AUTHOR : KHOKHO

DATE : 29/11/2023

Introduction

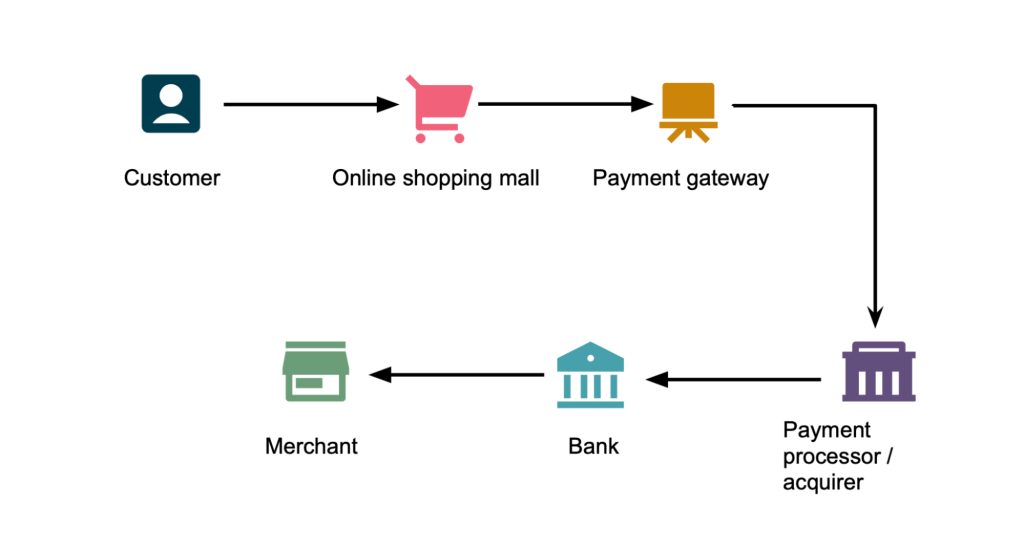

In the digital age, the significance of payment processors[1] cannot be overstated. These entities act as intermediaries, facilitating secure and also swift online transactions. As Australia witnesses a surge in e-commerce and digital transactions, understanding the landscape of payment processors becomes crucial for businesses and also consumers alike.

Types of Payment Processors in Australia

Payment processors can be broadly categorized into traditional and also digital entities[2]. Traditional processors involve banks and also financial institutions, Exploring these categories helps in grasping the diversity in the market. while digital processors leverage technology to streamline[3] transactions.

Popular Payment Processors

Australia boasts a diverse range of payment processors[4], each with its unique features and also advantages. From industry giants to emerging players, businesses need to make informed choices based on factors like transaction fees, user experience, and also compatibility.

Security Measures in Payment Processing

The security of online transactions[5] is paramount. This section will shed light on the measures implemented by payment processors to ensure the confidentiality and also integrity of user data. Understanding these protocols aids in instilling trust among users.

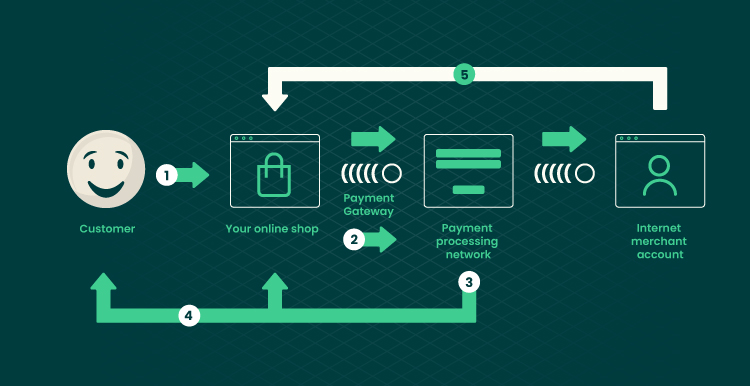

Integration of Payment Processors for Businesses

Selecting and also integrating a suitable payment processor is a critical decision for businesses. Whether you’re a small startup or an established enterprise, the process involves considerations such as scalability, customer support, and also compliance.

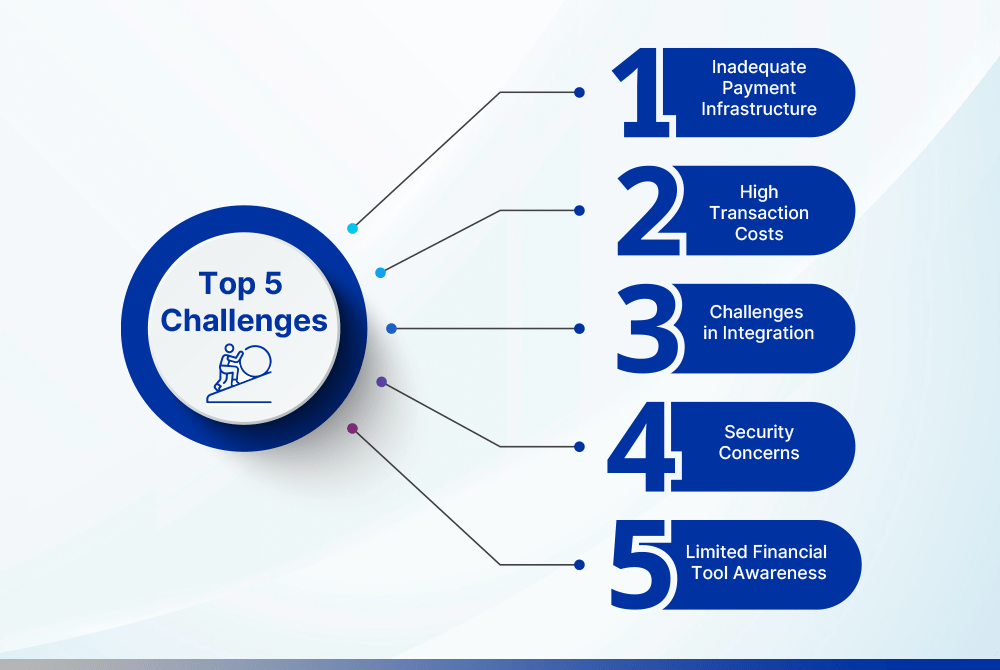

Challenges in Payment Processing

Despite their integral role, payment processors face challenges such as fraud, system glitches, and also regulatory changes. Exploring these challenges provides insights into the industry’s resilience and also adaptability.

Regulatory Environment in Australia

Australia has stringent regulations governing financial transactions. This section will navigate through the regulatory landscape, emphasizing the importance of compliance for both businesses and also payment processors.

Advancements in Payment Processing Technology

Innovation continues to shape the payment processing industry. From blockchain to contactless payments, this section explores the technological advancements influencing the user experience and also the efficiency of transactions.

Consumer Perspectives on Payment Processors

What do consumers look for in a payment processor? This part of the article dives into consumer feedback and also preferences, offering valuable insights for businesses aiming to enhance their payment processing systems.

Mobile Payment Trends in Australia

With the rise of smartphones, mobile payments have become ubiquitous. Examining how adapt to this trend provides a glimpse into the future of financial transactions in Australia.

Case Studies: Successful Implementations

Real-world examples of businesses benefiting from effective payment processor integration showcase the practical implications of choosing the right platform. Learning from these case studies helps businesses make informed decisions.

Future Outlook of Payment Processing in Australia

The final stretch of our journey explores the future of payment processors. Predictions and also emerging trends offer a glimpse into the potential innovations and also disruptions awaiting the industry.

Emerging Technologies and Their Impact

As we navigate the complex world of payment processors, it’s crucial to stay attuned to the pulse of emerging technologies. Innovations such as blockchain and also artificial intelligence (AI) are poised to revolutionize the payment processing landscape in Australia.

Blockchain: Transforming Security and Transparency

Blockchain, the technology behind cryptocurrencies like Bitcoin, is making waves in the payment processing industry. Its decentralized and also tamper-resistant nature enhances security, reducing the risk of fraud and unauthorized access. Additionally, the transparency offered by blockchain ensures a trustworthy and also accountable transaction environment.

Artificial Intelligence: Enhancing User Experience

Artificial Intelligence has permeated various industries, and also payment processing is no exception. AI algorithms analyze user behavior, detect anomalies, and enhance fraud prevention. Moreover, AI-driven chatbots and also virtual assistants streamline customer support, providing users with a more seamless and responsive experience.

Consumer Perspectives: The Heart of Payment Processing

Understanding the needs and preferences of consumers is paramount for any business, and payment processors are no exception. As we delve deeper into this aspect, we’ll explore how user feedback and reviews shape the reputation and success of payment processors in Australia.

Reviews and Ratings: The Power of Public Opinion

In an era of online reviews and instant feedback, consumers hold the power to shape the narrative around payment processors. Positive reviews not only boost the credibility of a processor but also influence the choices of potential users. Conversely, negative reviews can be detrimental, highlighting issues that need attention.

Factors Influencing Consumer Choices

What factors do consumers consider when selecting a payment processor? This section explores the elements that weigh on the minds of users, from transaction speed and reliability to the simplicity of the user interface. By understanding these factors, payment processors can tailor their services to meet consumer expectations.

Mobile Payment Trends: A Paradigm Shift

With the widespread use of smartphones, mobile payments have become a dominant force in the financial sector. In this section, we’ll uncover the trends and shifts in consumer behavior, shedding light on how payment processors are adapting to the mobile-centric landscape of Australia.

Conclusion

In conclusion, the landscape of payment processors in Australia is dynamic and multifaceted. Choosing the right processor involves careful consideration of factors such as security, user experience, and regulatory compliance. As technology continues to evolve, so too will the realm of payment processing.

FAQs

How do I choose the right payment processor for my business?

Consider factors such as transaction fees, scalability, and customer support. Customize your decision based on the unique requirements of your business.

What security measures should I look for in a payment processor?

Look for processors that implement encryption, tokenization, and other advanced security protocols to protect user data.

How do mobile payment trends impact the choice of payment processors?

Mobile payment trends necessitate processors to offer seamless and secure mobile transaction options for enhanced user convenience.

Are there any upcoming technologies that will revolutionize payment processing?

Emerging technologies like blockchain and artificial intelligence are expected to bring about significant changes in the payment processing landscape.

What regulatory considerations are important for businesses using payment processors in Australia?

Ensure compliance with relevant financial regulations and standards to avoid legal issues and maintain trust with customers.