AUTHOR : RIVA BLACKLEY

DATE : 23/11/2023

Introduction

In the vast landscape of finance and commerce, the role of payment providers [1]in Australia cannot be overstated. As technology[2] continues to reshape the way we conduct transactions, understanding the dynamics of payment methods[3] and their providers becomes crucial for businesses and consumers alike.

Evolution of Payment Methods

Australia has come a long way from traditional cash transactions. In the early days, physical currency ruled the market. However, with the advent of the digital age[4], the landscape shifted dramatically. The convenience and efficiency of digital payments have become the norm, with a myriad of payment providers[5] offering innovative solutions.

Key Features of Payment Providers

One of the primary reasons for the widespread adoption of payment providers is their commitment to security, ensuring that transactions are protected from potential threats. Moreover, the speed at which these transactions occur and the accessibility of services contribute to their popularity.

Popular Payment Providers in Australia

In the diverse market of payment providers, several stand out in Australia.

Each provider boasts distinctive attributes, tailored to meet diverse requirements. From established giants to agile startups, the competition is fierce, driving continuous improvements in services.

Impact on Businesses

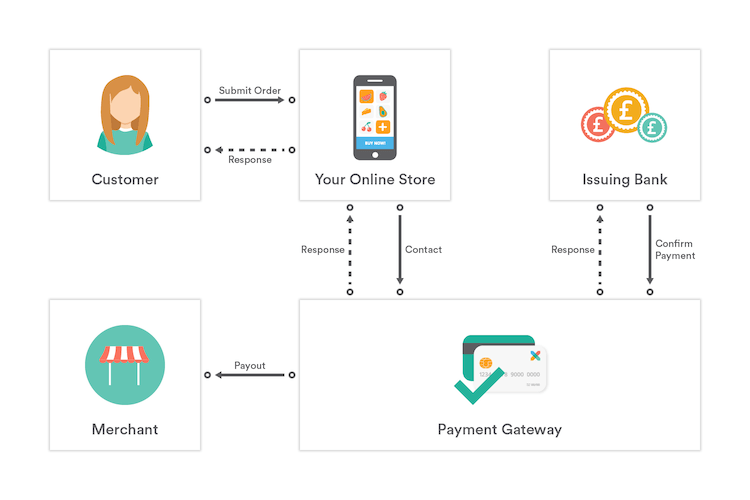

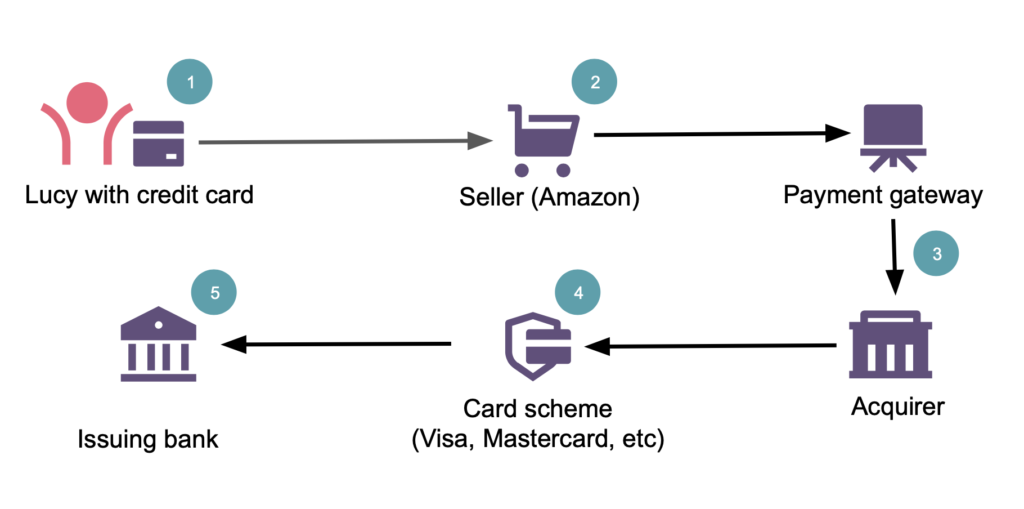

For businesses, integrating with payment providers is more than a convenience; it’s a necessity. E-commerce[1], in particular, has seen significant growth due to seamless payment solutions. The integration of payment gateways with business platforms has streamlined transactions, offering a better experience for both businesses and customers.

Consumer Perspectives

Understanding the preferences of Australian consumers is vital for payment providers. Factors like convenience, loyalty programs, and security influence the choices consumers make. Providers that align with these preferences tend to attract a more extensive user base.

Regulatory Landscape

In a digital age where financial transactions occur at the speed of light, regulations play a crucial role. Payment providers must adhere to strict guidelines, ensuring the safety and legality of transactions. This section explores the regulatory landscape governing payment providers in Australia.

Innovations in Payment Technology

The payment[2] industry is dynamic, with continuous innovations shaping its trajectory. From contactless payments to cryptocurrency integration, the landscape is evolving rapidly. Understanding these trends is essential for businesses aiming to stay ahead of the curve.

Challenges Faced by Payment Providers

While payment providers offer incredible convenience, they are not without challenges. Security[3] concerns, occasional technical glitches, and downtime pose potential risks. This section sheds light on the challenges faced by payment providers and how they address these issues.

Comparison with Global Payment Trends

Australia is not isolated from global trends in the payment industry. This section compares the payment landscape in Australia with global trends, highlighting the country’s alignment with international standards.

Choosing the Right Payment Provider

For businesses, choosing the right payment provider is a critical decision. Factors such as transaction[4] fees, security features, and integration capabilities need careful consideration. Case studies of successful implementations provide practical insights for businesses navigating this decision-making process.

Costs Associated with Payment Providers

While transparency in fee structures is essential, businesses must also be aware of hidden costs associated with payment providers. This section breaks down the costs businesses might encounter and offers guidance on managing them effectively.

Customer Support and Service

Customer support is often overlooked but plays a pivotal[5] role in the user experience. Reliable and responsive customer support contributes to a positive relationship between users and payment providers. Real-world user experiences and reviews provide valuable insights.

Case Studies

Examining real-world examples of businesses successfully leveraging payment providers offers inspiration and practical insights. From startups to established enterprises, these case studies showcase the diverse applications and benefits of integrating with payment providers.

Innovations in Payment Technology

As we gaze into the future, the payment industry continues to be a hotbed of innovation. Contactless payments, once considered cutting-edge, have become commonplace. Moreover, the integration of cryptocurrencies into payment solutions is gaining momentum, opening up new possibilities for both consumers and businesses. Keeping a finger on the pulse of these innovations is crucial for staying relevant in the ever-evolving landscape of payment technology.

Challenges Faced by Payment Providers

While the benefits of digital payments are undeniable, it’s essential to acknowledge the challenges faced by payment providers. Security concerns, although addressed with robust measures, remain a top priority. The occasional technical glitch or downtime can disrupt services, highlighting the need for continuous improvement and quick issue resolution.

Conclusion

In conclusion, the dynamic landscape of payment providers in Australia reflects the ever-changing nature of the financial and technological sectors. The seamless integration of digital payment methods into daily life has reshaped how businesses operate and how consumers transact.

FAQs

- How do payment providers ensure the security of transactions?

- Explore the robust security measures implemented by payment providers to safeguard transactions.

- What factors should businesses consider when choosing a payment provider?

- Discover the key considerations businesses should keep in mind when selecting a payment provider.

- Are there hidden costs associated with payment providers?

- Uncover potential hidden costs that businesses should be aware of when using payment providers.

- How do payment providers address technical glitches and downtime?

- Learn about the strategies payment providers employ to tackle technical challenges and minimize downtime.

- What role does customer support play in the payment industry?

- Understand the significance of customer support in ensuring a positive user experience with payment providers.