AUTHOR : MICKEY JORDAN

DATE : 11/12/2023

Introduction

In a world dominated by e-commerce and digital transactions[1], the need for efficient payment solutions has never been more critical. Payment link[2] providers have emerged as game-changers, offering businesses [3]and individuals a seamless way to send and receive payments. This article explores the significance of payment link [4]providers in simplifying transactions[5] and enhancing the overall digital payment experience.

Exploring the Perks of Payment Link Providers

Effortless Invoicing for Freelancers

For freelancers, creating and sending invoices is often a time-consuming task. Payment link providers offer a lifeline by simplifying the invoicing process. Freelancers can generate a payment link, send it to their clients, and receive payments promptly, freeing up valuable time for their creative pursuits.

Contactless Payments in a Post-Pandemic World

In the wake of global events, the demand for contactless payment methods has skyrocketed. Payment link providers contribute to this shift by offering a secure and convenient way for individuals and businesses to transact without physical contact. Explore how this evolution aligns with changing consumer preferences.

Navigating Challenges in the Payment Link Landscape

Security Concerns and Solutions

While payment link prioritize security, it’s essential to address potential concerns. Discuss common security issues associated with digital transactions and how payment link providers continually update their systems to stay ahead of evolving cyber threats.

Ensuring Accessibility for All Users

Inclusivity in the digital payment realm is crucial. Delve into how are working towards ensuring that their services are accessible to individuals with varying technological expertise and diverse financial backgrounds.

Case Studies: Real-world Impact of Payment Link Providers

Small Businesses Thriving

Share success stories of small businesses that have flourished after adopting payment link solutions. Highlight specific instances where the convenience of payment links played a pivotal role in their growth.

Empowering Entrepreneurs

Explore how empower entrepreneurs to launch and grow their businesses by providing a reliable and user-friendly infrastructure.

Understanding Payment Link Providers

What are Payment Links?

Payment links are customized URLs generated by , allowing users to share a with payers to facilitate quick and hassle-free transactions.

How Payment Link Providers Work

Delving into the mechanics of , this section explains the step-by-step process involved in creating, sending, and receiving through .

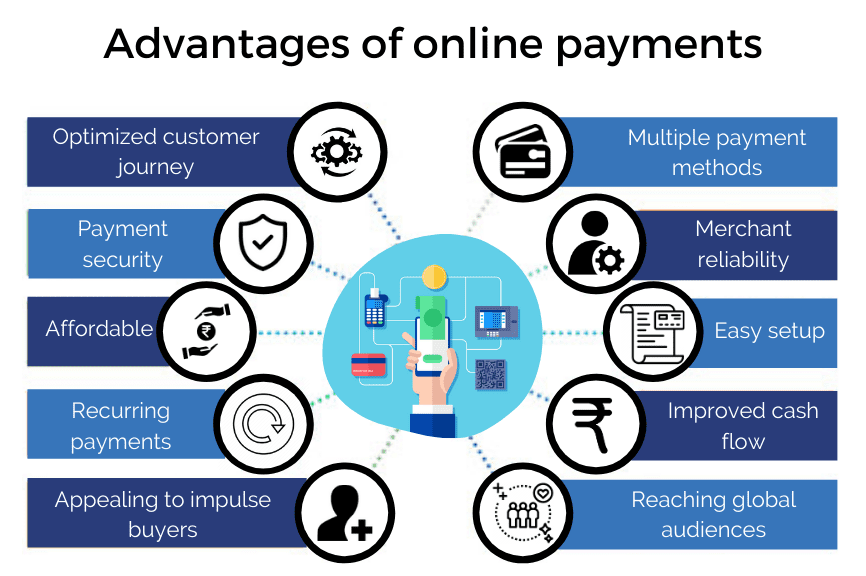

Advantages of Using Payment Link Providers

Streamlined Transactions

Discover how streamline the process, reducing the complexities associated with traditional methods.

Enhanced Security Measures

Explore the advanced security features implemented by to safeguard sensitive financial information and build trust among users.

Customization Options

Learn about the flexibility offered by , allowing users to customizeto align with their branding and preferences.

Real-Time Tracking and Notifications

Highlighting the real-time tracking capabilities of payment links, this section emphasizes the importance of instant notifications for both payers and recipients.

Choosing the Right Payment Link Provider

Factors to Consider

Guiding users through the decision-making process, outline essential factors such as fees, user interface, integration capabilities, and customer support when selecting a payment link provider.

Popular Payment Link Providers in the Market

Highlight [1]a few of the leading , providing a brief overview of their features, benefits, and user reviews.

Integration with E-Commerce Platforms

Simplifying Online Sales

Explore how seamlessly integrate with e-commerce[2] platforms, making it easier for businesses to accept online.

Improving Customer Experience

Discuss the impact of integrating payment links [3]on the overall customer experience, emphasizing the importance of a smooth and efficient payment process.

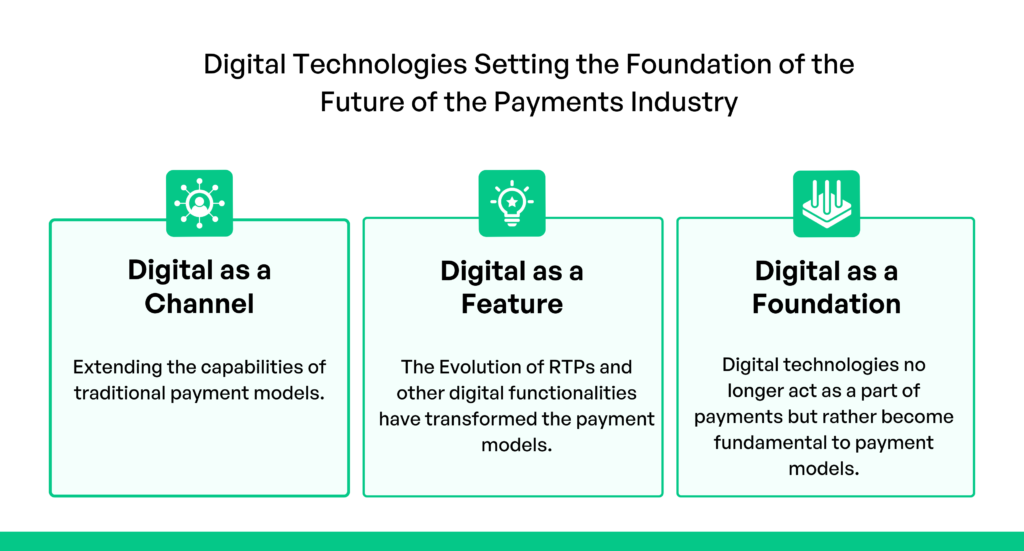

Future Trends in Payment Link Technology

Blockchain Integration

Speculate on the potential integration of blockchain [4]technology by , offering increased transparency and security.

Artificial Intelligence Enhancements

Explore how artificial intelligence could enhance the functionality of payment links, predicting payer behavior and optimizing the payment process[5].

Conclusion

As we navigate the ever-evolving landscape of digital transactions, stand as pioneers in simplifying financial interactions. Their user-friendly approach, coupled with advanced features, makes them indispensable in the modern era of commerce.

FAQs

1. Are payment link transactions secure?

Absolutely. Payment link providers employ robust security measures, ensuring the safety of your financial information during transactions.

2. Can I use payment links for international transactions?

Yes, many payment link providers support international transactions, making cross-border payments more accessible.

3. How do I know which payment link provider is right for my business?

Consider factors such as fees, user interface, and integration capabilities. Read user reviews and choose a provider that aligns with your specific needs.

4. Can payment links be used for recurring payments?

Some payment link providers offer features for recurring payments, making them suitable for subscription-based businesses.

5. What should I do if I encounter issues with a payment link transaction?

Contact the customer support of your chosen payment link provider. They are equipped to assist you with any issues you may encounter.