AUTHOR : KHOKHO

DATE : 07/12/2023

Introduction

As the digital landscape evolves, more businesses are relying on online payment processors[1] to streamline and secure their transaction processes. Certain industries are classified as “high-risk” because of the inherent risks associated with their products, services, or business models. High-risk online payment[2] processors cater specifically to businesses that operate in these sectors. In this guide, we will delve into what a high-risk payment processor is, how it works, the industries that need them, and the challenges involved.

What Is a High-Risk Online Payment Processor?

A high-risk online payment processor is a financial service[3] provider that specializes in offering payment solutions for businesses in high-risk industries. These businesses may face elevated chargeback rates, fraud, legal scrutiny, or regulatory challenges, making them harder to serve by traditional payment processors[4].

Why Are Some Businesses Considered High-Risk?

Certain industries are classified as high-risk due to a combination of factors, such as the nature of their products, their target market, and the frequency of chargebacks or fraud associated with their transactions. Some common traits of high-risk industries include:

- High chargeback rates: Industries with frequent disputes between consumers and merchants[5] are more prone to chargebacks.

- Regulatory scrutiny: Some industries, like gambling or cannabis, face tighter legal restrictions and require more stringent regulatory compliance.

- Fraudulent activity: Sectors with higher instances of online fraud and identity theft may be considered high-risk.

Industries That Require High-Risk Payment Processors

Several industries and business types typically require high-risk online payment processors. These industries face unique challenges that make traditional payment processors unwilling or unable to support them.

1. Adult Entertainment

Businesses in the adult entertainment sector face high chargeback rates, making them high-risk merchants. Many payment processors avoid these businesses due to concerns about fraud and regulatory issues.

2. Online Gambling and Gaming

Online casinos, sports betting platforms, and other gaming-related businesses are considered high-risk due to legal and regulatory challenges, fluctuating customer behavior, and high chargeback rates.

3. E-cigarettes and Vaping Products

The vaping industry is growing rapidly, but it faces significant challenges such as frequent chargebacks, regulatory uncertainties, and concerns about the age of customers.

How Does a High-Risk Payment Processor Work?

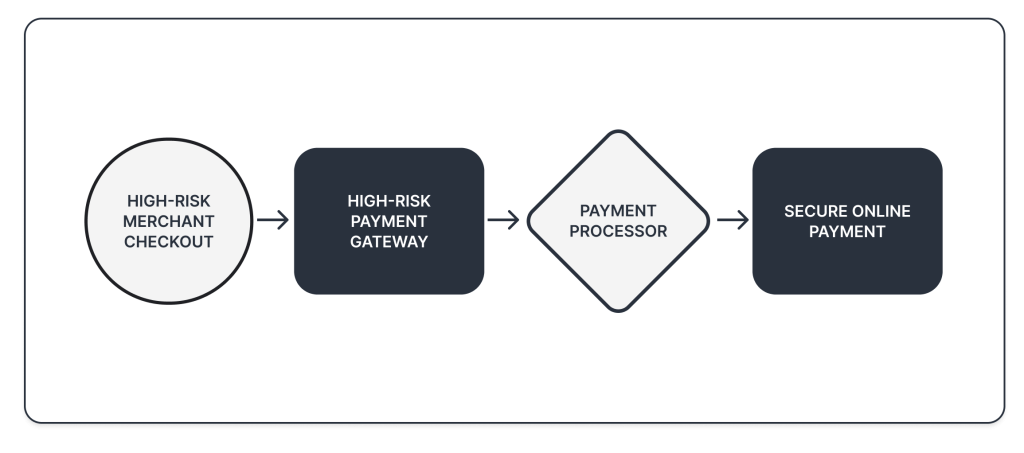

A high-risk payment processor works by offering specialized tools and support for businesses that fall into high-risk categories. Here are the steps involved in how they work:

1. Merchant Account Setup

To start processing online payments, a high-risk business needs to establish a merchant account specifically designed to handle their unique transaction needs. This account allows businesses to process card payments and receive funds from customers. High-risk processors typically provide accounts with higher transaction fees to compensate for the increased risk.

2. Payment Gateway Integration

The payment gateway is the platform that processes customer payments, verifying and authorizing the transactions. For high-risk businesses, the gateway will have additional fraud detection tools to minimize chargebacks and fraudulent transactions.

3. Risk Monitoring and Fraud Prevention

High-risk processors employ enhanced security measures to monitor transactions and identify potential fraud. This may include machine learning algorithms, manual reviews, and multi-layered fraud prevention techniques.

Benefits of Using a High-Risk Payment Processor

Despite the hurdles, leveraging a high-risk online payment processor provides numerous advantages for companies in high-risk sectors.

- Secure Transactions: High-risk processors offer robust fraud prevention and chargeback mitigation strategies.

- Industry-Specific Support: These processors understand the unique challenges of high-risk sectors and provide tailored services to meet those needs.

- Higher Approval Rates: Businesses in high-risk industries are more likely to have their payment processing applications approved by high-risk providers.

- Regulatory Compliance: High-risk processors ensure that businesses comply with the regulations and legal requirements governing their industries.

Challenges of High-Risk Payment Processing

While there are benefits, high-risk payment processors come with their own set of challenges:

1. Higher Fees

Because of the increased likelihood of fraud, chargebacks, and regulatory challenges, high-risk payment processors typically impose higher transaction fees to offset these risks.

2. Account Holds and Freezes

Payment processors may place holds or freezes on accounts with higher-than-usual chargeback rates, requiring businesses to maintain a reserve fund to cover potential losses.

3. Limited Payment Options

Some high-risk processors may restrict certain payment methods or limit the geographic regions they support due to the nature of the industry.

Conclusion

High-risk online payment processors are vital for businesses operating in sectors that face unique challenges, such as increased fraud, chargebacks, or regulatory scrutiny. These processors provide the necessary tools to ensure secure transactions and compliance with legal requirements. However, businesses must weigh the higher fees and potential account holds that come with using these specialized services.

FAQ

1.How do high-risk payment processors differ from low-risk payment processors in terms of services and fees?

A low-risk payment processor serves businesses in industries with low chargeback rates and minimal fraud risk, such as retail or SaaS. In contrast, high-risk processors specialize in industries with high chargeback rates, fraud concerns, or regulatory issues.

2. Can a high-risk business ever get a traditional payment processor?

It’s possible but challenging. Most conventional payment processors steer clear of high-risk industries because of the heightened chances of chargebacks and fraudulent activity. However, some may be willing to work with high-risk businesses if they demonstrate strong fraud prevention strategies and business practices.

3. How can I reduce my chargeback rates?

To minimize chargebacks, businesses should provide clear billing descriptions, offer excellent customer service, and have a transparent refund policy. Working with a high-risk processor that offers chargeback management tools can also help.

4. Are high-risk payment processors safe?

Yes, high-risk payment processors implement advanced security features to protect both businesses and customers from fraud. This includes encryption, multi-factor authentication, and fraud detection systems.

5. Can I switch from a high-risk processor to a traditional processor?

Switching to a traditional processor is possible, but it’s often difficult for high-risk businesses. They may need to prove their chargeback and fraud rates are under control, which could take time.