AUTHOR : SAYYED NUZAT

DATE : 25-10-2023

In the digital age, e-commerce[1] has become an integral part[2] of the business[3] landscape in India. As more and more businesses shift their operations online, ensuring[4] smooth and secure payment[5] processing is crucial. This article explores the world of payment gateways for e-commerce websites in India, shedding light on their significance, the best options available, and the key factors to consider when integrating them into your online store.

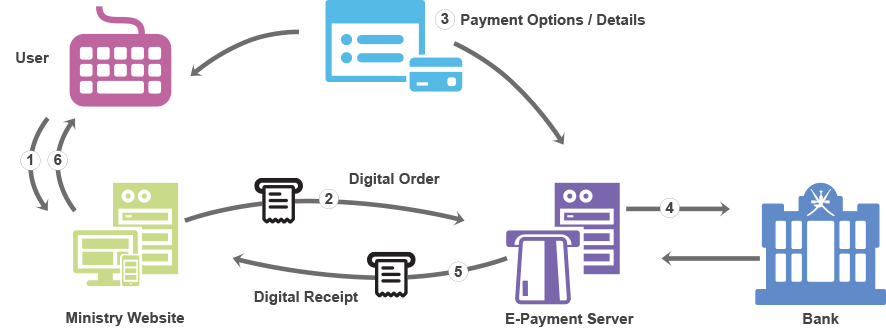

Understanding Payment Gateways

Payment gateways serve as intermediaries between the customer and the e-commerce website, facilitating secure online transactions. They are responsible for encrypting sensitive data and authorizing payments. In essence, payment gateways act as the virtual cashiers of e-commerce, ensuring that customers’ payments are processed safely and efficiently.

Importance of Payment Gateways for E-commerce

For e-commerce businesses, a reliable payment[1] gateway for e-commerce websites in India is indispensable. It not only enhances the customer experience but also plays a vital role in building trust. Secure payment processing ensures that sensitive information, such as credit card[2] details, remains confidential, which is critical in the age of cyber threats.

Popular Payment Gateways in India

India boasts a diverse array of payment gateways. Some of the most prominent options include Razorpay[3], Paytm, Instamojo, and CCAvenue. Each of these gateways offers unique features and also caters to different business needs. Choosing the right one depends on factors such as your target audience[4], the scale of your operations, and the types of payment methods you wish to accept.

Key Features to Look for in a Payment Gateway

When selecting a payment gateway for your e-commerce website, consider factors like ease of integration, security[5], support for multiple payment methods, and the overall cost. It’s crucial to evaluate the gateway’s compatibility with your website and its ability to provide a seamless checkout experience.

Choosing the Right Payment Gateway for Your E-commerce Website

The decision to choose a payment gateway should be well-informed. Conduct thorough research, read reviews, and seek recommendations from fellow e-commerce entrepreneurs. Make sure the chosen gateway aligns with your long-term business goals and the preferences of your target audience.

Setting Up a Payment Gateway

The process of setting up a payment gateway involves registration, verification, and integration. Once integrated into your website, it allows customers to make payments with ease. This step is critical for the success of your e-commerce venture, and it’s advisable to seek professional assistance if needed.

Security Measures for Payment Gateways

Security is paramount in the world of e-commerce. Payment gateways must comply with industry standards to protect customer data. Ensure that your chosen gateway has robust security features, including encryption protocols, fraud detection, and compliance with the Payment Card Industry Data Security Standard (PCI DSS).

Challenges in Payment Gateway Integration

Integrating a payment gateway can be a complex process, with challenges such as technical issues, compatibility problems, and legal compliance. To avoid disruptions in payment processing, work closely with your web development team and the payment gateway provider.

Benefits of a Reliable Payment Gateway

A reliable payment gateway streamlines the checkout process, reducing cart abandonment rates and also increasing sales. It also provides valuable data and insights that can help you optimize your e-commerce strategy and improve the overall customer experience.

Mobile Payments and E-commerce

With the increasing use of smartphones, mobile payments have gained popularity in India. Your payment gateway should support mobile transactions to cater to the growing segment of mobile shoppers.

E-commerce Payment Trends in India

The e-commerce landscape in India is dynamic and constantly evolving. Stay updated with the latest payment trends, such as digital wallets, UPI payments, and buy-now-pay-later options, to remain competitive in the market.

Comparison of Transaction Fees

Different payment gateways have varying fee structures. Compare transaction fees and also consider how they align with your budget and sales volume. It’s essential to strike a balance between cost-effectiveness and the quality of service provided.

User Experience in Payment Processing

A seamless and user-friendly payment process enhances the overall shopping experience. Prioritize features like single-click payments, guest checkouts, and smooth navigation to make your customers’ journey hassle-free.

Conclusion

In the world of e-commerce, a reliable payment gateway is the backbone of secure and efficient payment processing. Selecting the right payment gateway is crucial to ensuring a smooth shopping experience for your customers. Remember to prioritize security, user experience, and cost-effectiveness in your decision-making process.

FAQs

- What is a payment gateway, and why is it important for e-commerce?

A payment gateway is an online service that facilitates secure transactions between customers and e-commerce websites. It’s essential for building trust and ensuring the safety of sensitive data. - How do I choose the right payment gateway for my e-commerce website?

To choose the right payment gateway, consider factors like your target audience, integration ease, security features, and transaction costs. - What are the common challenges in payment gateway integration?

Challenges can include technical issues, compatibility problems, and legal compliance. Close collaboration with your web development team and the payment gateway provider is crucial. - What are some popular payment gateways in India?

India offers a range of payment gateways, including Razorpay, Paytm, Instamojo, and CCAvenue, each with unique features. - How can mobile payments benefit my e-commerce business?

Mobile payments cater to the growing number of smartphone users in India, making the shopping process more convenient and accessible to a broader audience.