AUTHOR : SELENA GIL

DATE : 4/11/2023

Introduction

Payment merchants[1], also known as payment service providers[2] (PSPs), are entities that facilitate electronic transactions between customers[3] and businesses. They enable businesses[4] to accept payments[5] through various means, offering convenience and security. In the UK, payment merchants are an integral part of the financial ecosystem.

The Importance of Payment Merchants for Businesses

For businesses in the UK, payment merchants are more than just a means of receiving payments. They are vital for expanding customer reach, improving cash flow, and ensuring the security of financial transactions. Payment merchants serve as a bridge between businesses and their customers, making it easier for them to make purchases and transactions.

Types of Payment Merchants in the UK

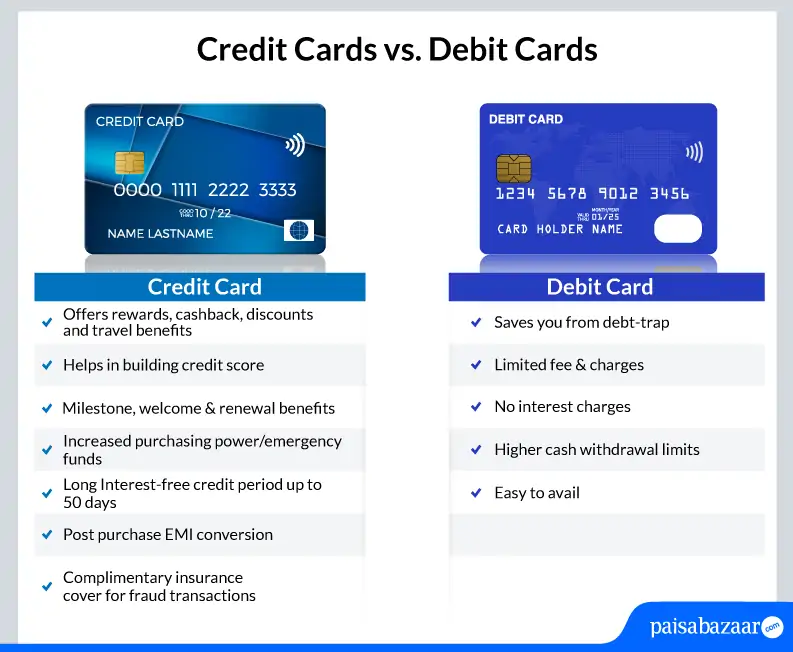

Credit and Debit Card Payments

Traditional payment merchants in the UK have long facilitated credit and debit card payments. These transactions are commonplace in both physical retail and online businesses.

Bank Transfers

Bank transfers are another traditional method of payment. Although they are less common in e-commerce, they remain a preferred choice for certain high-value transactions.

The Rise of Digital Payment Solutions

Mobile Wallets

Digital payment solutions have surged in popularity in recent years. Mobile wallets, such as Apple Pay and Google Pay, allow customers to make contactless payments using their smartphones.

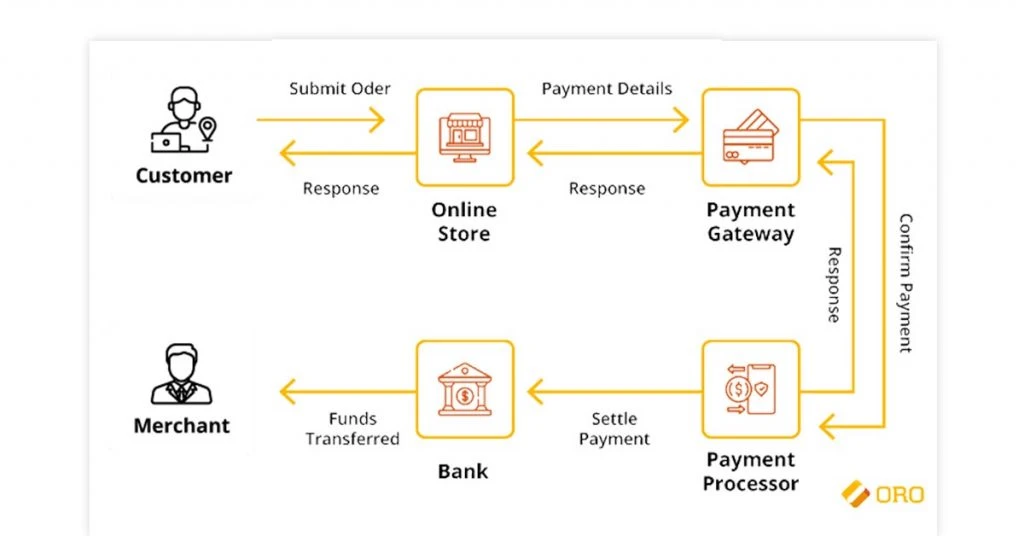

Online Payment Gateways

Online payment gateways, like Stripe and Skrill, enable secure online transactions. They are particularly valuable for e-commerce businesses looking to expand their reach.

Choosing the Right Payment Merchant for Your Business

Selecting the right payment merchant is crucial for any business. Considerations for selection include:

Transaction Fees

Different payment merchants may have varying fee structures. It’s important to choose one that aligns with your business’s financial goals.

Security Features

Security is paramount in online transactions. Ensure that your chosen payment merchant provides robust security features to protect both your business and your customers.

Integration Options

The ease of integrating a payment merchant into your business processes is a key factor. Some payment merchants offer user-friendly APIs and plugins for various platforms.

Key Players in the UK Payment Merchant Market

In the UK, several companies dominate the payment merchant market. These include:

PayPal

PayPal is a globally recognized payment merchant, providing versatile solutions for businesses and consumers. “It has gained recognition for its easily navigable interface and robust security protocols.”.

Worldpay

Worldpay is a significant player in the UK market,[1] offering a wide range of payment solutions. It is trusted by businesses of all sizes.

Square

Square is renowned for its innovative payment solutions,[2] including mobile point-of-sale systems. It caters to businesses with unique needs, such as food trucks and market stalls.

The Impact of Payment Merchants on E-commerce

E-commerce has witnessed exponential growth, and payment merchants have played a vital role in this expansion. They have made online shopping convenient, safe, and accessible, leading to increased consumer confidence in making digital purchases.

How Payment Merchants Benefit Customers

Customers also benefit from payment merchants[3] through the ease of making payments, whether through debit or credit cards, mobile wallets, or other digital payment methods. The quick and secure nature of these transactions enhances their overall shopping experience.

Challenges Faced by Payment Merchants

Payment merchants encounter challenges such as fraud prevention, regulatory compliance, and adapting to evolving technology. Staying ahead of these challenges is crucial for their continued success.

The Regulatory Landscape for Payment Merchants in the UK

Payment merchants[4] operate under a regulatory framework designed to safeguard the interests of businesses and consumers. Compliance and regulations ensure transparency and accountability.

PSD2 and SCA

The revised Payment Services Directive (PSD2) and Strong Customer Authentication (SCA) regulations are key aspects of the legal framework[5]. They aim to enhance the security of electronic payments and protect consumers.

The Future of Payment Merchants

As technology continues to advance, the payment merchant industry will evolve. Innovations in payment methods, security measures, and customer experiences are on the horizon, promising an exciting future for businesses and consumers alike.

Conclusion

Payment merchants are the unsung heroes of the modern business world in the UK. They have revolutionized the way transactions occur, ensuring efficiency and security. As businesses and consumers continue to embrace digital transactions, payment merchants will remain at the forefront of this financial, evolution.

FAQs

1. What are payment merchants, and why are they important for businesses in the UK?

Payment merchants are entities that facilitate electronic transactions between customers and businesses, ensuring smooth financial transactions. They are essential for expanding customer reach, improving cash flow, and ensuring transaction security.

2. What types of payment merchants are available in the UK?

Payment merchants in the UK include traditional methods like credit and debit card payments and bank transfers, as well as digital solutions like mobile wallets and online payment gateways.

3. How do I choose the right payment merchant for my business in the UK?

Selecting the right payment merchant involves considering factors such as transactionfees, security features, and integration options that align with your business goals.

4. What is the regulatory landscape for payment merchants in the UK?

Payment merchants in the UK operate under a regulatory framework, including the revised Payment Services Directive (PSD2) and Strong Customer Authentication (SCA) regulations, aimed at enhancing security and protecting consumers.

5. What does the future hold for payment merchants in the UK?

The future of payment merchants is promising, with continuous advancements in technology, security, and customer experiences on the horizon, ensuring a dynamic and secure financial ecosystem.