AUTHIOR : PUMPKIN KORE

DATE : 01/11/2023

The Importance of Payment Processing

In today’s fast-paced business environment, payment processing plays a pivotal role. It’s not just about accepting money; it’s about providing a seamless and secure experience for your customers. Whether you run a physical store or an online shop, having a robust payment processing system is crucial to your success.

Types of Payment Methods

Cash Payments

Cash has been a traditional method of payment for centuries. While it’s becoming less common in some areas, it’s still an essential option for many businesses.

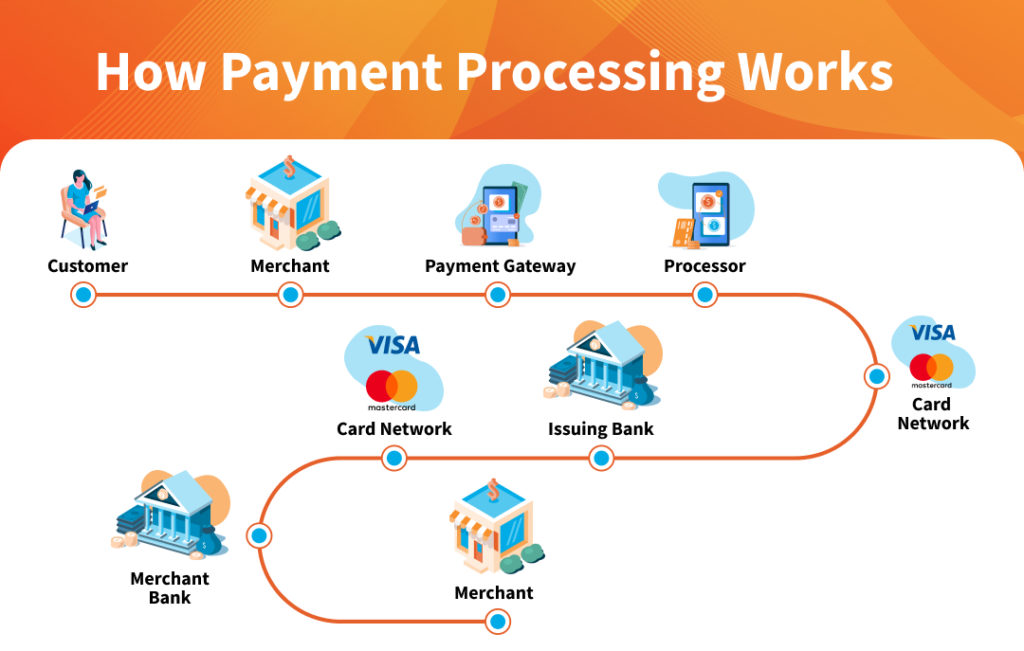

Credit Card Payments

Credit cards are the most popular form of payment globally. They offer convenience and security for both customers and businesses.

Mobile Wallets

Mobile wallets, like Apple Pay and Google Wallet, are gaining traction, especially with younger consumers. They allow for quick and contactless transactions.

Online Payment Gateways

For e-commerce[1] businesses, online payment gateways[2] are essential. They facilitate secure transactions over the internet.

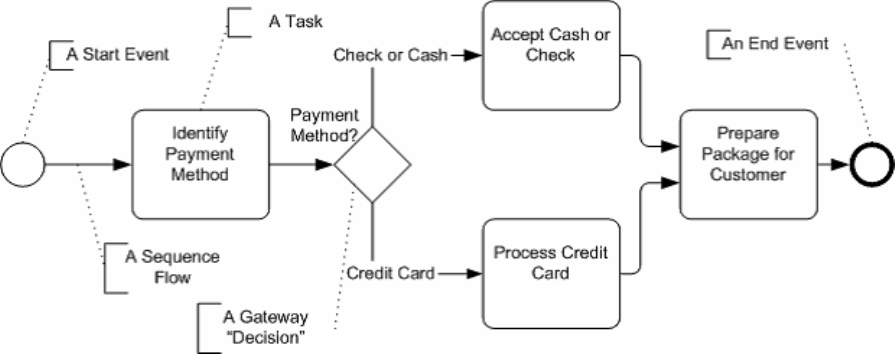

Setting Up a Payment Processing System

Choosing the Right Payment Processor

Selecting the right payment processor is critical. Factors like transaction[3] fees, processing time, and customer support should be considered.

Legal and Security Considerations

Compliance with legal regulations and ensuring data security are paramount. Failure to do so can lead to severe consequences.

In-Store Payment Processing

POS Systems

Point of Sale (POS)[4] systems streamline in-store payments, offering features like inventory management and sales tracking.

Cash Registers

Traditional cash registers are still used by many businesses, particularly those with low transaction volumes.

Online Payment Processing

Shopping Carts and E-commerce Platforms

Online businesses[5] rely on shopping cart software and e-commerce platforms for a smooth checkout experience.

Payment APIs

Payment APIs enable websites to connect directly with payment processors, providing more control over the payment process.

Understanding Transaction Costs

Payment processors charge fees for their services. Understanding these costs is essential for managing your finances.

Hidden Charges

Watch out for hidden charges that may impact your bottom line. These can include monthly fees, chargeback fees, and more.

Security and Fraud Prevention

SSL Encryption

SSL encryption secures data during transmission, protecting your customers’ sensitive information.

Chargeback Protection

Implementing measures to prevent chargebacks can save your business money and reputation.

Payment Processing for Small Businesses

Simplified Solutions

Small businesses can benefit from user-friendly payment processing solutions tailored to their needs.

Cost-Effective Options

Look for processors with competitive rates to reduce the impact on your profits.

International Payment Processing

Currency Conversion

Handling international payments involves currency conversion, which may come with additional costs.

Cross-Border Fees

Be aware of cross-border fees when dealing with international customers.

Trends in Payment Processing

Contactless Payments

Contactless payments are on the rise, offering speed and convenience for customers.

Cryptocurrency

Some businesses are accepting cryptocurrency as a payment method, though it’s not yet mainstream.

Case Studies

Success Stories in Payment Processing

Learn from successful businesses that have optimized their payment processing systems.

Challenges and Solutions

Dealing with Payment Failures

Addressing payment failures promptly is essential for maintaining customer trust.

Addressing Customer Concerns

Listening to customer feedback and addressing their concerns can lead to improvements in your payment process.

Customer Experience

Smooth Checkout Processes

A seamless checkout process is vital for a positive customer experience.

Payment Confirmation

Providing payment confirmation to customers reassures them that their transaction was successful.

The Future of Payment Processing

AI and Automation

Artificial intelligence and automation are poised to revolutionize payment processing, making it even more efficient.

Biometric Authentication

Biometric authentication methods like fingerprint and facial recognition are enhancing security.

In this digital age, the way businesses process payments has evolved significantly. Efficient payment processing is crucial for the success of any business, whether it’s a brick-and-mortar store or an online enterprise. This article will delve into the world of payment processing for business, providing you with valuable insights to streamline your financial operations. Let’s get started with a detailed outline before diving into the specifics.

Conclusion

Enhancing Your Business’s Financial Health

Streamlining payment processing is essential for your business’s financial health. By offering a variety of payment options, ensuring security, and staying up-to-date with industry trends, you can create a positive and efficient payment experience for your customers.

FAQs

1. What is the best payment method for my small business?

- The best payment method depends on your business’s nature, size, and target audience. It’s essential to offer a variety of options to cater to diverse customer preferences.

2. How can I prevent fraud in my online payment system?

- To prevent fraud, implement robust security measures like SSL encryption, two-factor authentication, and a vigilant monitoring system for suspicious activities.

3. Are there any emerging payment trends I should be aware of?

- Yes, contactless payments and the acceptance of cryptocurrencies are two significant trends in payment processing that are gaining popularity.

4. What should I do if a customer experiences payment issues?

- Promptly address the issue by providing customer support and resolving the problem. Ensuring a smooth resolution process can build trust with your customers.

5. How can automation benefit my payment processing system?

- Automation can enhance efficiency by reducing manual tasks, decreasing errors, and providing insights into customer payment behaviors.