AUTHOR : SAYYED NUZAT

DATE : 26-08-2023

In today’s rapidly evolving digital landscape, the way we conduct financial transactions has undergone a significant transformation. The advent of Digital payment platforms has revolutionized the way businesses and individuals manage their financial transactions. Whether you’re a business owner seeking streamlined payment solutions or an individual looking for secure and convenient ways to pay, online payment processors offer a range of benefits that are worth exploring.

Introduction

The digital era has reshaped how we manage financial transactions, making it imperative for businesses and individuals to adapt to the changing landscape. One of the most significant advancements in this realm is the emergence of online payment processors. These platforms offer a wide array of benefits that cater to the needs of both businesses and consumers alike.

The Rise of Online Payment Processors

In recent years, the popularity of Digital payment platforms has soared. Businesses across industries have recognized the need for seamless, secure, and also efficient payment solutions. Online payment processors have filled this gap by providing a platform that facilitates transactions, making them an essential tool for anyone involved in financial exchanges.

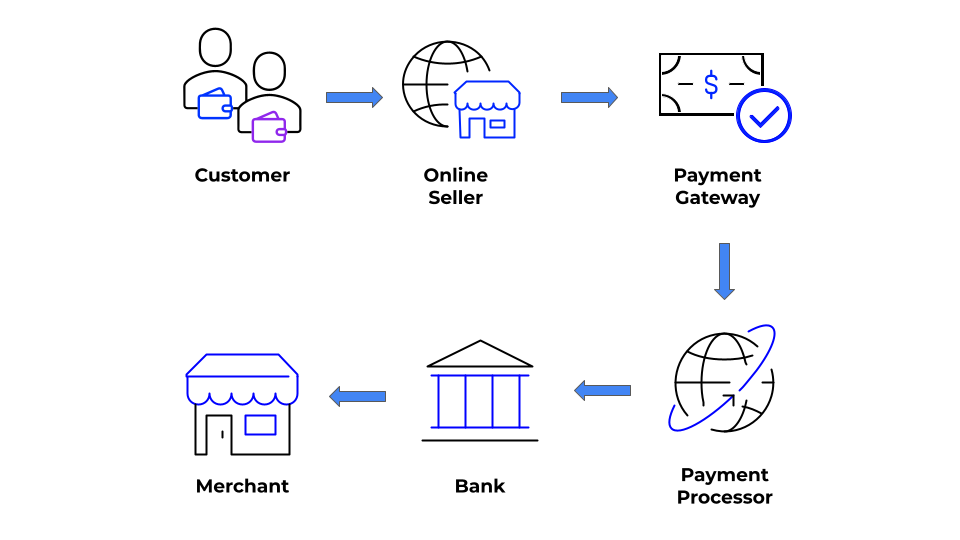

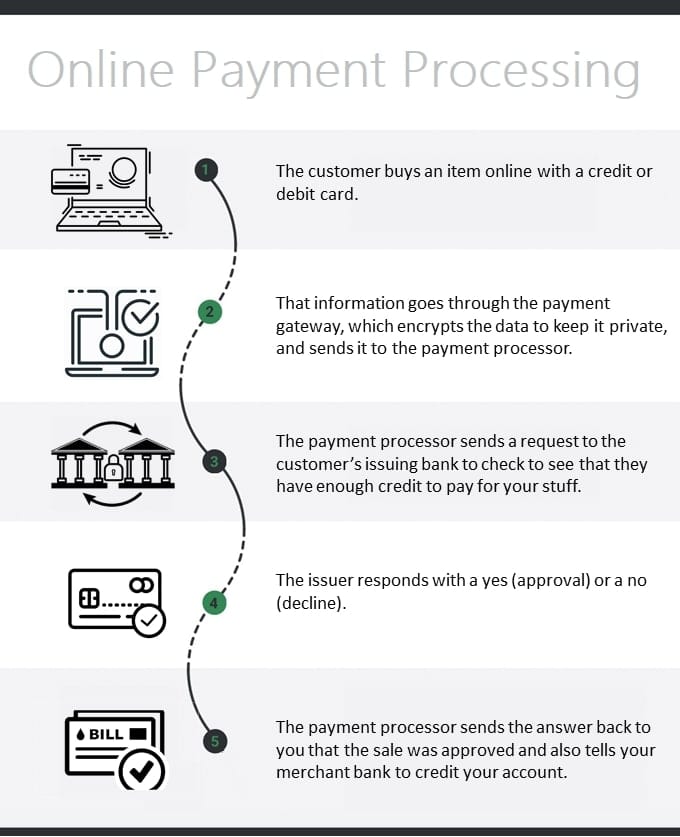

How Online Payment Processors Work

Online payment processors act as intermediaries between the payer and the payee, enabling the swift and also secure transfer of funds. They leverage cutting-edge encryption and security measures to safeguard sensitive financial information, giving users peace of mind when conducting transactions.

Advantages of Using Digital payment platforms

4.1. Enhanced Security

Security is paramount when it comes to financial transactions.[1] Online payment processors utilize advanced encryption and fraud detection mechanisms to ensure that every transaction is secure and also protected from potential threats.

4.2. Convenience and Accessibility

Gone are the days of writing checks or dealing with physical currency. Online payment processors offer unparalleled convenience, allowing users to make transactions with just a few clicks. This convenience is further amplified by the accessibility of these platforms across devices.

4.3. Efficient Transaction Processing

Traditional payment methods often involve delays and also manual processing. Online payment processors automate the transaction process,[2] reducing the chances of errors and delays, and also ensuring that funds are transferred promptly.

4.4. Global Reach

For businesses operating on an international scale, Digital payment platforms eliminate geographical barriers. Customers from around the world can make payments seamlessly, overcoming the limitations of traditional payment methods.

4.5. Integration with E-commerce Platforms

E-commerce businesses thrive on smooth payment processes. Online payment processors can be seamlessly integrated into e-commerce platforms[3], providing customers with a hassle-free checkout experience and also increasing conversion rates.

Choosing the Right Online Payment Processor

With numerous options available, selecting the right Digital payment platforms is crucial. Consider factors such as transaction fees, supported payment methods, customization options, and security features when making your decision.

Factors to Consider When Integrating a Payment Processor

6.1. Transaction Fees

Different payment processors have varying fee structures. It’s essential to choose a processor that aligns with your budget and also business model.

6.2. Accepted Payment Methods

Ensure that the payment processor supports [4]a wide range of payment methods to cater to the preferences of your customers.

6.3. Customization and Branding

Branding plays a significant role in business success. Opt for a payment processor that allows you to customize the payment experience to align with your brand identity.

6.4. Security Features

Security should be non-negotiable. Prioritize payment processors that offer robust security features to protect both your business and your customers’ sensitive data.

The Future of Online Payments

As technology continues to advance, the landscape of online payments is expected to evolve further. We can anticipate even more secure, seamless, and innovative payment solutions in the years to come.

Conclusion

The era of online payment processors has arrived, transforming the way we handle financial transactions. Their ability to provide security, convenience, and efficiency has made them an indispensable tool for businesses and also individuals alike. Embracing these platforms empowers us to navigate the digital economy with confidence.

FAQs

- Are Digital payment platforms safe to use? Absolutely. Online payment processors utilize advanced security measures to ensure the safety of your transactions.

- Can I use Digital payment platforms for international transactions? Yes, most Digital payment platforms support international transactions, making global payments seamless.

- How do I integrate an online payment processor into my website? Integration methods vary, but most payment processors offer easy-to-follow instructions for integration.

- Do Digital payment platforms have customer support? Yes, reputable payment processors typically offer customer support to assist users with any issues or concerns.

- What sets online payment processors apart from traditional payment methods? Digital payment platforms offer speed, security, and also convenience that traditional methods often struggle to match.