AUTHOR: HELLY KHAN

DATE: 02-11-2023

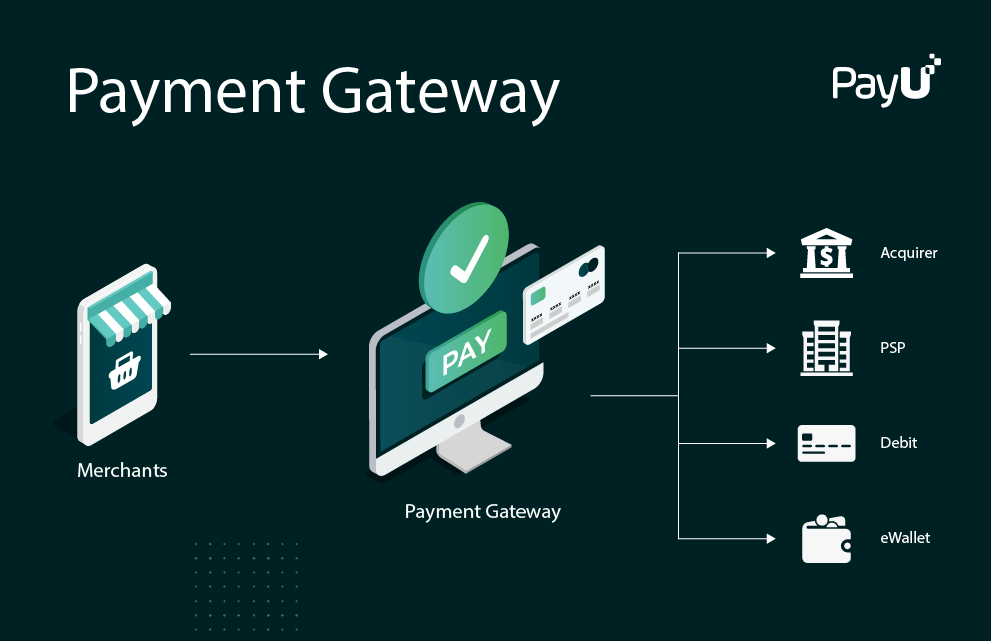

In the digital era, businesses are increasingly adopting online payment solutions[1] to streamline their transactions. Payment gateway platforms[2] have become the backbone of e-commerce, enabling merchants to securely accept payments from customers worldwide. This guide explores what payment gateway[3] platforms are, their significance, types, benefits, and common questions businesses ask when integrating them. These platforms act as intermediaries, securely processing payments between customers and merchants.

What Are Payment Gateway Platforms?

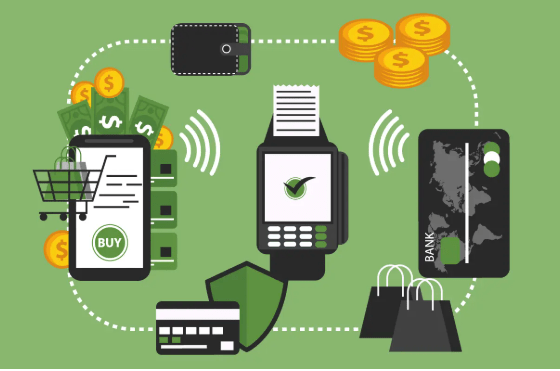

A payment gateway platform is a service that facilitates the transfer of payment information[4] between a customer, a merchant, and the bank involved in the transaction. When a customer makes an online purchase, the payment processes[5] the payment and ensures that funds are securely transferred to the merchant’s account. These platforms are essential for any online business because they act as the intermediary between the customer’s payment method (e.g., credit card, debit card, or digital wallet) and the merchant’s account.

Key Features of Payment Gateway Platforms

1. Security and Encryption

Security is one of the most crucial aspects of any online transaction. Payment gateway platforms use encryption protocols such as SSL (Secure Socket Layer) to protect sensitive customer data. These platforms also comply with PCI-DSS standards to ensure secure handling of card details.

2. Fraud Prevention

A good payment gateway platform offers robust fraud detection tools, helping to mitigate risks like chargebacks, stolen card usage, and other fraudulent activities. These tools include address verification systems (AVS) and card verification value (CVV) checks.

3. Multiple Payment Methods

Payment gateway platforms support various payment methods, including credit and debit cards, bank transfers, e-wallets (PayPal, Apple Pay, Google Pay), and even cryptocurrencies. This flexibility enables businesses to serve a wider variety of customers.

4. Global Reach

Leading payment gateway platforms provide businesses with the ability to accept international payments, often in multiple currencies. This global reach is essential for e-commerce businesses aiming to expand their customer base beyond borders.

5. Mobile Compatibility

With the rise of mobile shopping, payment gateway platforms ensure that transactions are seamless across all devices, including smartphones and tablets. Mobile-optimized payment gateways ensure smooth checkout processes for mobile users.

Types of Payment Gateway Platforms

1. Hosted Payment Gateways

Hosted payment gateways redirect customers to the payment processor’s website to complete the payment. While the customer is directed away from the merchant’s website, the payment processing itself happens securely on the third-party server.

2. Integrated Payment Gateways

Integrated payment gateways are fully embedded into the merchant’s website, offering a seamless payment experience. This type of gateway doesn’t redirect customers to another website, allowing the entire transaction process to take place within the business’s online store. Popular integrated gateways include Authorize.Net and Square.

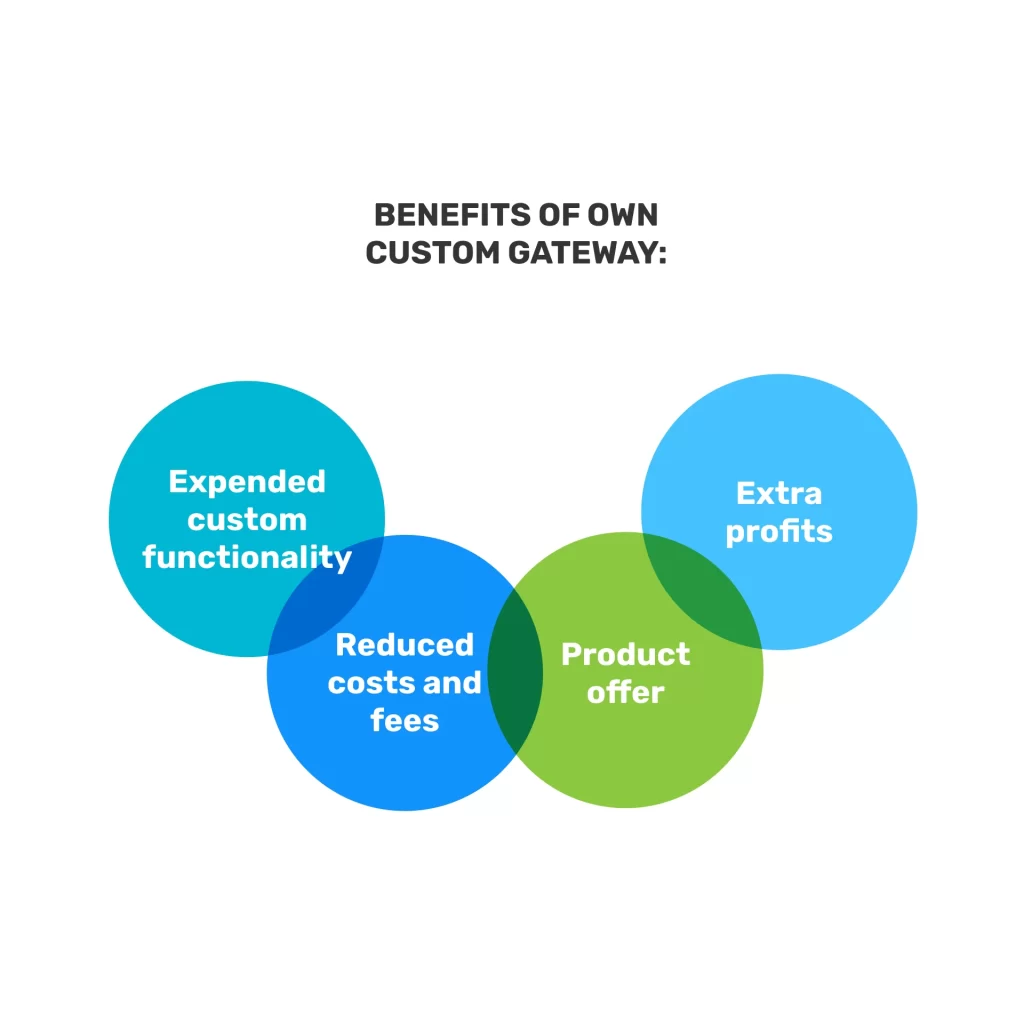

3. Self-Hosted Payment Gateways

Self-hosted payment gateways allow businesses to host their own payment processing infrastructure while still using a third-party service for the payment transaction. They offer more control over the payment process but require advanced technical expertise for setup.

4. API-Based Payment Gateways

API-based payment gateways provide businesses with the flexibility to build a fully customized payment experience using an API (Application Programming Interface). These platforms allow for deep integration into the website and other back-end systems.

Benefits of Payment Gateway Platforms

1. Improved Customer Experience

With fast and secure transactions, payment gateway platforms enhance the overall shopping experience. Customers can make payments quickly and securely, reducing cart abandonment rates and increasing conversions.

2. Increased Sales

By offering various payment methods, including credit cards, digital wallets, and even installment payments, merchants can cater to diverse customer preferences, potentially increasing sales.

3. Reduced Fraud Risks

Payment gateway platforms incorporate advanced fraud detection tools and compliance with industry standards, offering merchants protection from financial losses due to fraudulent activities.

4. Cost-Effective Solution

Using a third-party payment gateway platform eliminates the need for businesses to invest in expensive infrastructure and security systems. This cost-effective solution helps companies of all sizes improve their payment processing without significant upfront investments.

5. Seamless Mobile Payments

With the increasing use of mobile devices for online shopping, having a payment gateway that supports mobile payments can give businesses an edge in meeting customer expectations for a smooth mobile shopping experience.

Choosing the Right Payment Gateway Platform for Your Business

1. Transaction Fees

Different platforms have varying fee structures, typically based on a percentage of the transaction amount. Be sure to review the pricing structure and compare multiple options to find a platform that fits your budget.

2. Geographic Reach

If your business caters to international customers, choosing a payment gateway with global reach and support for multiple currencies is essential for growth.

3. Integration Capabilities

Consider how easily the payment gateway integrates with your existing e-commerce platform. A seamless integration will save time and reduce the likelihood of technical issues.

4. Customer Support

Good customer support can make a difference when issues arise. Ensure the payment gateway provider offers reliable support channels like phone, email, and live chat.

5. Reputation and Reviews

Before committing to a payment gateway, research customer reviews and testimonials to ensure that the platform is reliable and trustworthy.

Conclusion

Payment gateway platforms are essential for businesses that want to accept payments securely and efficiently in today’s digital marketplace. Whether you’re running a small business or a large e-commerce site, choosing the right platform can significantly improve customer satisfaction, increase sales, and reduce fraud risks. By understanding the different types of platforms, their features, and the benefits they offer, businesses can select the most suitable option for their needs, ensuring smooth, secure transactions for their customers.

FAQs

1. What is a payment gateway?

A payment gateway is a technology that processes payment transactions by securely transmitting payment data between the customer, merchant, and financial institutions involved in the transaction.

2. How does a payment gateway platform work?

When a customer makes a purchase, the payment gateway encrypts their payment details and forwards them to the payment processor. The processor then communicates with the customer’s bank to authorize the payment and returns the result to the merchant, allowing the transaction to be completed.

3. Why do I need a payment gateway for my online store?

A payment gateway ensures secure transactions, providing customers with a safe way to pay for products and services online. It also helps prevent fraud, comply with regulations, and streamline the payment process.

4. Are payment gateway platforms secure?

Yes, reputable use encryption protocols and comply with industry standards such as PCI-DSS to ensure the safety and security of all financial transactions.

5. Can I use multiple payment methods with a payment gateway?

Yes, most payment gateway platforms support a variety of methods, including credit cards, debit cards, e-wallets, bank transfers, and sometimes cryptocurrencies.