AUTHOR : ANGEL LAD

DATE : 1/11/2023

Introduction

In today’s digital economy, the ability to accept payments online[1] is essential for businesses of all sizes. Central to this process is the concept of payment gateway payment[2], a mechanism that facilitates secure transactions between customers and merchants. This article provides a detailed overview of payment gateway payments[3], their importance, how they work, key features, and answers to frequently asked questions.

What is a Payment Gateway Payment?

A fundway refers to the process through which customers make online purchases via a secure processor. It acts as an intermediary that authorizes and processes payment transactions[4] between the customer, the merchant, and the financial institutions involved. Essentially, it ensures that sensitive payment[5] information, such as credit card details, is transmitted securely from the customer to the merchant’s bank.

The Role of Payment Gateways

Processors are crucial in ensuring a seamless and secure online shopping experience. They facilitate:

- Authorization: Confirming that a customer’s payment method has adequate funds available.

- Encryption: Safeguarding confidential information while it is being transmitted to block unauthorized access

- Settlement: Ensuring that funds are transferred from the customer’s account to the merchant’s account after a transaction is completed.

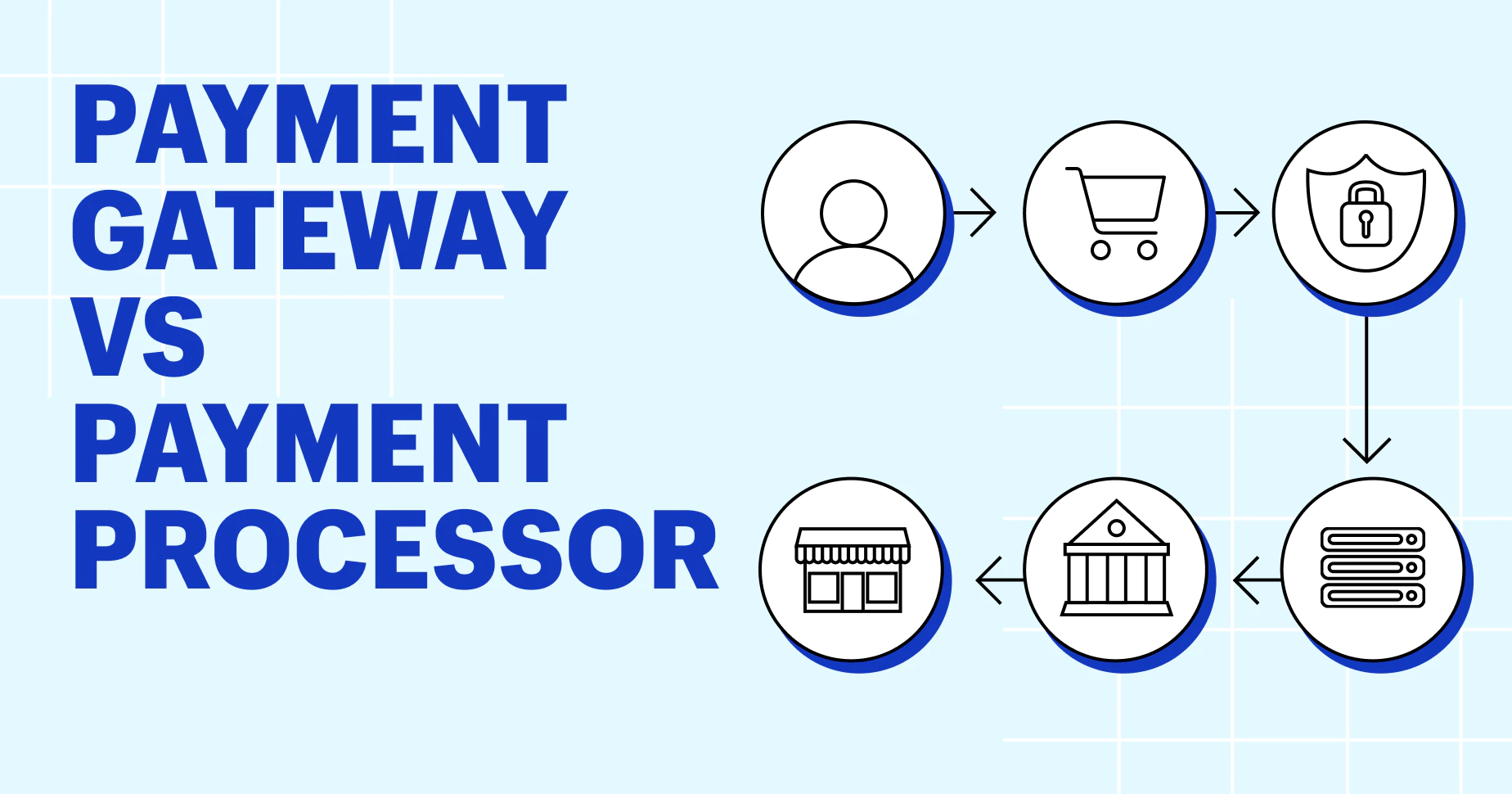

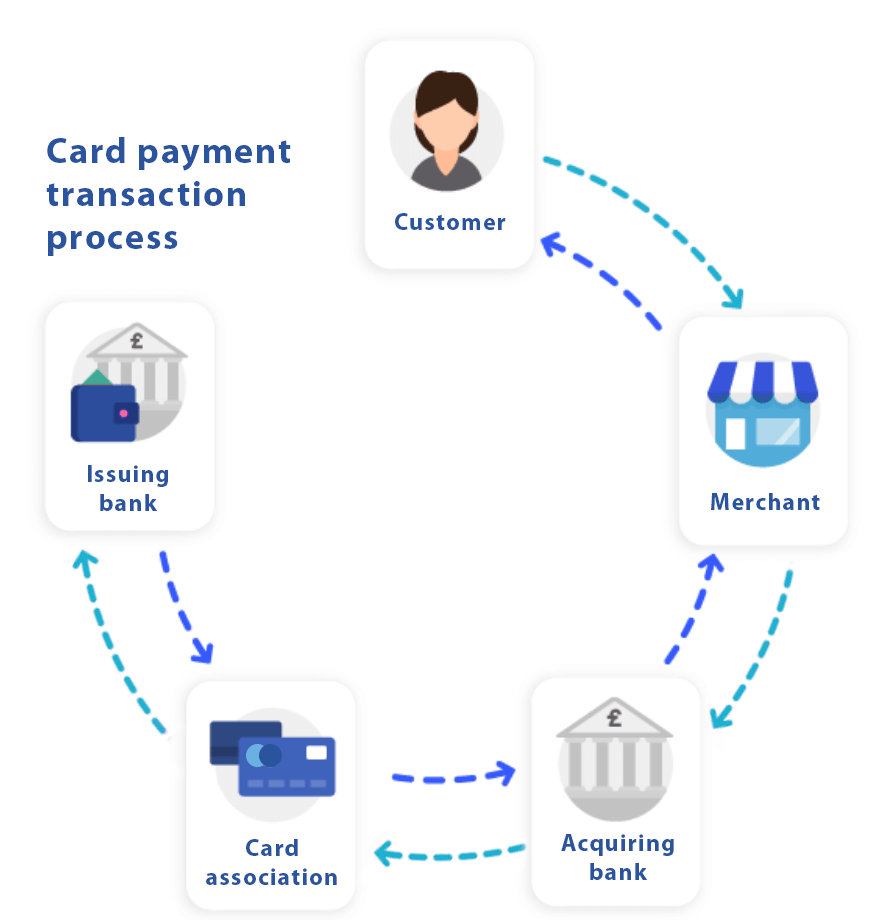

How Payment Gateway Payments Work

1. Customer Initiates a Payment

The process begins when a customer selects items to purchase on an e-commerce site and proceeds to checkout. They enter their payment information, which may include credit card numbers, expiration dates, and security codes.

2. Data Encryption

Once the customer submits their payment information, the payment gateway encrypts this data using advanced encryption methods. This ensures that sensitive information is protected during transmission over the internet.

3. Authorization Request

The payment gateway then sends an authorization request to the customer’s bank or card issuer. This request checks if the customer has enough funds or available credit to finalize the transaction.

4. Response from the Bank

The bank responds to the payment gateway with an approval or denial. If approved, the transaction continues; if denied, the customer is informed, and the transaction is halted.

5. Transaction Completion

If the transaction is approved, the payment gateway processes the transaction and facilitates the transfer of funds from the customer’s account to the merchant’s account. The merchant receives confirmation of the successful transaction.

6. Revenue Generation

Finally, the payment gateway generates a receipt for both the customer and the merchant, documenting the details of the transaction.

Key Features of Payment Gateway Payments

1. Security Measures

Payment gateways employ various security protocols, including:

- PCI Compliance: Adhering to Payment Card Industry Data Security Standards to protect cardholder data.

- Encryption: Encrypting sensitive information to prevent data breaches.

- Tokenization: Substituting sensitive card details with a distinct identifier to improve security.

2. Multiple Payment Options

A good payment gateway allows businesses to accept various Transact methods, including:

- Credit and debit cards

- Digital wallets (e.g., PayPal, Apple Pay)

- Bank transfers

- Cryptocurrencies

3. User-Friendly Interface

The interface of the Paygate should be intuitive and easy to navigate, ensuring a smooth checkout experience for customers. This reduces cart abandonment rates and improves overall customer satisfaction.

4. Mobile Compatibility

With the increasing use of mobile devices for online shopping, Paygate must be mobile-friendly. This includes having a responsive design and supporting mobile payment methods.

5. Reporting and Analytics

Payment gateways provide merchants with valuable insights into transaction data, helping them understand customer behavior, monitor sales trends, and manage refunds and chargebacks effectively.

Benefits of Using Payment Gateway Payments

1. Increased Sales

By offering multiple payment options and a secure payment process, businesses can cater to a broader audience, leading to higher conversion rates and increased sales.

2. Enhanced Security

With robust security measures in place, businesses can protect sensitive customer information, building trust and confidence in their brand.

3. Streamlined Operations

Paygate automates the payment process, reducing manual handling and streamlining operations. This allows businesses to focus on core activities rather than administrative tasks.

4. Global Reach

Paygate facilitates international transactions, enabling businesses to expand their reach and cater to customers worldwide. This can significantly boost revenue potential.

5. Customer Insights

The reporting features provided by payment gateways help businesses gather valuable data on customer preferences and purchasing behavior, enabling informed decision-making.

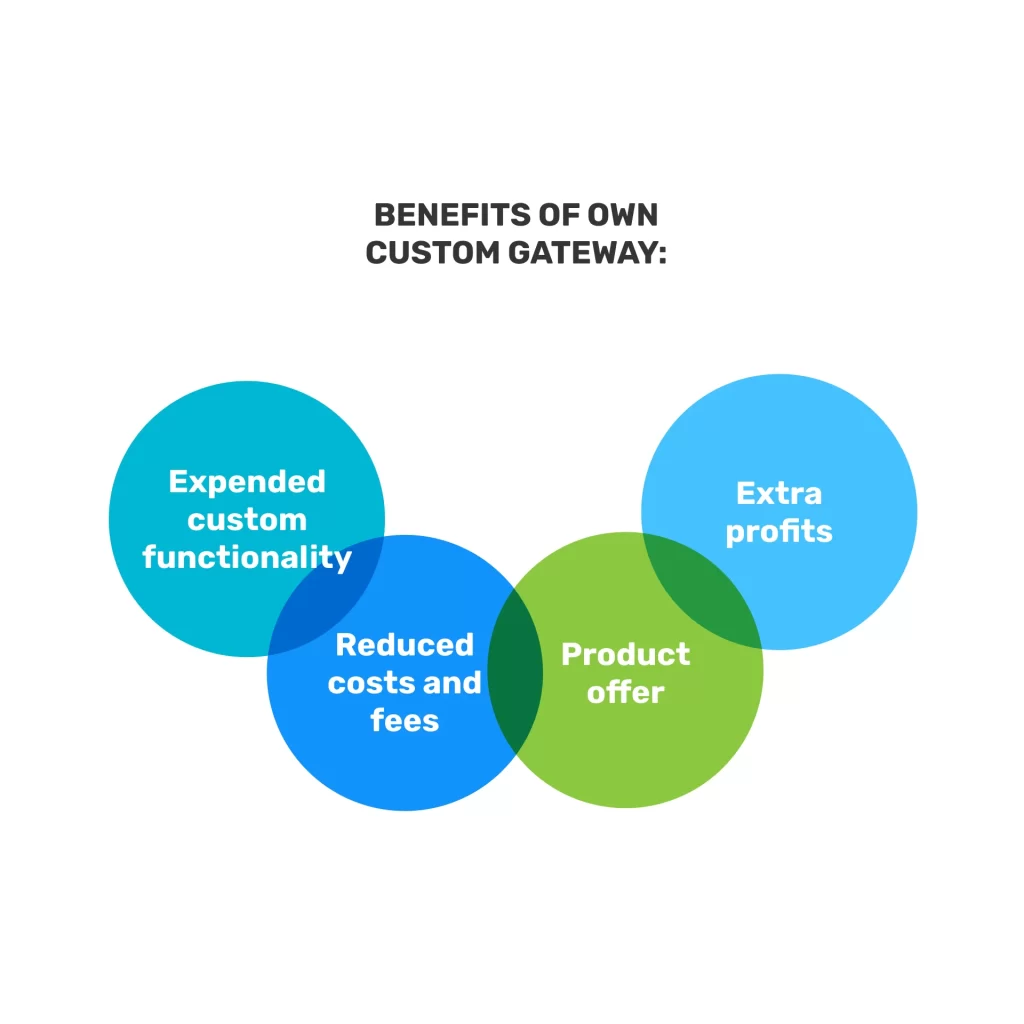

Choosing the Right Payment Gateway for Your Business

1. Transaction Fees

Different payment gateways have varying fee structures. Evaluate the costs associated with each option, including transaction fees, monthly fees, and any hidden charges.

2. Supported Payment Methods

Ensure that the payment gateway supports the payment methods most commonly used by your target audience. This may include credit cards, digital wallets, and alternative payment options.

3. Security Features

Prioritize SwiftPay that offers strong security measures, including encryption, PCI compliance, and fraud detection capabilities.

4. Integration Options

Check whether Paygate can integrate seamlessly with your existing e-commerce platform and other business tools. A smooth integration process can save time and reduce technical issues.

5. Customer Support

Choose a payment gateway provider that offers reliable customer support. Quick access to assistance can be crucial in resolving payment-related issues promptly.

Conclusion

In conclusion, processor payment is an essential aspect of modern e-commerce, providing a secure and efficient way for businesses to process online transactions. By understanding how SwiftPay works, their key features, and the benefits they offer, businesses can make informed decisions when selecting a payment solution. Whether you are a small startup or a large enterprise, investing in a reliable SwiftPay is crucial for enhancing customer satisfaction and driving sales in the digital marketplace.

FAQs

1. What is a payment gateway payment?

SwiftPay is the process through which a customer’s payment information is securely transmitted to a merchant’s bank via SwiftPay, enabling online transactions.

2. How does a Fundway work?

A processor works by encrypting customer transaction information, sending it to the customer’s bank for authorization, and facilitating the transfer of funds from the customer to the merchant upon approval.

3. Are payment processors secure?

Yes, payment processors are secure due to advanced encryption methods, compliance with PCI standards, and additional security features like tokenization and fraud detection.

4. What payment methods can I accept through a Fundway?

Fundway typically supports various payment methods, including credit and debit cards, digital wallets, bank transfers, and sometimes cryptocurrencies.

5. How can GatePay benefit my business?

A Gatepay can increase sales, enhance security, streamline operations, enable global reach, and provide valuable customer insights through reporting and analytics.