AUTHOR : BABLI

DATE : 12/12/23

Introduction

In the ever-evolving landscape of financial transactions, payment transaction fees play a pivotal role. These fees are more than just numbers; they constitute a complex ecosystem influencing businesses and consumers alike. This article delves into the intricacies of payment transaction fees, shedding light on their types, influencing factors, and the broader impact on the business world.

Understanding Payment Transaction Fees

Definition of Payment Transaction Fees

Payment transaction fees refer to the charges incurred during the processing of financial transactions. These fees are a fundamental aspect of modern commerce, facilitating the smooth flow of money between consumers, businesses, and financial institutions.

Importance in Financial Transactions

The significance of payment transaction fees cannot be overstated. They contribute to the maintenance and improvement of payment infrastructure, ensuring the reliability and security of transactions in a digital age.

Common Types of Payment Transaction Fees

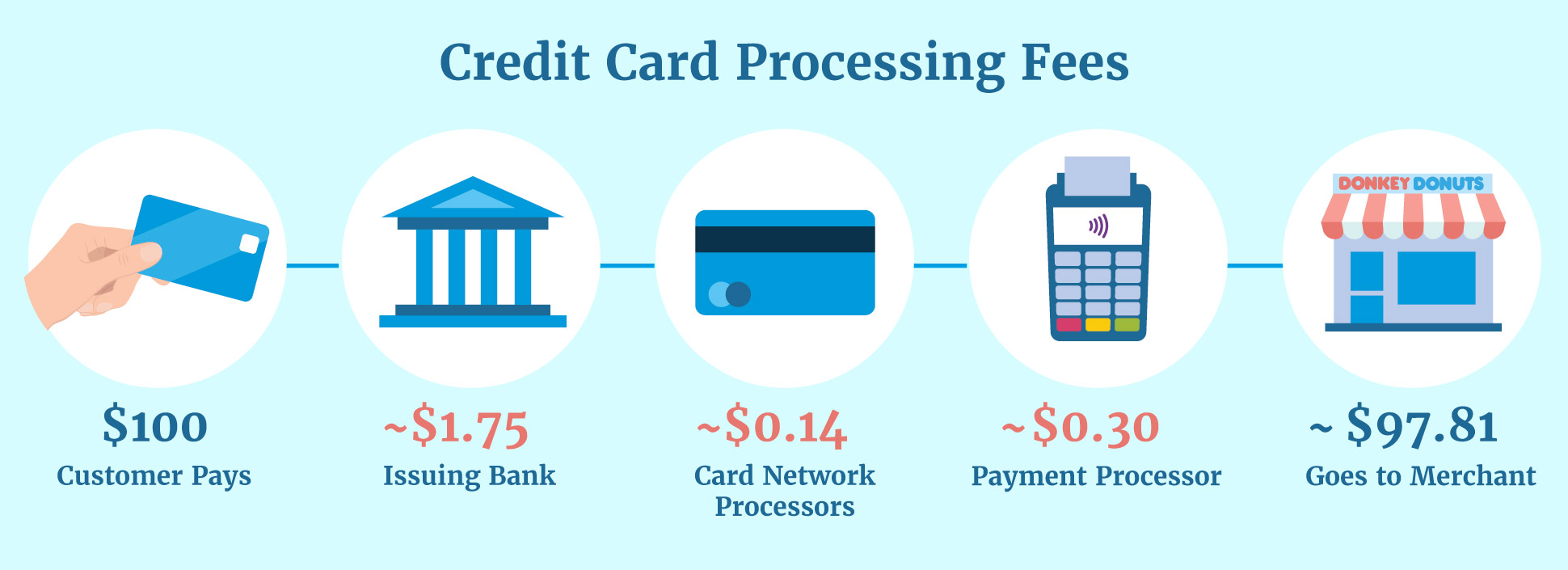

Processing Fees

Among the various types, processing fees[1] are the most common. These fees cover the costs associated with the actual handling of transactions,[2] from initiation to completion.

Interchange Fees

Interchange fees are charges between banks for the acceptance of card-based[3] transactions. Understanding [5]these fees is crucial for businesses relying on card payments.[4]

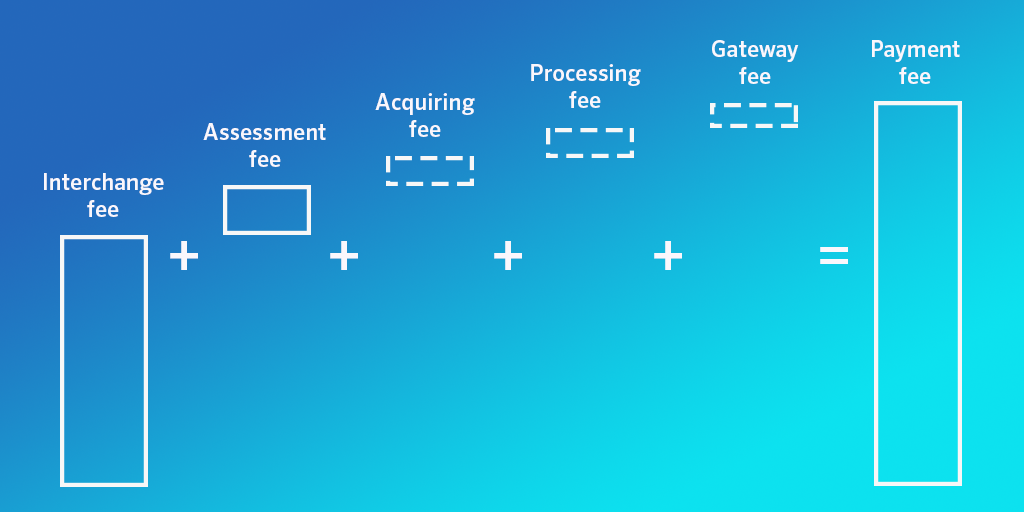

Assessment Fees

Assessment fees are charged by card associations and networks. This section explores how these fees impact businesses and consumers.

Factors Influencing Payment Transaction Fees

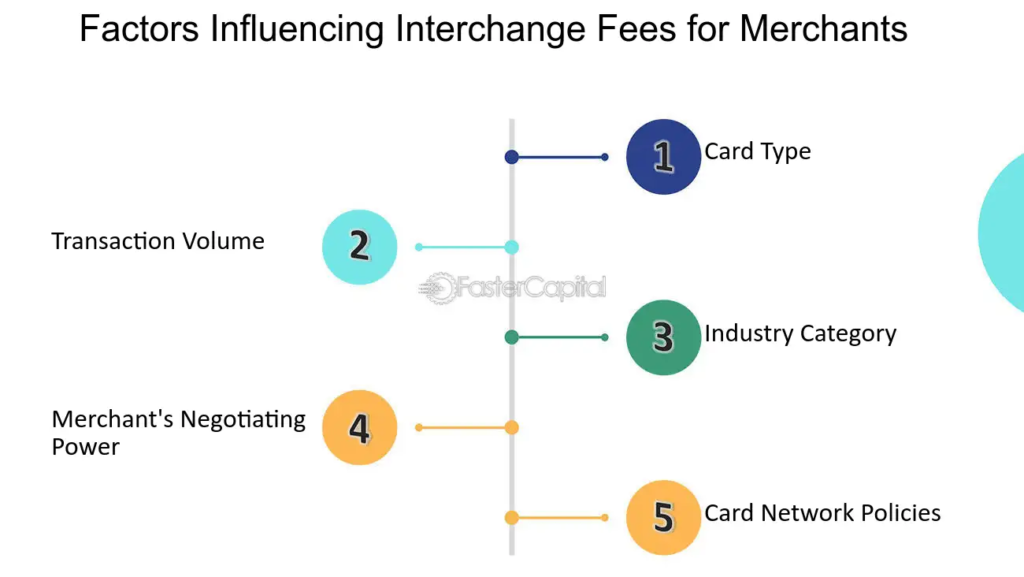

Payment Method

The choice of payment method [1]significantly influences transaction fees[2]. A detailed analysis of how different methods impact costs is essential for businesses aiming to optimize expenses.[3]

Transaction Volume

Businesses with high transaction volumes may benefit from economies of scale. [4]This section explores the correlation between transaction volume[5] and overall fees.

Industry Standards

Understanding industry standards helps businesses benchmark their payment transaction fees. Staying competitive requires knowledge of what is considered standard within a specific sector.

Understanding Merchant Accounts

Role in Payment Processing

Merchant accounts are central to payment processing. This section explores their role in facilitating transactions and the associated fees.

Associated Fees

Beyond transaction fees, merchants may encounter additional charges. This part elucidates various fees associated with maintaining a merchant account.

The Impact of Payment Transaction Fees on Businesses

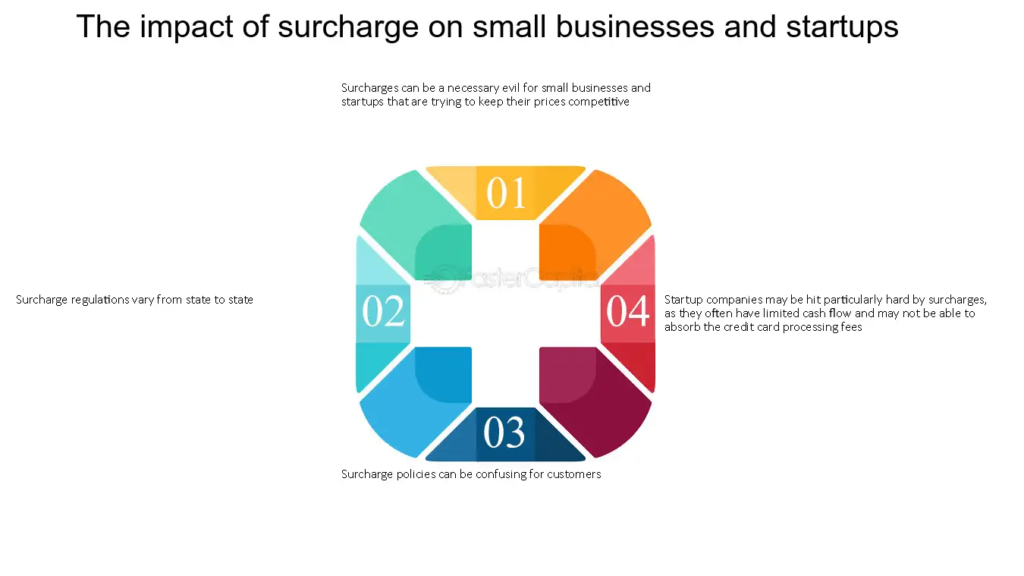

Cost Considerations

Businesses, especially small enterprises, need to carefully consider the impact of transaction fees on their bottom line. This section provides insights into effective cost management.

Strategies to Mitigate Fees

Implementing strategies to mitigate fees is crucial. From negotiating with processors to exploring alternative payment methods, businesses can proactively manage their expenses.

Innovations in Payment Processing

Blockchain and Cryptocurrencies

The rise of blockchain technology and cryptocurrencies introduces new possibilities for payment processing. This section explores how these innovations impact transaction fees.

Contactless Payments

Contactless payments are gaining popularity. This part examines the impact of this trend on transaction fees and consumer behavior.

Comparison of Payment Processors

Popular Payment Gateways

Businesses often have a choice of payment processors. A detailed comparison of popular gateways helps in making informed decisions.

Fee Structures

Understanding the fee structures of different processors is vital. This section provides a comparative analysis to aid businesses in choosing the most cost-effective option.

Negotiating Payment Transaction Fees

Tips for Businesses

Negotiating payment transaction fees is an art. This section offers practical tips for businesses looking to secure favorable terms with payment processors.

Building Long-term Relationships with Processors

Establishing a long-term relationship with payment processors is beneficial. This part explores strategies for building and maintaining such partnerships.

Emerging Trends in Payment Technology

Mobile Wallets

Mobile wallets are transforming the way consumers make payments. This section examines the impact of mobile wallets on transaction fees and user experience.

Biometric Authentication

The integration of biometric authentication adds an extra layer of security to transactions. This part explores how this trend influences payment processing.

Regulatory Landscape

Compliance and Security Measures

Compliance with regulations and robust security measures are essential. This section discusses the importance of adhering to industry standards.

Government Regulations

Governments play a role in shaping the regulatory landscape. This part provides an overview of government regulations affecting payment transaction fees.

The Future of Payment Transaction Fees

Predictions and Speculations

Predicting the future of payment transaction fees involves analyzing technological advancements and consumer behaviors. This section explores potential scenarios.

Evolving Technologies

Technological advancements continually reshape the payments industry. This part discusses how emerging technologies may impact transaction fees.

Case Studies

Successful Fee Management Strategies

Examining real-world case studies provides valuable insights into successful fee management strategies adopted by businesses.

Lessons from Industry Leaders

Learning from industry leaders helps businesses understand best practices in navigating payment transaction fees.

Educating Consumers on Payment Fees

Transparent Communication

Transparent communication about transaction fees fosters trust. This section emphasizes the importance of clear communication with consumers.

Consumer Empowerment

Empowering consumers with knowledge about transaction fees enables them to make informed choices. This part explores educational initiatives.

Conclusion

In conclusion, navigating the complex world of payment transaction fees requires a comprehensive understanding of the factors at play. Businesses must adapt to technological innovations, negotiate favorable terms, and prioritize transparent communication with consumers. As we look to the future, staying informed and proactive will be key to successfully managing payment transaction fees in an ever-changing landscape.

FAQs

- Q: How do processing fees impact small businesses?

- A: Processing fees can significantly affect small businesses, cutting into their profit margins. Implementing cost-effective strategies is crucial.

- Q: Are there alternatives to traditional payment processors?

- A: Yes, various alternative payment processors offer different fee structures. Researching and comparing options is advisable.

- Q: How can businesses negotiate better terms with payment processors?

- A: Negotiating better terms involves understanding the business’s needs and building a mutually beneficial relationship with the processor.

- Q: What role do government regulations play in payment transaction fees?

- A: Government regulations set standards for security and fair practices, influencing how transaction fees are managed within the industry.

- Q: What are the upcoming trends in payment technology that may impact fees?

- A: Emerging trends, such as decentralized finance and artificial intelligence, may shape the future of payment technology and associated fees.