AUTHOR : REON ATWELL

DATE : 30-10-2023

In the digital age, payment platforms have become an integral part of our lives. Whether you’re running an online business,[1] shopping online, or managing[2] your personal finances, having access to reliable and efficient payment platforms [5]is crucial. In this article, we’ll delve into the world of payment platforms[3] in the United Kingdom,[4] exploring their types, benefits[5], and how to choose the right one for your needs.

Introduction

The United Kingdom has witnessed a remarkable transformation in the way things are made and received. With the advent of digital technology, payment platform options have expanded, providing convenience and security to both businesses and consumers.This article will explore the payment platforms available in the UK, their types and benefits, and also how to select the most suitable one for your needs.

The Evolution of Payment Platforms

Payment platforms have come a long way. From traditional cash transactions to the digital age, where electronic payments reign supreme, the evolution has been nothing short of revolutionary.

This transition has significantly broadened the scope of payment platforms.

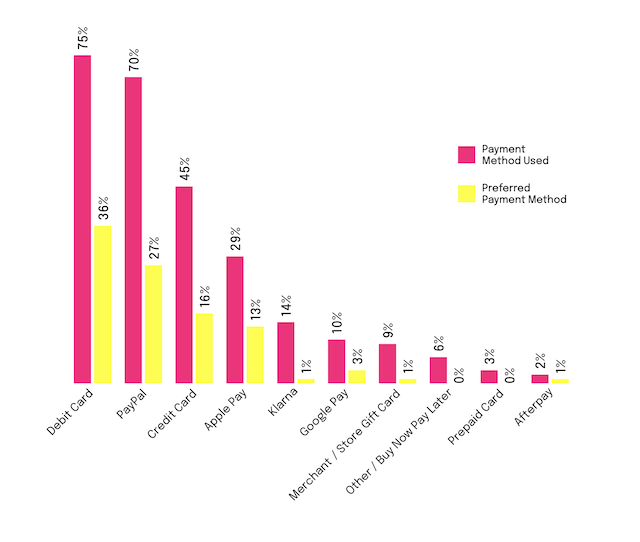

Types of Payment Platforms

3.1 Mobile Wallets

Mobile wallets have gained immense popularity in the UK. They allow users to store credit or debit card information on their smartphones, enabling swift and secure transactions. Apple Pay[1], Google Pay[2], and Samsung Pay are some of the prominent players in this category.

3.2 Online Banking

Online banking platforms offer users the convenience of managing their finances from the comfort of their homes. These platforms facilitate transactions, bill payments, and fund transfers. Prominent examples include Barclays Online Banking[3] and HSBC Online Banking[4].

3.3 Payment Gateways

Payment gateways are crucial for online businesses. They enable secure processing of payments on e-commerce websites. Widely used gateways in the UK include PayPal, Stripe, and Square.

Popular Payment Platforms in the UK

4.1 PayPal

PayPal is one of the most recognized and widely used payment platforms globally. It offers a secure and straightforward way to make online transactions. PayPal is accepted by numerous online retailers and businesses in the UK.

4.2 Stripe

Stripe is an excellent choice for businesses looking to integrate online payment processing into their websites or apps. It provides a flexible and developer-friendly platform for online transactions.

4.3 Square

Square proves to be an adaptable payment solution that caters to the diverse needs of businesses With its point-of-sale systems and e-commerce solutions, Square is a valuable asset for retailers and restaurants in the UK.

How to Choose the Right Payment Platform

5.1 Business Needs

Selecting the right payment platform depends on your specific requirements. Consider the nature of your business, your target audience, and also bthe volume of transactions you anticipate.

5.2 Security

Security is paramount when choosing a payment platform. Ensure that the platform adheres to robust security measures, such as encryption and two-factor authentication.

5.3 Transaction Fees

Different payment platforms have varying fee structures. Compare these fees and choose the one that aligns with your budget and revenue model.

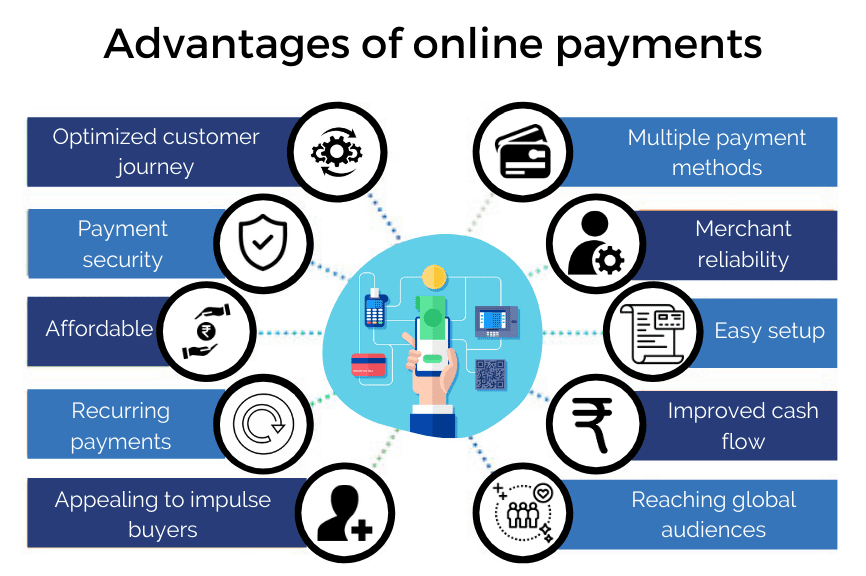

The Advantages of Using Payment Platforms

Using payment platforms offers numerous benefits. They offer ease, swiftness, and assured safety during transactions . Moreover, they enable businesses to reach a broader customer base, including international markets.

Challenges and also Concerns

7.1 Security Risks

While payment platforms offer security, they are not entirely immune to risks. Users must stay vigilant and take precautions to protect their financial information.

7.2 Regulatory Compliance

Payment platforms must adhere to stringent regulations and compliance standards. It’s vital to choose a platform that complies with UK financial regulations.

Future Trends in Payment Platforms

The payment platform landscape is continuously evolving. Future trends indicate increased adoption of blockchain technology, biometric authentication, and also contactless payments. Staying updated with these trends is essential for businesses and consumers alike.

Case Study: Success Stories

In this section, we’ll explore real-world examples of businesses in the UK that have thrived due to their choice of payment platforms.

Tips for a Seamless Payment Experience

We’ll provide valuable tips for businesses and individuals to ensure a smooth and also hassle-free payment experience.

Conclusion

The payment platform ecosystem in the UK is diverse and dynamic. Selecting the right one requires careful consideration of your needs and also priorities. With the right choice, you can enjoy the convenience, security, and also efficiency of modern payment platforms.

FAQs

- Are payment platforms safe to use?

Payment platforms prioritize security and use advanced encryption methods to protect users’ data, making them a secure option for transactions. - Can I use payment platforms for international transactions?

Yes, many payment platforms, such as Wise, are designed for international transfers, making cross-border payments easier. - What are the fees associated with payment platforms?

Fees vary by platform but are often more cost-effective than traditional banking services. - Do I need a bank account to use payment platforms?

Some payment platforms require a linked bank account, while others can be used independently. - How do I choose the right payment platform for my needs?

Your choice should depend on your specific requirements, such as domestic or international transactions, security features, and ease of use.