AUTHOR : ADINA XAVIER

DATE : 26/10/2023

In the age of digitization, the realm of online transactions[1] has seamlessly woven itself into the fabric of our daily existence. From shopping for our favorite products to paying bills and subscribing to services, the convenience of making payments online[2] is unmatched. Behind the scenes, the magic happens through a critical component known as the payment gateway checkout[3]. In this article, we will delve into the intricacies of the payment gateway checkout process[4], how it works, and why it’s essential for both businesses[5] and consumers.

What is a Payment Gateway?

A payment gateway is a technology that acts as a bridge between a customer’s financial transaction and the merchant’s website. It plays a vital role in securely transmitting the customer’s payment data to the payment processor and then authorizing the transaction. The whole process happens in real-time, ensuring that the transaction is seamless and secure.

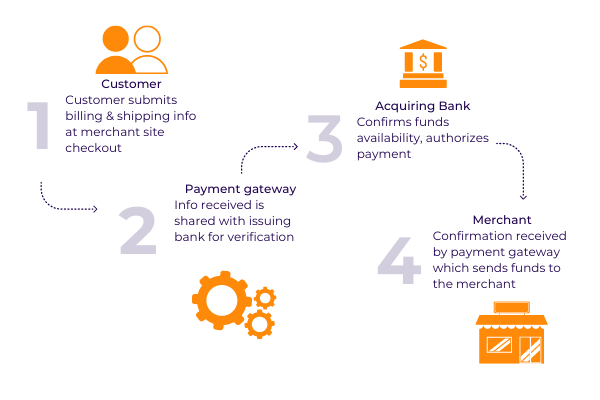

How Does it Work?

When a customer makes a purchase online, they enter their payment information, which is encrypted and sent to the payment gateway. The payment gateway then forwards this data to the payment processor[1], which contacts the customer’s bank to verify the transaction’s authenticity. If the bank approves, the payment processor informs the gateway, and the payment is processed.

The Importance of Secure Transactions

When it pertains to online payments, ensuring security stands as an absolute necessity. Payment gateways employ robust encryption and security protocols to safeguard sensitive financial information. Customers need to trust that their data won’t be compromised during the checkout process, and a reliable payment gateway ensures just that.

Types of Payment Gateways

Two primary classifications of payment gateways exist: the hosted variety and the self-hosted alternative.

Hosted Payment Gateways

Hosted gateways direct customers to an external page for the finalization of the payment procedure[2]. This method simplifies security compliance for merchants, but it can result in a less customizable checkout experience.

Self-hosted Payment Gateways

Self-hosted gateways, on the other hand, allow merchants to collect payment information directly on their website. While this offers more control, it requires a higher level of security and compliance measures.

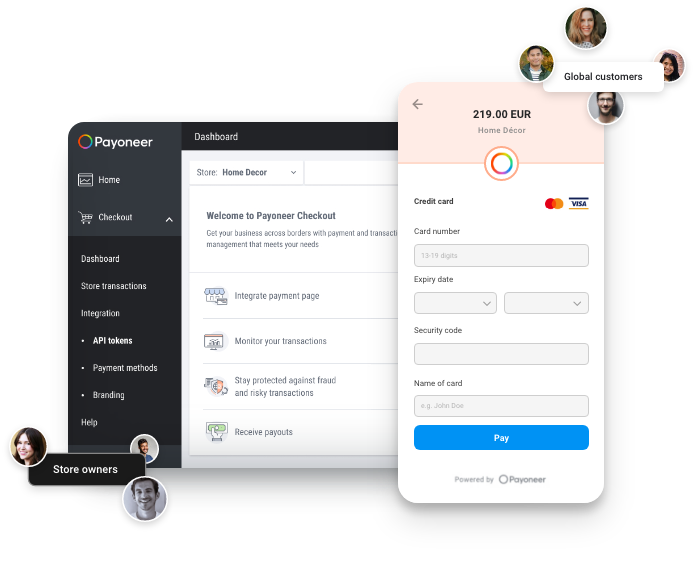

Integration with E-commerce Platforms

Payment gateways can seamlessly integrate with popular e-commerce platforms like Shopify, WooCommerce, and Magento. This simplifies the process for businesses, as they can easily set up a payment gateway checkout system that suits their needs.

User-Friendly Checkout Experiences

In the competitive world of online shopping[3], a seamless and user-friendly checkout process can make or break a sale. Payment gateways contribute to this by ensuring that the payment process is quick, easy, and intuitive.

Mobile Payment Gateways

As smartphones continue to see growing usage, the prominence of mobile payment gateways has surged. They enable customers to make payments on their mobile devices, making the checkout process even more convenient.

International Transactions Made Easy

Payment gateways often support multiple currencies and international payment methods. This allows businesses to cater to a global customer base and accept payments from different parts of the world.

Payment Gateway Fees

Payment gateways aren’t free; they charge fees for their services. These fees can vary, so it’s essential for businesses to understand the cost structure and choose a gateway that aligns with their budget.

Payment Gateway Checkout Trends

The payment industry is continually evolving. New trends like contactless payments, buy now, pay later, and one-click checkouts are changing the way we make payments online. Staying updated on these trends can give businesses a competitive edge.

The Role of Cryptocurrency

Cryptocurrencies have entered the realm of payment gateways, offering an alternative payment method. Some gateways now allow customers to make payments using popular cryptocurrencies[4] like Bitcoin and Ethereum.

Future Innovations

The future of payment gateways is exciting. Innovations like biometric authentication, artificial intelligence, and blockchain technology are set to revolutionize online payments, making them even more secure and convenient.

Challenges and Security Concerns

As the payment gateway landscape evolves, new challenges and security concerns arise. It’s crucial for both businesses and customers to stay informed about potential risks and how to mitigate them.

Ensuring PCI Compliance

Payment Card Industry Data Security Standard (PCI DSS) compliance is essential for businesses handling cardholder data. Payment gateways can help simplify this compliance, ensuring that businesses meet the necessary security standards.

How to Choose the Right Payment Gateway

Selecting the right payment gateway[5] is a critical decision for businesses. Factors like cost, ease of integration, security features, and customer support should all be considered when making this choice.

Conclusion

In a world where digital transactions are the norm, payment gateway checkouts serve as the silent heroes ensuring the security and efficiency of our online payments. They have evolved to meet the demands of businesses and consumers alike, offering a seamless and secure payment experience.

FAQs

1. What is the role of a payment gateway in an online transaction?

A payment gateway acts as a bridge between a customer’s payment information and the merchant’s website, ensuring secure and seamless transactions.

2. Are payment gateways safe for online transactions?

Yes, payment gateways employ robust security measures to safeguard customer data during the checkout process, making online transactions safe.

3. What is PCI compliance, and why is it important for businesses?

PCI compliance refers to adhering to the Payment Card Industry Data Security Standard, which is crucial for businesses to protect cardholder data and ensure secure transactions.

4. How do I choose the right payment gateway for my business?

When selecting a payment gateway, consider factors such as cost, integration options, security features, and customer support to find the one that best suits your business needs.

5. What are the future trends in payment gateway technology?

Future trends in payment gateway technology include biometric authentication, artificial intelligence, blockchain integration, and the acceptance of cryptocurrencies as a form of payment.