AUTHOR : HANIYA SMITH

DATE : 13/10/2023

Payment gateways have become an integral part of our digital lives. In an era where e-commerce and online transactions are booming, these gateways play a vital role in securely processing payments[1]. Whether you’re shopping online[2], booking a flight, or making a donation to your favorite charity, payment gateways facilitate the transfer of funds from your bank account or credit card to the merchant. In this article, we’ll delve into the world of payment gateways, exploring their importance, functioning, types, key players, and much more.

The Importance of Payment Gateways

Payment gateways are the digital bridges that connect your financial institution[3] with the merchant’s website, ensuring that your transaction is smooth, secure, and swift. Without them, online transactions would be chaotic, and your personal information could be at risk. These gateways provide[4] a layer of security, encrypting your data and authorizing transactions[5] in real time. They are the backbone of e-commerce, allowing businesses to accept payments, making it possible for you to shop online with confidence.

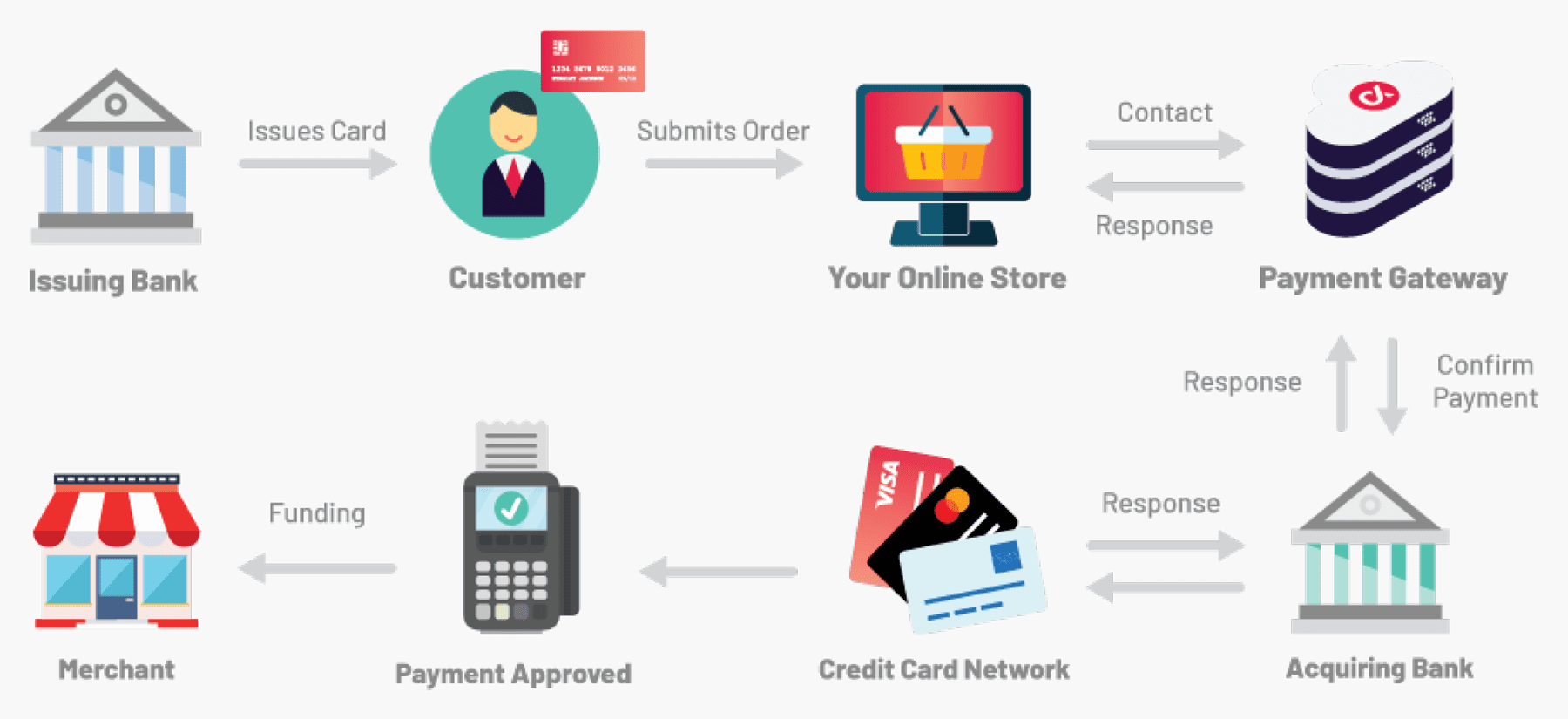

How Payment Gateways Work

- You enter your payment information on the merchant’s website.

- The payment gateway securely encrypts this data.

- It then forwards the encrypted information to your bank.

- Your bank verifies the transaction and checks for available funds.

- Once approved, the bank sends a confirmation to the payment gateway.

- The gateway informs the merchant, and also the transaction is completed.

It all happens in a matter of seconds, ensuring a seamless shopping experience.

Types of Payment Gateways

- Hosted Payment Gateways: These channels customers to a secure payment platform maintained by the gateway service provider.Popular examples include PayPal and Stripe.

- Integrated Payment Gateways: These are integrated directly into the merchant’s website,[1] allowing for a more customized checkout process. Examples include Authorize.Net and Braintree.

Key Players in the Payment Gateway Industry

The payment gateway industry is highly competitive, with several key players leading the way. Some of the major names in the business include PayPal, Stripe, Square, and also Adyen. These companies offer a wide range of services and have a global presence, making them crucial players in the industry.

Key Aspects to Keep in Mind When Selecting a Payment Gateway

Choosing the appropriate payment gateway for your enterprise is of paramount importance.Factors to consider include transaction fees, security features, ease of integration, and the range of payment options supported. The choice of a payment gateway can significantly impact your business’s success.

Security in Payment Gateways

Security is paramount in the world of payment gateways. These gateways employ various security measures, including data encryption, fraud detection, and also compliance with industry standards such as PCI DSS. Customers need to trust that their financial information[2] is safe when making online payments.

Integration of Payment Gateways

Integrating a payment gateway into your website is a crucial step for any e-commerce business. Most gateways offer plugins and also APIs to simplify the integration process. This integration ensures that your customers have a seamless checkout experience.

Payment Gateway Pricing Models

Payment gateways have diverse pricing models, including transaction-based fees, monthly subscriptions, and also setup costs. It’s essential to understand these pricing structures to make an informed decision for your business.

Emerging Trends in Payment Gateways

The payment gateway industry is continually evolving. Key trends include the rise of mobile payments, contactless technology, and also biometric authentication. These trends shape the future of online transactions.

Challenges in the Payment Gateway Industry

Despite their many advantages, payment gateways face challenges, such as data breaches and also increasing competition. Staying ahead of these challenges is crucial for the industry’s growth.[3]

The Global Expansion of Payment Gateways

Payment gateways are not limited by geographical boundaries. They are expanding globally, providing opportunities for businesses to reach a broader customer base.

Case Studies: Successful Implementations

Examining successful case studies can shed light on how payment gateways have transformed businesses. We’ll explore some real-world examples of companies that have benefited from effective payment gateway implementations.

Future Prospects for Payment Gateways

The future looks promising for payment gateways, with innovations in technology, security, and also user experience. As online transactions continue to rise, these gateways will play an even more significant role in shaping the digital economy.

Conclusion

In conclusion, payment gateways have revolutionized the way we transact online. Their significance in e-commerce, security measures, and seamless integration into businesses make them an essential component of the digital landscape. As the payment gateway[4] industry continues to evolve, businesses and consumers can expect even more convenience and security in their online transactions.

Frequently Asked Questions

- What is a payment gateway, and why is it important? A payment gateway is a technology that facilitates online transactions by securely transferring funds from customers to merchants. It’s important because it ensures the security and efficiency of online payments.

- How do I choose the right payment gateway for my business? When choosing a payment gateway, consider factors like transaction fees, security features, integration options, and the range of supported payment methods. This choice can significantly impact your business’s success.

- What security measures do payment gateways employ to protect customer data? Payment gateways use various security measures, including data encryption, fraud detection, and also compliance with industry standards like PCI DSS to protect customer data.

- What are the emerging trends in the payment gateway industry? Emerging trends include mobile payments, contactless technology, and biometric authentication, which are shaping the future of online transactions.