AUTHOR : SAYYED NUZAT

DATE : 25-08-2023

In today’s digital landscape, where online shopping and e-commerce[1] have become the norm, having a reliable payment processor[2] for your website [3]is crucial. A payment processor acts as the bridge between your customers [4]and your business, ensuring secure[5] and smooth transactions. But what exactly is a payment processor, and how does it work? In this article, we’ll dive into the intricacies of payment processors, their benefits, and how to choose the right one for your website.

Introduction: The Role of Payment Processors

Imagine running an online store without the ability to accept payments electronically. A payment processor enables your website to accept various forms of payment, such as credit cards, debit cards, digital wallets, and even cryptocurrency. It acts as the intermediary that securely handles the transaction process, ensuring that sensitive financial information is protected.

How Payment Processors Work

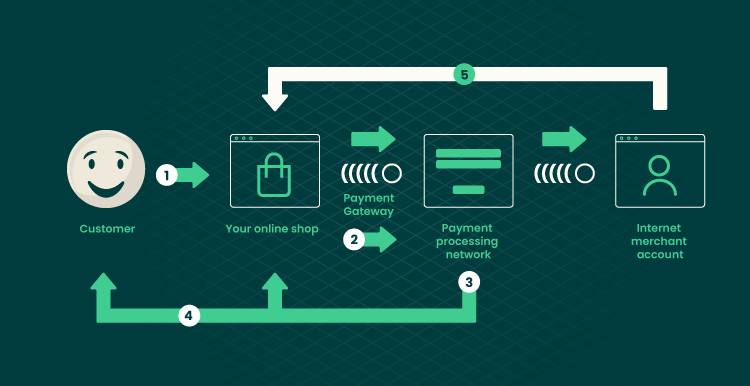

Payment processors facilitate the entire payment journey. When a customer makes a purchase on your website, the payment processor takes care of the following steps:

- Authorization: The processor verifies whether the customer’s payment method is valid and has sufficient funds.

- Encryption: Sensitive payment information, such as credit card [2]numbers, is encrypted to prevent unauthorized access.

- Transaction Routing: The payment processor directs the transaction to the appropriate financial institutions involved.

- Confirmation: Once the payment is approved, the processor confirms the transaction’s success to both the customer[3] and the merchant.

Advantages of Using Payment Processors

Integrating a payment processor into your website offers several advantages:

- Enhanced User Experience: Payment processors provide a seamless and user-friendly checkout experience, increasing the likelihood of completed purchases.

- Global Reach: By accepting various payment methods and currencies, payment processors allow you to tap into a global customer base.

- Security: Reputed payment processors adhere to strict security standards, safeguarding both customer and merchant data from potential breaches.

- Efficiency: Payment processors[4] automate tasks like currency conversion and transaction reconciliation, saving time and reducing errors.

Key Factors to Consider When Choosing a Payment Processor

Selecting the right payment processor requires careful consideration of the following factors:

- Transaction Fees: Compare processing fees and any additional costs associated with different processors.

- Accepted Payment Methods: Ensure the processor supports the payment methods your target audience prefers.

- Integration Ease: Choose a processor that seamlessly integrates with your website’s e-commerce platform.

- Security Measures: Prioritize processors that offer robust security[5] features such as encryption and fraud detection.

Different Types of Payment Processors

There are various types of payment processors to choose from:

- Merchant Account Providers: These offer more customization but often involve higher setup costs.

- Aggregators: They are quick to set up and are suitable for smaller businesses but may have higher per-transaction fees.

- Payment Gateways: These facilitate real-time authorization and are ideal for businesses with high transaction volumes.

Integrating a Payment Processor into Your Website

The integration process involves:

- Account Setup: Create an account with the chosen payment processor and provide the required documentation.

- API Integration: Use the provided API documentation to integrate the processor into your website’s checkout process.

- Testing: Thoroughly test the payment process to ensure it works flawlessly.

Ensuring Security in Online Transactions

Security is paramount when dealing with online transactions. To ensure safety:

- PCI Compliance: Adhere to Payment Card Industry Data Security Standard (PCI DSS) requirements.

- SSL Encryption: Secure your website with SSL encryption to protect customer data during transmission.

The Future of Payment Processors

The payment processing industry continues to evolve with advancements like:

- Biometric Authentication: Integrating biometrics for enhanced security and convenience.

- Blockchain Technology: Exploring the use of blockchain for transparent and secure transactions.

Conclusion

In conclusion, a reliable payment processor is the backbone of successful online transactions. From simplifying payments to ensuring security, the right payment processor can significantly impact your website’s success. So, whether you’re running an e-commerce store or offering online services, choosing the right payment processor is a decision that deserves careful consideration.

FAQs

- Q: Can I use multiple payment processors on my website? A: Yes, depending on your e-commerce platform’s capabilities, you can integrate multiple processors.

- Q: How long does it take to integrate a payment processor? A: The time varies, but with proper documentation, it can take a few days to a week.

- Q: Are payment processors safe for small businesses? A: Yes, reputable payment processors offer security measures suitable for businesses of all sizes.

- Q: What happens if a customer’s payment is declined? A: The customer will receive a notification, and they can try again with a different payment method.