of Payment Platforms

Cross-Border Transactions

Payment platforms have changed the landscape of international transactions and allow individuals and businesses to conduct cross-border payments efficiently. They offer currency conversion services and perfect.” processes, slash barriers in global trade.

Financial Empowerment

In regions with limited access to traditional banking services, payment platforms have emerged as catalysts for financial inclusion. They empower individuals to participate in the digital economy, fostering economic growth and sanction.

Evolving Trends in Payment Platforms

Contactless Payments

The rise of contactless payments, assisted by Near Field Communication (NFC) technology, has revolutionized in-person transactions. Mobile wallets and Payment Platform Definition contactless cards offer ease and speed, transforming the retail payment experience.

Cryptocurrency Integration

Some payment platforms have embraced cryptocurrencies, permitting users to conduct transactions using digital assets. This integration bridges the gap between traditional finance and emerging “deconcentrated lender technologies, offering alternative payment methods.

Conclusion

Payment platforms play a pivotal role in shaping the modern economy, transforming how individuals and businesses conduct Their evolution continues to bridge the Payment Platform Definition gap between ease and security, reexploring the dynamics of financial exchanges.

FAQs

- What is the Payment Platform Definition in simple terms?

The Payment Platform Definition refers to a system or software that enables businesses to process payments electronically. It acts as an intermediary, allowing transactions between customers and merchants through various payment methods, including credit cards, digital wallets, and bank transfers. - Why is the Payment Platform Definition important for e-commerce businesses?

The Payment Platform Definition highlights the role of a payment platform in enabling e-commerce businesses to accept secure, fast, and seamless payments. It ensures smooth operations, supports multiple currencies, and enhances the overall shopping experience for customers. - What key components are included in the Payment Platform Definition?

The Payment Platform Definition typically includes features such as payment gateway integration, fraud detection, real-time processing, reporting tools, multi-channel support, and compliance with regulatory standards. These components work together to create a reliable and efficient payment system. - How does the Payment Platform Definition apply to global transactions?

The Payment Platform Definition encompasses support for multi-currency processing, international payment methods, and compliance with global financial regulations. This makes it easier for businesses to operate across borders and cater to a diverse customer base. - Can small businesses benefit from understanding the payment platform definition?

Yes, understanding the Payment Platform Definition helps small businesses choose scalable payment solutions that fit their needs. It allows them to offer secure, versatile payment options, reduce operational complexities, and improve customer satisfaction.