AUTHOR : SAYYED NUZAT

DATE : 26-08-2023

As the digital[1] landscape continues to evolve, websites have become more than just a source of information. They have transformed[2] into platforms for e-commerce, making online transactions a part of our daily lives. To facilitate seamless and secure payment processing, the role of payment providers[3] has gained significant importance. In this article, we’ll delve into the world of payment providers for websites, exploring their functions, benefits, and how to choose the right one for your business[4].

1. Introduction: The Evolution of Online Payments

The way we conduct transactions[5] has fundamentally changed with the rise of online commerce. From traditional cash transactions to digital wallets and cryptocurrencies, the payment landscape has diversified significantly.

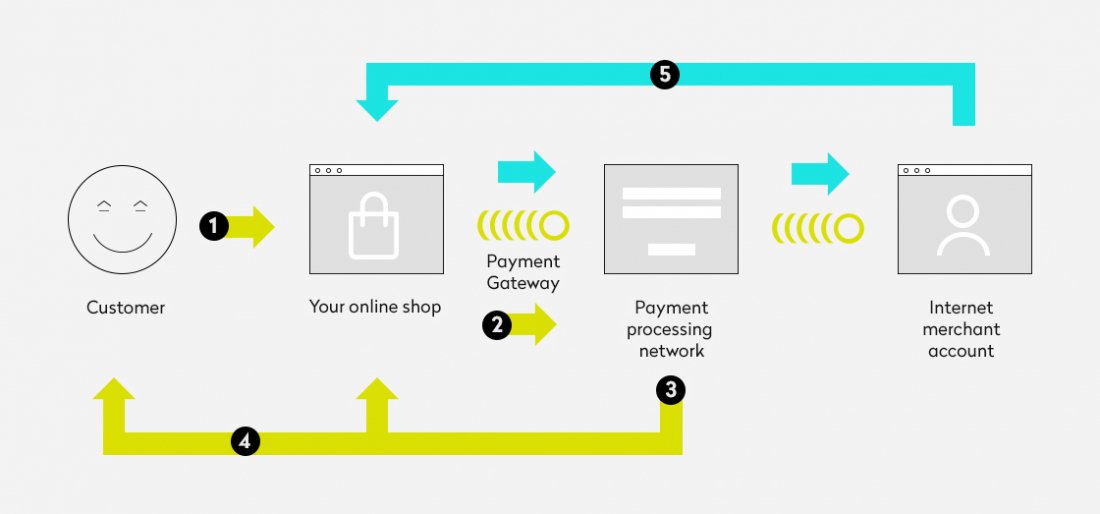

2. Understanding Payment Providers

Payment providers, commonly recognized as payment gateways, play a pivotal role as robust technology platforms that effectively enable websites to securely accept a diverse range of electronic payments. Through their intricate mechanisms, these gateways ensure the safe and efficient processing of transactions, thereby fostering an environment of trust and reliability for both businesses and customers alike.

3. Key Features to Look for in a Payment Provider

The process of selecting the right payment provider necessitates careful consideration of several crucial features. These encompass elements such as seamless integration, which ensures a harmonious merger with existing systems, robust fraud protection[1] mechanisms to safeguard transactions, and the pivotal capability to support multiple currencies,

Within the market, a number of dominant payment providers stand out, each presenting its own set of unique features. Notably, names such as PayPal, Stripe, Square, Authorize.Net, and Amazon Pay have gained significant popularity as some of the most sought-after options, showcasing their diverse capabilities and catering to a wide spectrum of businesses and their distinct requirements.

4.1 PayPal

Evident through its user-friendly interface and its extensive global reach, PayPal[2] stands as a notably preferred choice for businesses of all sizes. Its widespread popularity can be attributed to these features, making it an appealing option that caters effectively to the needs of diverse businesses operating on both local and international scales.

4.2 Stripe

Distinguished by its developer-friendly approach and its offering of customizable payment solutions, Stripe emerges as a standout choice for businesses well-versed in technology.

4.3 Square

Having significantly revolutionized the landscape of mobile payments, Square continues to uphold its reputation by providing user-friendly point-of-sale systems alongside its capabilities for online payments. This seamless combination underscores Square’s commitment to delivering comprehensive solutions that cater to both physical and digital transaction needs, thereby ensuring a holistic and integrated payment experience for businesses and customers alike.

4.4 Authorize.Net

Central to its offerings, Authorize.Net is distinguished by its unwavering focus on providing solutions that are designed to seamlessly scale with the growth of your business. This pivotal feature makes it an exceptionally suitable choice, particularly for enterprises that are in the process of expansion[3], ensuring that as business operations evolve, the payment solutions provided by Authorize.Net continue to align perfectly with the changing needs and demands of the growing venture.

4.5 Amazon Pay

Amazon Pay leverages Amazon’s extensive customer base, enhancing the checkout experience for users with Amazon accounts.

5. Integrating a Payment Provider into Your Website

The process of integration encompasses a range of technical considerations that warrant attention. This includes elements such as the utilization of APIs, the integration of plugins, and ensuring compatibility with the existing infrastructure of your website. These intricacies underscore the importance of a meticulous integration process that not only maintains the functionality of your website but also seamlessly incorporates the chosen payment processing solution.

6. The Security Aspect: Ensuring Safe Transactions

In the dynamic realm of online payments, security undeniably assumes a paramount role. Acknowledging this critical imperative, payment providers proactively embark on implementing an array of comprehensive measures. The resultant outcome is an environment that is meticulously fortified to safeguard user data at every juncture, thereby cultivating a pervasive sense of trust and confidence that resonates throughout the expansive landscape of the online payment ecosystem.

7. Mobile Payment Solutions: Adapting to Changing Consumer Behavior

In the contemporary landscape marked by the widespread proliferation of smartphones, the role of mobile payment solutions has burgeoned, gradually evolving into an integral component[4] that significantly contributes to the creation of a genuinely seamless checkout experience.

8. Subscription and Recurring Payments Made Easy

Within the intricate realm of financial transactions, payment providers undeniably occupy a pivotal role, specifically when it comes to facilitating subscription models. These models, in turn, bestow businesses with the invaluable capability to seamlessly offer services on a recurring basis.

9. Advantages of Using Payment Providers

Utilizing payment providers offers benefits such as simplified checkout processes, heightened security, diverse payment options, and valuable analytics insights.

9.1 Streamlined Checkout Process

Payment providers optimize the payment flow, reducing cart abandonment rates and boosting conversions.

9.2 Enhanced Security Measures

Employing a sophisticated range of measures, including advanced fraud detection mechanisms and robust data encryption protocols, payment providers[5] effectively instill a sense of reassurance among customers. These measures, far from being mere precautions, serve as instrumental shields that steadfastly safeguard sensitive information.

9.3 Diverse Payment Options

Payment providers accommodate credit cards, digital wallets, and emerging payment methods to cater to customer preferences.

9.4 Analytics and also Insights

Access to transaction data and customer behavior patterns helps businesses make informed decisions.

10. Factors to Consider When Choosing a Payment Provider

Choosing a payment provider involves evaluating factors like transaction fees, accepted payment methods, integration complexity, and branding options.

10.1 Transaction Fees

Different providers have varying fee structures, which can significantly impact your bottom line.

10.2 Accepted Payment Methods

As you navigate through the selection process, it becomes paramount to ensure that the chosen provider seamlessly accommodates the payment methods that are not only relevant but also tailored to resonate with your specific target audience.

10.3 Integration Complexity

In the process of deliberation, it’s imperative to take into account the extent of your technical resources. From this vantage point, it becomes crucial to deliberately select a provider that impeccably aligns with your prevailing integration capabilities. This calculated approach ensures not only a seamless amalgamation of the payment solution but also a sustainable and efficient operational workflow that caters to your unique business requirements

10.4 Customizability and Branding

The remarkable attribute lies in the ability to intricately customize the payment experience, thereby establishing a harmonious consistency that seamlessly resonates with your website’s distinct branding and user interface. This dynamic capability extends beyond a mere transactional process, contributing to an immersive user journey that reflects the essence of your brand while fostering an environment of familiarity and trust for your customers.

11. The Future of Payment Providers: Trends and Innovations

AI-driven fraud detection, voice-activated payments, and enhanced biometric security are some trends shaping the future of payment providers.

12. Case Studies: Real-Life Implementation of Payment Providers

By analyzing real-world scenarios, one can clearly observe the beneficial influence that PAYMENT PROVIDERS FOR WEBSITES have on businesses spanning various industries.

13. Expert Advice: Tips for Optimizing Payment Processing

Experts highly recommend implementing strategies such as transparent pricing, offering localized payment options, and conducting regular security audits.

14. Conclusion: Empowering Your Online Business Transactions

PAYMENT PROVIDERS FOR WEBSITES have orchestrated a remarkable revolution in the landscape of online transactions. Their innovative solutions have completely transformed the way businesses and consumers interact in the digital realm, elevating the efficiency and security of the entire process to unprecedented heights.

15. Frequently Asked Questions

- What exactly is a payment provider?

- How do payment providers ensure the security of transactions?

- Can I use multiple payment providers on my website?

- Are there any hidden fees associated with payment providers?

- What role will AI play in the future of payment processing?