AUTHOR : ADINA XAVIER

DATE : 14/09/2023

In today’s fast-paced digital economy, businesses of all sizes are increasingly turning to e-commerce[1] as a means of expanding their customer base also revenue streams. However, for some enterprises, especially those in industries deemed high risk[2], obtaining payment processing services can be a daunting challenge. This article will explore the world of high risk merchant account services[3], shedding light on what they are, why they matter, also how to navigate the intricate landscape.

Introduction

In the world of online commerce[4], accepting credit card payments is a necessity. However, for businesses operating in high risk industries[5], this seemingly simple task can become a significant roadblock. High risk merchant account services are designed to bridge this gap, allowing these businesses to process payments securely also efficiently.

Understanding High Risk Merchant Accounts

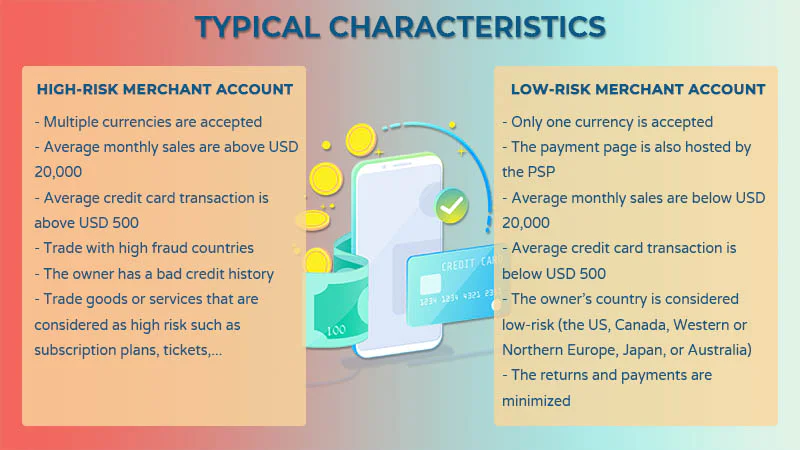

A high risk merchant account is a specialized type of financial account that enables businesses in industries with elevated levels of risk to accept credit card payments. These accounts are tailored to the unique needs also challenges that high risk businesses face.

Why Businesses Need High Risk Merchant Accounts

High risk businesses often find themselves labeled as such due to factors like a higher likelihood of chargebacks, legal restrictions, or reputational concerns. Without access to high risk merchant accounts, they may be unable to accept electronic payments, limiting their growth potential.

Common Industries Considered High Risk

4.1. Online Gambling and Casinos

The online gambling[1] industry is one of the most prominent high risk sectors. Due to the nature of the business, including regulatory scrutiny and potential for fraud, reliable payment processing is crucial.

4.2. Adult Entertainment

Adult entertainment businesses face unique challenges when it comes to payment processing. High risk merchant accounts provide a lifeline for these companies to accept payments discreetly and securely.

4.3. Pharmaceuticals

Pharmaceutical companies, particularly those selling controlled substances or prescription drugs online, often fall into the high risk category. Merchant accounts for such businesses must adhere to strict regulations.

Challenges Faced by High Risk Businesses

High risk businesses encounter a multitude of challenges, including higher processing fees, increased scrutiny, and a greater likelihood of account freezes. Understanding these challenges is key to navigating the world of high risk merchant accounts[2] effectively.

Locating a High Risk Merchant Account Service Provider

Finding the right provider is crucial. Research and due diligence are essential to ensure you partner with a reputable company that understands your industry’s specific needs.

Key Features to Look for in a Provider

When selecting a high risk merchant account provider, look for features such as robust fraud prevention measures, excellent customer support, and competitive pricing. These factors can make or break your payment processing experience.

Application and Approval Process

The application process for a high risk merchant account can be more extensive than that of a standard account. Understanding what to expect and preparing accordingly can streamline the approval process.

Costs Associated with High Risk Merchant Accounts

High-risk merchant accounts often involve increased charges when contrasted with regular accounts.”It’s crucial to comprehend these expenses and incorporate them into your financial planning[3].

Security and Fraud Prevention

Security is paramount in high risk industries. Explore the security measures offered by your chosen provider to protect your business also your customers.

Benefits of High Risk Merchant Account Services

Despite the challenges, high risk merchant account services offer numerous benefits, including access to a wider customer base, increased revenue, and protection against fraud.

Alternatives to High Risk Merchant Accounts

In some cases, alternative payment processing[4] solutions may be viable options. Explore these alternatives to determine if they are a better fit for your business.

Tips for Successful High Risk Merchant Account Management

Managing a high risk merchant account[5] requires diligence and proactive measures. Learn how to keep your account in good standing also avoid common pitfalls.

Case Studies: Success Stories

Explore real-world examples of businesses that successfully navigated the high risk merchant account landscape also thrived in their respective industries.

Conclusion

High risk merchant account services are a lifeline for businesses operating in industries with elevated levels of risk. By understanding their unique needs, finding the right provider, and taking proactive steps to manage their accounts effectively, these businesses can unlock new opportunities for growth and financial success.

FAQs

- What is a high risk merchant account?

- A high risk merchant account is a specialized financial account that allows businesses in high risk industries to accept credit card payments securely.

- How do I find the right high risk merchant account provider?

- Research and compare providers, focusing on their experience in your industry, security measures, and pricing.

- What are the common challenges faced by high risk businesses?

- High risk businesses often deal with higher processing fees, increased scrutiny, and a greater likelihood of account freezes.

- Are there alternatives to high risk merchant accounts?

- Yes, some businesses may consider alternative payment processing solutions, depending on their specific needs and circumstances.

- How can I ensure the security of my high risk merchant account?

- Choose a provider with robust fraud prevention measures and stay vigilant against potential security threats.