AUTHOR : RIVA BLACKLEY

DATE : 04-11-23

Introduction

payment gateway method[1] In an age where e-commerce and digital transactions have become the norm, the need for reliable payment[2] gateway methods has never been greater. Payment gateways[3] act as the digital bridge connecting your business or website to your customers, ensuring that financial transactions occur seamlessly and securely.

Understanding Payment Gateways

What Is a Payment Gateway?

A payment gateway[4] is a technology that facilitates the online transfer of funds between a buyer and a seller. It plays a pivotal role in authorizing and processing transactions[5], encrypting sensitive data, and ensuring that the funds reach the intended recipient.

How Do Payment Gateways Work?

Payment gateways operate by securely transmitting transaction data between a website, the payment processor, and the bank. They verify the authenticity of transactions, ensuring that the customer’s payment information is accurate and that funds are available.

The Importance of Payment Gateway Methods

Security and Encryption

One of the primary functions of payment gateways is to provide robust security and encryption. They safeguard customer data, preventing it from falling into the wrong hands.

Convenience and Accessibility

Payment gateways enhance the convenience and accessibility of online transactions, allowing customers to pay with their preferred method, be it credit cards, digital wallets, or bank transfers.

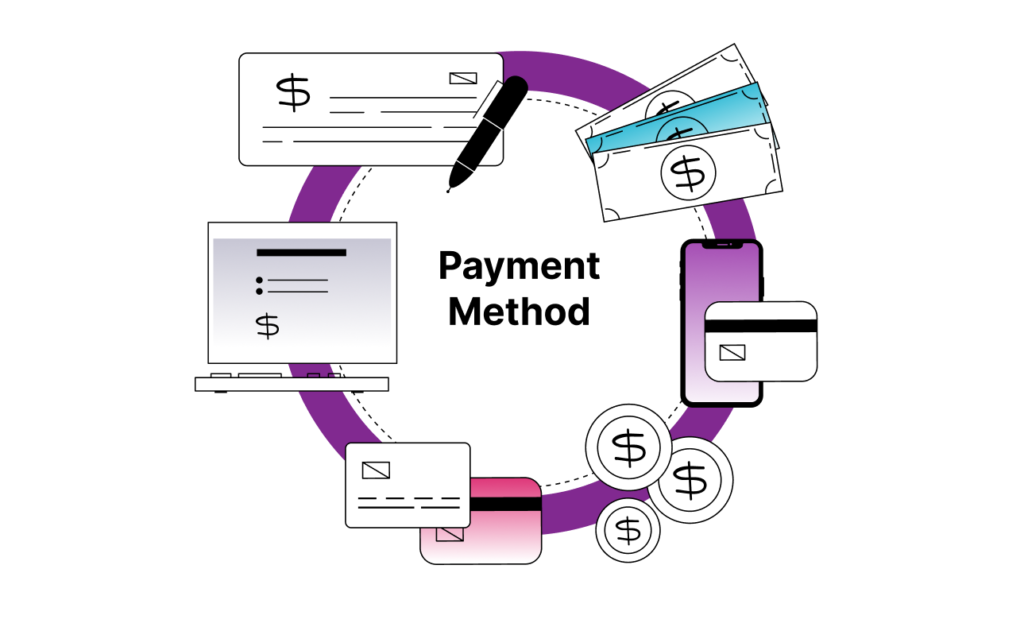

Types of Payment Gateway Methods

Payment gateways come in various forms to cater to different preferences and needs. Let’s explore the most common types:

Credit Card Payment Gateways

These gateways are designed to process credit card transactions securely and quickly, making them suitable for most businesses.

Digital Wallets

Digital wallets like Apple Pay and Google Wallet allow customers to store their payment information securely and make swift, contactless payments.

Bank Transfers

Bank transfer gateways enable direct funds transfer from the customer’s bank account to the seller’s account, offering an alternative to credit cards.

Cryptocurrency Payments

As the popularity of cryptocurrencies grows, some businesses are now accepting digital currencies as a payment option through specialized gateways.

How to Choose the Right Payment Gateway

Choosing the appropriate payment gateway is of paramount importance for the success and efficiency of your business.

Consider factors such as transaction fees, security measures, and the compatibility of the gateway with your website.

Popular Payment Gateway Providers

Several established payment gateway providers offer reliable services.

PayPal

PayPal is known for its global reach and user-friendly interface, making it a top choice for small and large businesses alike.

Stripe

Stripe provides a developer-friendly gateway with extensive customization options and robust security features.

Square

Payment gateway Method Square offers a seamless payment experience and is ideal for small businesses, restaurants, and retail stores.

Authorize.Net

Authorize.Net is a well-established gateway known for its reliability and broad compatibility.

Setting Up a Payment Gateway

If you’re considering integrating a payment gateway into your website, follow this step-by-step guide to ensure a smooth setup.

Challenges and Security Concerns

Payment gateways face challenges in terms of data security and fraud prevention. Learn about the common issues and how to address them effectively.

Benefits of Mobile Payment Gateways

The rise of mobile e-commerce has brought mobile payment gateways to the forefront. Explore the trends and advantages of mobile wallets.

The Future of Payment Gateway Methods

As technology advances and consumer preferences evolve, payment gateway methods are poised for significant changes. Discover what the future may hold.

Benefits of Mobile Payment Gateways

Payment Mateway Method With the increasing prevalence of smartphones, mobile payment gateways have gained immense popularity. These gateways offer a range of advantages that cater to the evolving needs of consumers in the digital age.

Mobile commerce, often referred to as m-commerce, is on the rise. Shoppers now have the convenience of making purchases on their mobile devices from virtually anywhere. Mobile payment gateways play a pivotal role in facilitating these transactions and offer several benefits:

- Convenience: Mobile payment gateways enable customers to make purchases on the go. Whether you’re in a coffee shop, on public transportation, or simply at home, your mobile device can serve as your wallet.

- Contactless Payments: Many mobile wallets, such as Apple Pay and Google Wallet, support contactless payments. This means you can complete a transaction without physically swiping a card or handling cash, reducing the risk of contamination.

- Security: Mobile payment gateways utilize advanced security features like biometric authentication (such as fingerprint or facial recognition) and tokenization. These measures ensure that your payment information remains safe and private.

- Digital Receipts: Mobile payments often come with the added benefit of digital receipts. This allows you to easily track your spending, making it simpler to manage your finances.

- ** loyalty Programs:** Some mobile payment gateway methods offer integration with loyalty and rewards programs. This means you can accumulate points or discounts with every purchase, encouraging customer loyalty.

- Integration with Apps: Many businesses and retailers have their own mobile apps, which are frequently integrated with popular mobile payment gateways. This simplifies the purchasing process and enhances the user experience.

Conclusion

In a world driven by digital transactions, the role of payment gateway methods cannot be understated. They provide security, accessibility, and convenience, ensuring that online commerce continues to thrive.

FAQs

1. Is it safe to utilize payment gateways for online transactions?

Yes, payment gateways prioritize security and use encryption to protect customer data, making them safe for online transactions

2. Is it possible to incorporate several payment gateways on my website?

Yes, it’s possible to integrate multiple payment gateways to offer customers various payment options.

3. What fees are associated with using payment gateways?

Fees vary depending on the payment gateway provider and the type of transaction. It’s crucial to thoroughly examine the stipulations and policies of your selected service provider.

4. Are mobile payment gateways as secure as traditional ones?

Mobile payment gateways use advanced security features, making them just as secure as traditional gateways.

5. How can I stay updated on the latest developments in payment gateway technology?

To stay informed about the latest advancements, follow industry news and consider joining forums or associations related to payment gateway technology.